Improving structures around grain marketing decision making

Author: Brad Knight | Date: 16 Sep 2014

Brad Knight,

GeoCommodities.

Keywords:

grain marketing, marketing strategies, marketing plans, farm business management.

Take home messages

- Good grain marketing can only occur if other aspects of the business are being managed appropriately to ensure there is choice in products and timing of sales.

- Understanding the different stages of the grain marketing process and optimising the length of the sales window are two key underlying frameworks for improving decision making.

- An overall decision making framework is introduced that outlines the need for the foundation of a good internal structure and an understanding of those factors that can be controlled within a business and then overlaying good plans and strategies to deal with external factors that are outside of your control.

Introduction

Grain marketing can be viewed in a simplified way as a series of decisions that start with thinking about the market right through to ensuring sales are finalised, delivered on and paid. The result is cashflow; grain has been turned into cash which can then be used for a number of things. Hence a simplified definition of grain marketing is as follows:

'a series of decisions and subsequent actions that turn grain into cashflow'

The ultimate aim is to maximise this cashflow by maximising yield and price given the constraints of any one season (both production and market constraints at the time). In terms of price, the single most important requirement is to have choice on when grain is sold. The idea behind price risk management is to create more pricing opportunities and manage them in a way that reduces overall risk, and doesn’t just transfer one risk to another that can still impact the business. For example, reducing price risk if not done correctly can impact production risk.

This paper outlines some key concepts about grain marketing decision making and focusses on ways of building more structure around these decisions. Three concepts will be introduced:

- The grain marketing process,

- the grain marketing window, and;

- the grain marketing pyramid.

These three concepts give a theoretical context to some of the more specific actions that can be undertaken to improve grain marketing outcomes.

The grain marketing process

We can break the process of marketing grain into five main stages which helps to break down the overall grain marketing process and make clearer some of the decisions required and risks at each stage (Figure 1).

These five parts can differ in terms of who manages each step, how it is managed, when it is managed, etc. Understanding the different parts to grain marketing helps to reduce the complexity of grain market decisions and helps to identify areas that potentially can be outsourced.

Figure 1. The grain marketing process.

The grain marketing window

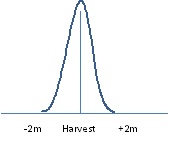

The concept of the grain marketing window is about the length of time either side of harvest over which the business is prepared to price grain. A short market window (for example selling majority of the grain at harvest for cash) is highly exposed to the price at that point in time which may be a profitable price or may not. Given prices fluctuate quite a lot over time, by consistently marketing grain over a short period you are not maximising the chances of being able to sell at above average prices.

Figure 2. Narrow marketing window.

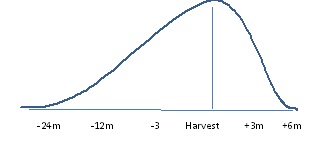

Over the long run, a business which is prepared to stretch out the marketing window, purely by weight of probability due to the cyclical nature of pricing, has a greater chance of seeing above or well above prices within that period. Being prepared to (safely) sell grain a long time forward is a very good start to maximising price and income, as is having the ability to store grain for a reasonably long period post harvest.

Figure 3. Wide marketing window.

Being prepared to sell grain over a long period does add complexity which needs to be managed. Price risk management is about managing the risks and costs associated with marketing and in a long selling window there can be significant costs (especially carrying physical grain) and or risks that need to be managed depending on the situation.

The grain marketing pyramid

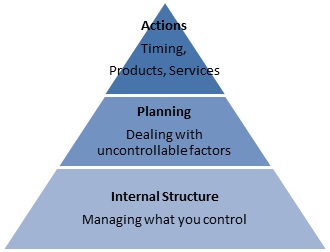

The grain marketing pyramid is a diagrammatic representation of the process of decision making that can be applied to the smallest decision right up to whole farm business planning (Figure 4). The majority of the time should be spent at the base of the pyramid for any decision and good work here will lay the foundation for building strategies and plans (second tier) that help in executing (capstone) these plans using structures that are in place.

Figure 4.The grain marketing pyramid.

Internal structure – dealing with what you can control

The first critical element in any business is the people. Defining who is responsible for what in the decision making process is critical for success. Each member of a business should understand their role in the grain marketing process to ensures decision are made quickly and accurately, with volatile markets, opportunities can be fleeting. As an example, looking at the price negotiation and sale steps, an often successful structure is to have one primary contact point with buyers of grain who has a pre-agreed approval for transactions to a certain volume or value without discussing with others in the business.

In the case of more complex marketing strategies for managing price risk, regular discussions should occur between the primary contact point and other members of the business who are involved with the design of the process to ensure adherence to strategies.

Sometimes you cannot control who the people are but you can definitely match the skills, knowledge and interest in grain marketing to the right people. Further, understanding the risk profile of people in the business is critical in product and service choice to ensure these are matched. Complex grain marketing strategies are not always wrong; if they are matched to the right business and the right people, they can create opportunity. For example, risk management tools such as futures and options are inherently more complex to understand but when matched to the correct business can add another dimension to the grain marketing process and reduce risk. Other businesses will choose not to utilise a complex product like this but can opt for simpler approaches that can potentially achieve similar outcomes.

What external assistance will be bought into the business to assist in the marketing process is another important aspect. At one end of the spectrum is 100% self-managed grain marketing where every element of the ‘Grain Marketing Process’ is internalised. And at the other end of the spectrum the ‘Grain Marketing Process’ would be totally or partly outsourced.

You should be prepared to pay more the more you outsource, but you should also get what you pay for. To measure this, some assessment criteria or benchmarks are vital to be built into the overall grain marketing plan to help make decisions in the long term. Some proposed assessment criteria include returns against the cash market (on a monthly/yearly basis, return against competing products/services and return against alternative strategies, Quantification of this is often hard though because the baseline return from each alternative will differ dramatically each year depending on strategy, so the only true assessment tool is to analyse performance against the benchmark over a three to five year period.

One element of the grain marketing process that is often outsourced is market intelligence. Careful consideration of the sources of market intelligence is required to ensure information is up to date, relevant and accurate. The key message on market intelligence is to choose a small number of reliable, regular suppliers of market intelligence and stick to these. These resources include verbal as well as written; keeping grain marketing contacts to a small number is also recommended for time efficiency but also keeping consistent, clear messages. Many growers often rely on the free market intelligence provided by a number of grain marketing organisations. Whilst this information is often relevant and up to date, sometimes its accuracy and or relevance can be questionable. Other parts of the process that can be outsourced include the price discovery part (subscribing to SMS lists or publications that list all the best bids) and price negotiation and sales by utilising brokers/agents to sell or buy on your behalf. Some brokers/agents only assist with the sale whilst others offer a full service across the entire grain marketing process.

Overtime the internal structure of a business can change and evolve and can also be nurtured to take the structure in a direction more preferable to the business. This might include education for some of the business members or changes to who is responsible for what aspects of the grain marketing process to better suit individuals. As grain marketing strategies and plans are evaluated you can also learn from experience and use this to guide the internal structure in the future.

Planning - how to manage the unknown?

Gaining control over the internal aspects of the business is critical, but this also needs to be combined with the overlay of plans and strategies to cope with external factors outside of anyone's control. This aspect is not about setting exact times and or prices that grain will be sold at no matter what, but establishing guiding principles that assist in objectifying decisions. Given the unpredictable nature of grain markets and production, guiding principles are the only way to plan, as specific plans cannot deal with the unknown well. Objectiveness is very important in this planning; taking as much emotion out of the decision making and adhering to the established marketing guidelines is critical.

There are a number of external factors which drive markets, ultimately all of which cannot be influenced by the business but definitely the business can have plans put in place to manage different pricing scenarios. Perhaps the biggest external factor guiding price movements is the underlying supply and demand of crops both locally and internationally. It is not necessary to know this inside out every day but to have a general awareness is important because it explains current and possibly future underlying price movements. It is important to have some knowledge of major growing and demand areas globally and when the critical times for their crops are, and to monitor market commentary about what’s happening to that specific crop. The market trades rumour and fact relating to all of the factors that produce a crop, including planting intentions and acres sown and weather surrounding planting, key developmental stages and harvest. The market is always re-adjusting price depending on the actual outcome of a report and/or weather event. When discussing market conditions and price, the most pertinent question to ask is ‘What is going to drive the market in the next x weeks/months?’ not ‘what will the price do?’

In reality there are only two criteria that matter when it comes to a grain marketing decision; time or price. Either grain needs to be sold for time reasons (cash flow or strategy) or if the price is good (what is 'good' we can try and define later). Different valued commodities will have differing costs of carry due mainly to the time value of money, but also the location of storage. There are also consistent market phenomena that occur during the cropping cycle around volatility and risk premiums in the market so understanding and designing selling strategies around these helps.

Most sellers will tell you that the best reason to sell grain is when the price is 'good', but what defines a 'good' price? Ultimately a price that is above the cost of production is a good price but the cost of production and amount required over cost of production (return) differs with every business. Further, the market at any one point in time doesn't care about cost of production and the further issue is that we are in a global market and cost of production varies greatly around the world. So this means cost of production can only by one guiding factor.

Rather than asking what a good price is, good decisions need to be made based on information available at the time of a sale or across the grain marketing period. Several proposed criteria are outlined below and help form the basis of an objective decision about why grain should be sold.

| Weighting (%) |

|||

| Price decile above trigger (e.g. Decile 6) | _____________ | Y | N |

| Price/grade spreads positive | _____________ | Y | N |

| Market View neutral to bearish | _____________ | Y | N |

| Local mkt momentum neutral to bearish | _____________ | Y | N |

| Cashflow required within 60 days | _____________ | Y |

N |

| Price greater than Cost of Production | _____________ | Y | N |

Identifying objective criteria, of which the above are just some examples, and using these to guide the selling decision is a much better approach than a 'gut' feel or a false view. In fact too often the seller’s 'view' of the market is used to guide the decision to sell (or to not), when in fact it is only a small part of the overall decision to sell grain. The criteria proposed above can be altered to suit each individual business.

The development of hedging or sales guidelines is proving a really good way of determining sale possibilities and priorities in an objective way. This is a document that first and foremost defines the length of the grain marketing window; how far before and after harvest are we prepared to make pricing decisions and what guides these decisions? It also approves certain instruments for use and outlines under what scenarios grain can be sold (crop condition, crop stage, pricing levels versus average, etc.) and includes maximum sales limits (often as a percentage of forecast production).

Actions – executing sales

In terms of the grain marketing process, even though price negotiation, sale and execution make three of the five parts, it is really the pointy end of the process (or pyramid). By laying the foundations of good marketing through a good internal structure and overlaying this with a plan on how to deal with fluctuation and changes in the market, the idea is that the sale and execution of contracts become much easier. Specifically the most difficult decision of sales timing is addressed by having an objective plan. Having a limited number of solid counterparties that the business is happy to trade with greatly reduces the time and cost of pricing and execution. Hopefully by getting the other elements of the plan right, it helps not only guide the timing of sales but also the choice of products whether it be derivatives, self managed cash market or handing over management of all or some grain to a pool manager. Often a combination of strategies and products is used mainly as a way of growers spreading decision risk.

Conclusion

Several grain marketing concepts have been introduced as ways to help build structure around the grain marketing decision making process. The theory behind the pyramid is that by building the foundation of a good internal structure then overlaying this with a strategy and a plan, and capping this off by good execution, an overall strong grain marketing process will result.

Rather than outlining specifics actions, tools and resources, a general theory is outlined to help growers design their own 'pyramid' that suits their business.

Contact details

Brad Knight

GeoCommodities

PO Box 19 Strathfieldsaye VIC 3551

0429 802 538

Was this page helpful?

YOUR FEEDBACK