Principles of selling grain

Author: Nathan Cattle and Hannah Janson (Profarmer Australia, a service provided by NZX Australia) | Date: 10 Mar 2016

Abstract

Profarmer has been working with the GRDC on a ‘GrowNotes to BankNotes’ project which is aimed at improving farm profitability by ensuring world-class agronomic practices and technology adopted inside the farm gate are captured with best-in-class conversion of the tonnes into dollars at the farm gate.

Many associate best practice grain selling to the use of futures or options, yet there are many simple principles that can be implemented by growers immediately to improve returns through their grain selling.

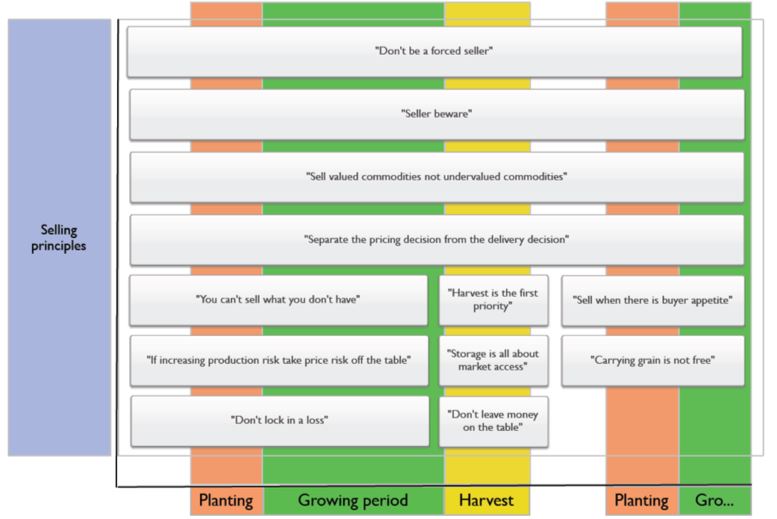

We will outline the dollar benefits which flow from several of these simple strategies, based off actual market prices (Figure 1).

Figure 1: Key selling principles throughout the production of a crop cycle (Source Profarmer Australia).

Expand the sales window

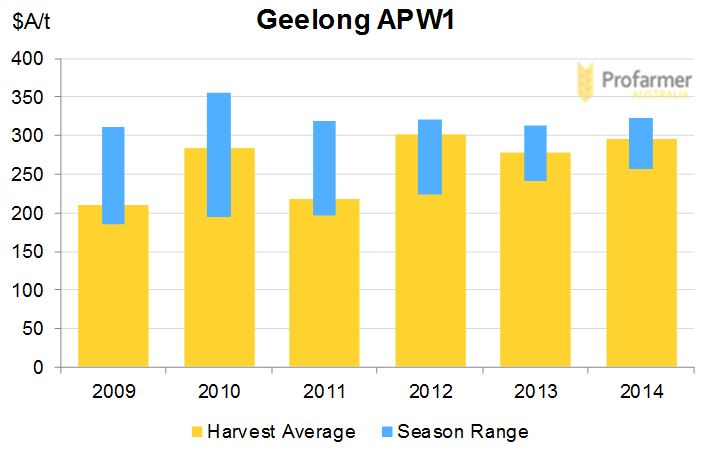

Principle: ‘Expand the sales window’. By expanding the period in which growers can make grain sales (Figure 2), growers are able to capture price opportunities in volatility observed year to year and achieve higher overall returns (GRDC Southern Wheat Grow Note Chapter 15.1.1).

Figure 2: Expand the sales window.

Melbourne APW2 wheat prices varied $60-$160/t per season over the last six seasons, reflecting 25-60 per cent variability. For a property producing 2,000t wheat this means potentially $120,000-$320,000 difference in income depending on price management skill.

Don’t be a forced seller

Principle: ‘Don’t be a forced seller’. Be ahead of cash requirements to avoid selling in unfavourable markets (GRDC Southern Wheat Grow Note Chapter 15.1.2.3).

Price variability also means growers who are not organised with their cash flow may risk becoming a forced seller in unfavourable markets.

As the market falls, growers need to sell greater volumes of grain in order to achieve the same cash flow outcome. This reduces their ability to capture any favourable price moves that may eventuate later in the season.

As per the variability highlighted in the chart above, becoming a forced seller when market demand for grain is not strong, can impact farm revenue by $60-$160/t within a season.

Sell valued commodities

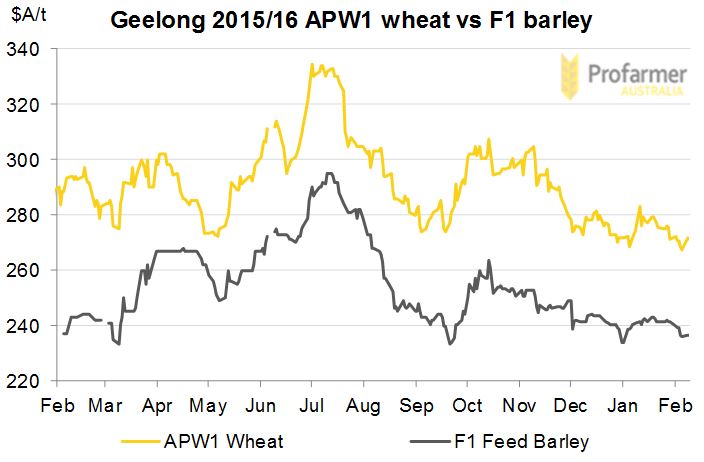

Principle: ‘Sell valued commodities; not undervalued commodities’. If one commodity is priced strongly relative to another, focus sales there. Don’t sell the cheaper commodity for a discount (GRDC Southern Wheat Grow Note Chapter 15.1.5.4).

In the example in Figure 3, the grower can sell wheat or feed barley on any given day. Assuming a grower decided to make sales on the 5 August and 6 November, their revenue can differ significantly depending on which commodity the grower chooses to sell on those days.

Figure 3: Wheat versus barley prices.

Table 1 demonstrates the possible outcomes in this simple example.

| Outcome 1 | Outcome 2 | |

|---|---|---|

| 5/8/15 | Sell 200t APW1 @ $297/t | Sell 200t F1 @ $273/t |

| 6/11/15 | Sell 200t F1 @ $253/t | Sell 200t APW1 @ $303/t |

| Average $275/t | Average $288/t | |

| Difference = $13/t over 400t this equates $5,200.00 | ||

Contract allocation

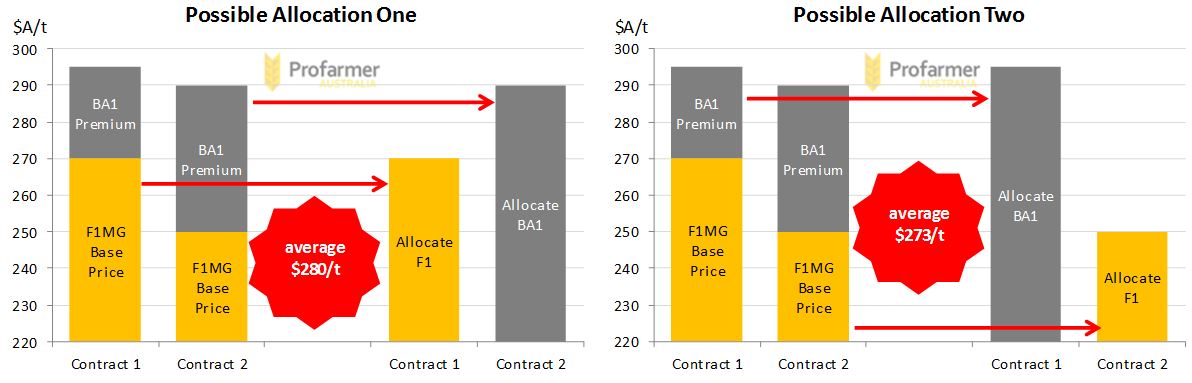

Principle: ‘Don’t leave money on the table’. To achieve the best average wheat price growers should:

- Allocate lower grades to contracts with the lowest discounts.

- Allocate higher grades to contracts with the highest premiums.

The above principles apply regardless of the base price (GRDC Southern Wheat Grow Note Chapter 15.1.5.5).

In the two examples in Figure 4, the difference between achieving an average price of $273/t and $280/t is which contracts each grade of grain was allocated to. Over 400t that equates to $2,800 which could be lost just in how grain parcels are allocated to contracts.

Figure 4: Examples of different allocations of grain grades to different contracts.

Read market signals

Principle: ‘Sell when there is buyer appetite’. When buyers are chasing grain, growers have more market power to demand a price when selling (GRDC Southern Wheat Grow Note Chapter 15.1.5.6).

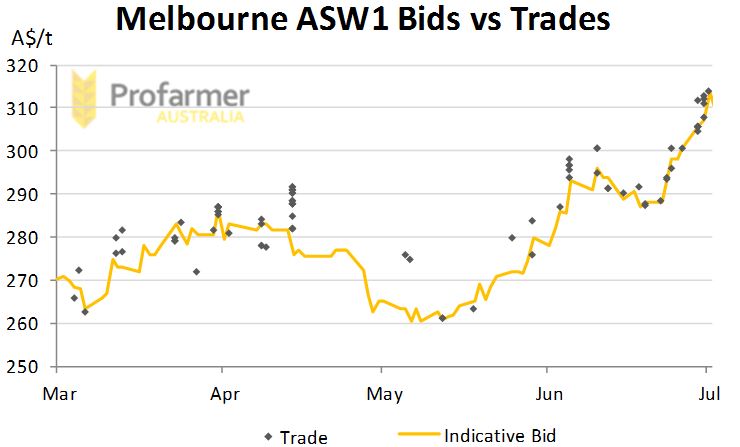

When buyer appetite is strong the seller has more ability to negotiate a better price. Figure 5 clearly illustrates that by growers proactively engaging the market with their offer price they are less likely to miss potential selling opportunities, rather than waiting for the bid to reach their target price.

Figure 5: Comparison of bid versus trades.

For example, the seller who sold in April at $290/t, were able to achieve their target price sooner by having a firm offer in the market. Had they waited for the indicative bid to reach their targeted price of $290/t, these values would not have been achieved until June.

Separate the delivery decision from the pricing decision

Principle: ‘Storage is all about market access’. Storage decisions depend on quality management and expected markets (GRDC Southern Wheat Grow Note Chapter 15.1.4.1).

Storage decisions are dependent on quality management and least cost pathways to expected markets. Alternatives include variations around the bulk handling system, private off farm storage, and on-farm storage.

If we look at the example below for field peas, by knowing at harvest that the least cost pathway to market is going to be delivering direct to a container packer or end user, growers can plan to keep the grain on farm and deliver it later.

Furthermore, delivered container and end user markets may be willing to pay monthly carry, compensating for some of the cost of on farm storage and finance.

| Deliver to BHC and out-turn later | Store on-farm and deliver direct | |

|---|---|---|

| Cartage to BHC site | $8.00/t | N/A |

| BHC receival fee | $7.10/t | N/A |

| BHC out turn fee | $6.40/t | N/A |

| Cartage to container packer | $25.00/t | $28.00/t |

| Allocated capital cost | N/A | $12.00/t |

| Cost incurred | $46.50/t | $40.00/t |

Contact details

Nathan Cattle

Profarmer Australia

Level 1, 616 St Kilda Rd, Melbourne

03 9514 9000

nathan.cattle@nzx.com

Was this page helpful?

YOUR FEEDBACK