Farm funding models and business structures in Australia

Author: The Australian Farm Institute | Date: 05 Sep 2016

Introduction

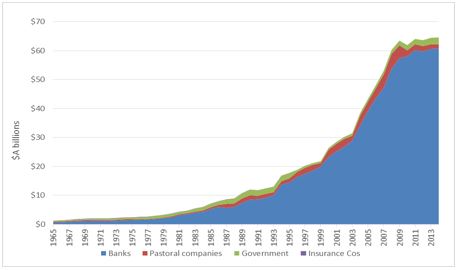

Australian agricultural businesses are capital intensive. In 2015, the average Australian broad-acre farm business involved assets valued in excess of $4.2 million; a figure much greater than is the case for many small to medium sized businesses in the Australian economy. Historically, and particularly over the last two or three decades, farmers have secured the capital required to operate their businesses utilising debt financing from financial institutions such as banks. Total farm debt in Australia as a result has increased dramatically over the last few decades to approximately $60 billion in 2013 (Figure 1).

Figure 1: Farm debt in Australia by source, indicating banks as the largest source of $A. (Source RBA)

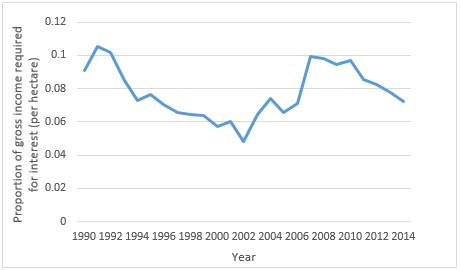

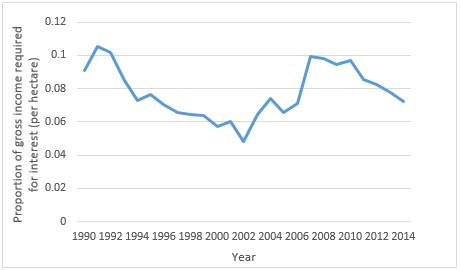

Figure 3: The proportion of gross income per hectare required to service debt. (Source ABARES)

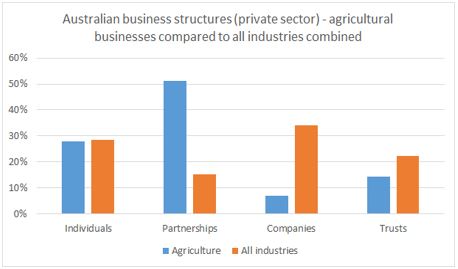

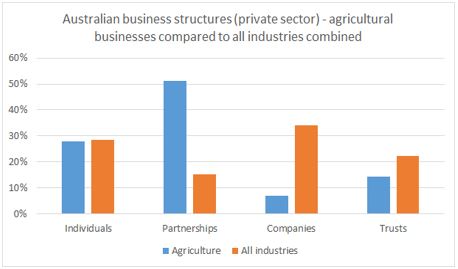

Figure 4: Australian agricultural business structures compared to the average for all Australian businesses. (Source: ATO taxation statistics 2012-2013)

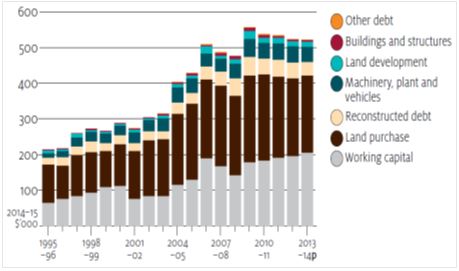

Figure 2 however shows that while a proportion of the debt has been acquired for farm working capital a significant proportion of the growth in debt has also been for land purchases, supporting consolidation in farm numbers and family farm expansion. Over the period from 1995 to 2013, the average real debt carried per broad-acre farm has increased from just under $200,000 per farm in 1990 to just over $500,000 per farm in 2015 (ABARES, 2016).

There has been much commentary about the sustainability of this increase in average farm debt, however data on average farm debt levels is only part of the story. Low interest rates in recent years combined with increases in productivity and farm size have meant that although average debt per farm has increased, the proportion of farm income required to service that debt (in other words to pay interest costs, often referred to as debt coverage) has not followed the same trend. In fact, over this period average farm debt coverage has broadly reflected economic conditions in the agriculture sector. In 1990 nine cents from every dollar of gross farm income per hectare was required to pay interest costs. Debt coverage gradually improved through the 1990’s to a low of five cents, but then rose through the millennium drought in the first decade of the 2000s to a high of ten cents in every dollar in 2007. Since that time, and coinciding with better seasonal conditions and more recently a depreciation of the Australian dollar, average farm debt coverage has improved to seven cents per dollar of gross farm income. (ABARES, 2016).

Total farm debt has increased in some part because, other than during periods of economic downturn caused by externalities such as drought, the managers of Australian agricultural businesses have generally been quite successful in utilising debt to increase the size of their farms, to invest in capital improvements enabling innovation, and to fund business succession.

While debt funding seems to have been adequate in providing the capital needed for the growth of the agricultural sector to date, there is a growing perception that alternative sources of capital and new farm business structures will be required into the future, as the average value of farm assets continues to increase in order to secure scale advantages.

There are several drivers behind the push for alternative farm funding models and business structures. The additional capital required by farmers to invest in the improvements and technology needed to resuscitate Australian farm productivity growth rates through to 2050 has been estimated to be as high as $600 billion (ANZ 2012). While this figure may be at the top end of expectations there is no doubt that if farm productivity growth is to increase beyond the moribund levels experienced in recent times, the capital required by farmers to achieve this will push the limits of sustainable farm debt financing.

Another driver is the desire to position agriculture as a credible market for institutional investors. Investments in agriculture make up a very small proportion of Australian institutional investors’ portfolios. Although the financial performance of institutional agricultural investments over the short term has been patchy, longer-term returns are more than competitive. However fund managers still cite the lack of appropriate business structures as a reason for the low level of institutional investment.

Of the $1.2 trillion under management by superannuation fund managers, only a very small proportion has been invested in agriculture. A BDO report (BDO 2015) found that only 0.3 per cent of superannuation funds are invested in agriculture. The most important reasons given by fund managers for not investing in agriculture included a lack of investable products and a lack of fund managers with specific agricultural knowledge. Interestingly the perception that super funds have too much of a short term focus to invest in agriculture was the lowest ranked reason given, although the survey population may have been somewhat defensive about this perception.

The BDO report recognised that long term returns in the agricultural sector are attractive and that with appropriate structures in place there would likely be more investment by financial institutions. Direct investment by superannuation funds into agribusiness will be limited however, to large farming businesses or major agricultural projects. This is due to the need to ensure management expenses remain efficient. It is unlikely therefore, that superannuation fund investments of less than $50 million would be made in agricultural businesses on a regular basis.

There appears to be more institutional investment in agriculture outside of Australia and indeed Australia has a low level of innovation in finance models and business structures compared to some countries that the Australian Farm Institute (AFI) has investigated.

In the US a high level of government intervention has eliminated a great deal of risk for agricultural businesses and provided the financial security that is needed for institutions and individuals to invest in agriculture. There is a large and liquid market for investing in agriculture which creates an environment conducive to the development of a range of financial services products.

Conversely, in New Zealand it could be argued that the complete lack of government support has created an entrepreneurial environment where innovation flourishes in both production methods and in the business structures and financing methods that support them. Security of production in New Zealand, which is required to give confidence for investors, is derived not from government support but from the productive environment in New Zealand which is much more stable than Australia.

In Brazil innovation in finance models is stimulated both by government support and productive certainty. While the environment is conducive to stable production there are also large government programs and risk mitigation products providing surety for financial return. This, in turn with having agriculture more integrated into the wide economic system than in Australia, has led to agriculture being a widely accepted investment class in Brazil.

The lack of both government support and productive certainty has probably led to a level of conservatism in Australian agriculture that goes some way to explaining the low level of innovation in financing arrangements and business models. Necessity is the mother of invention however, and increasing demand for capital combined with a growing willingness to invest in agriculture should see less reliance on debt funding from banks and alternative financing products becoming more prominent.

One of the alternative sources of funding which is receiving a lot of attention in recent times is crowdfunding. Investing through crowdfunding is a relatively new development and is increasing rapidly. Equity based crowdfunding which results in investors owning a share of a business or participating in an alternative profit sharing arrangement, increased at a compound annual growth rate (CAGR) of 114 per cent from 2009 to 2012. Lending based crowdfunding which provides investors with a fixed rate of interest on the principle invested, experienced a CAGR of 78 per cent over the same period (World Bank 2013). At first glance crowdfunding for capital to invest in agriculture would seem to be a pathway to a practically limitless source of funds however the regulations in place around equity crowdfunding limit its applicability for agriculture.

In December 2015 the Australian government introduced legislation governing how companies are permitted to use equity crowdfunding to raise capital. Equity crowdfunding can only be accessed by public (unlisted) companies with assets or income of less than $5 million. Companies will not be able to raise more than $5 million per year and each investor has to be treated as separate shareholder meaning that under corporation law, crowdfunding would be limited to 50 investors per business.

The above regulations do not preclude agriculture from equity crowdfunding however the transaction costs involved and limits on the asset base and size of investment certainly make the model less attractive to broad-acre agriculture. Smaller or niche agribusinesses may fit well in this model.

Australian real estate investment trusts (A-REIT) are vehicles that give investors access to property assets and are another funding model that is receiving interest. A-REITs provide a regular income stream through income derived from the asset (most often as a rental or lease) as well as the longer term capital gain. The major benefit of A-REITs is that they can provide access to assets that may otherwise be out of reach for individual investors, such as large-scale commercial properties. The fund manager selects the investment properties and is responsible for all administration, improvements, maintenance and rental. While each A-REIT will have its own set of characteristics, the properties selected for inclusion in a trust are usually diversified across regions, lease lengths and tenant types (ASX, 2016).

There have been some spectacular failures of A-REITS, particularly those built around forestry operations however recent changes to the regulation of A-REITS which staples the productive part of the operation to the land asset has resulted in a renewed interest in their suitability as an investment vehicle.

Alternative financing models also need to be considered in the context of the structure of the businesses to be financed. As with financing models, Australian farm business structures have tended to be conservative in their nature and are dominated by structures suited to family farming enterprises.

Accurate data on the use of different business structures in the Australian farm sector are not readily available due to varying definitions used within ABS, ABARES and the ATO reporting systems as well as the complication that many farming businesses use multiple structures within a single business. The data that is available reveals that sole-trader and partnership arrangements are the most common business structures used by farm businesses. The predominant use of partnership structures sets agriculture apart from all other industries where company structures are the preferred model (Figure 4).

Alternative business structures such as collaborative farming and joint ventures are growing in prominence as business owners seek ways to more efficiently distribute capital or create structures that are more attractive to alternative finance providers. Many family farm businesses however, have inherited their current business structure and even if there are more suitable structures available, the compliance costs of converting to a new business structure can be a disincentive to make changes. It is likely however that if the need to find alternative financial models to traditional debt financing continues to gather pace, a more diverse set of business structure options will result.

References

ANZ (2012) ANZ Focus Greener Pastures - The Global Soft Commodity Opportunity for Australia and New Zealand, Issue 4, 2012

BDO (2015) An Analysis: Australian Superannuation Fund Investment In Agriculture 2014/15

Contact details

Richard Heath

Was this page helpful?

YOUR FEEDBACK

To protect your privacy, please do not include contact information in your feedback. If you would like

a response, please contact us.