Grain marketing

Author: Brad Knight (GeoCommodities) | Date: 07 Sep 2016

Introduction

This paper firstly outlines several key underlying concepts that once understood can take good grain marketing to ‘best practice’ grain marketing and help to reduce some of the confusion surrounding grain selling. The core of the paper discusses the decision making process around grain marketing by discussing some of the common mistakes made in this area and introducing some concepts to improve this process and begin the journey of improvement for a farm business and its managers.

Finally, a framework for building a grain marketing plan is introduced as a guide for a farm business to develop their own plan.

Key concepts

Several underlying key concepts are outlined that are central to strategy development for ‘best practice’ grain marketing. By understanding these key concepts of component pricing, the marketing window, decision making frameworks and what separates grain selling from price risk, will help improve profitability and reduce confusion around aspects of grain selling.

Component pricing

In very introductory terms, every grain price can be made up of an underlying ‘base’ price (typically an international price) and a local (basis) component that is relevant to the grower. This is true of all commodities including those where it is more difficult to understand the difference between local and international prices, e.g. pulses and fodder. For the purposes of this paper, the easiest commodity to discuss component pricing for is wheat. It is the easiest to monitor and use as an example because there is an active futures market that acts as a global price discovery mechanism and the components of a wheat price can also be managed (utilising the appropriate tools).

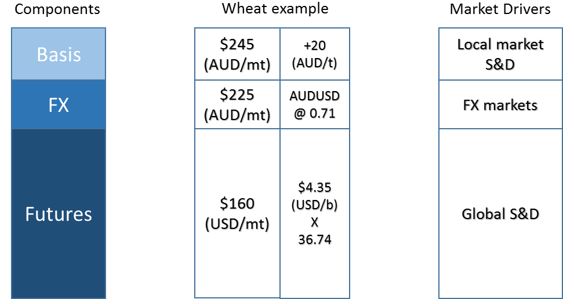

Any wheat price can be made up of the underlying futures price, e.g. Chicago Board of Trade (CBOT) wheat; a foreign exchange component and basis, which is the difference between the local price for wheat and the futures market (converted to the same units) (Figure 1).

Figure 1: Component pricing (wheat example).

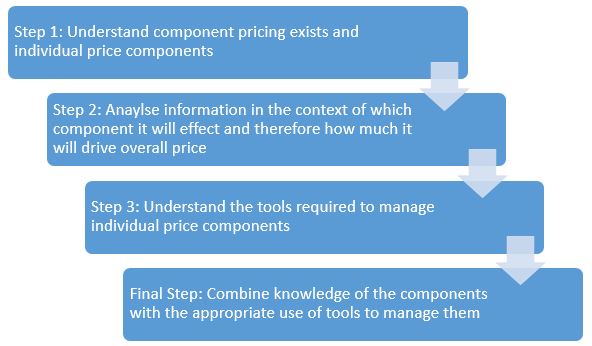

The relative scale of the components in Figure 1 are the scale of the reflective impact each component has on the final price. In the majority of cases the ‘base’ price (futures) makes up the bulk of the price. In order to achieve ‘best practice’ grain marketing it is important to firstly understand that these components exist, break down the information to consider its impact on each component and finally utilise the appropriate tools to manage components individually (Figure 2).

Figure 2: Steps in understanding price components.

There are some distinct steps in learning and implementing improved strategy using component pricing. The most important step and often the hurdle many grain growers struggle with is, understanding the tools that are required to manage price components. Certainly over the last five years the knowledge and understanding of the term ‘basis’ has come a long way with the next step actually being able to manage that part of the price independently from the overall cash price (flat price) or futures price only. The main tools available to manage different price components are liquid markets that trade a standardised contract, with the most obvious being CBOT wheat, but there are many other futures exchanges and over the counter products available to market participants to price grain independently of making a physical sale. Seeking assistance to understand these markets is recommended. A really good further resource for reading is located at https://grdc.com.au/uploads/documents/GRDC%20Grain%20Marketing%20Lingo.pdf

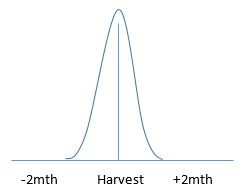

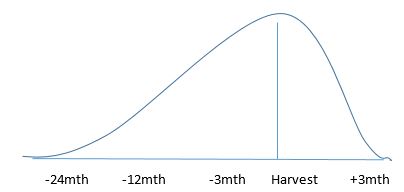

Marketing window

The concept of the ‘grain marketing window’ refers to the timeframe over which the business is prepared to price grain for each season. Using examples, a short marketing window such as selling the majority of the grain at harvest for cash (Figure 3) is highly exposed to the price at that point in time which may be a profitable price or may not. Over a longer time frame, purely by weight of probability due to the cyclical nature of grain prices, there are more opportunities to sell at or above long term prices (Figure 4).

Figure 3: Short marketing window.

Figure 4: Long marketing window.

Being prepared to price some or all of the grain price components a long time before it is harvested is a very good start to maximising price and income.

Being prepared to market grain over a long period does add complexity which needs to be managed. Price risk management is about managing the risks and costs associated with marketing and in a long selling window there can be significant costs (especially carrying physical grain) and or risks that need to be managed depending on the situation.

Pre-harvest marketing

Identifying long term target prices and what represents value for a farm business is a key underlying task involved with running any significant forward marketing plan. In the southern Australian environment, careful and significant consideration should be given to pricing the futures and FX component of a grain price and not the basis component unless production and or farm conditions lend themselves to this. Forward pricing more than a year ahead of harvest gives no real indication as to what the proceeding crop conditions will look like in that year so only pricing using international prices (e.g. a bank over-the-counter ‘OTC’ wheat swap) avoids the potential for being on the wrong side of basis in a drought fuelled domestic rally. On the flipside, if the basis component is unpriced and when a large crop occurs, basis is likely to weaken; this is where constant monitoring of short to medium term timeframes is important

Post-harvest marketing

Many businesses are choosing to focus more on post-harvest marketing programs to eliminate the production risk factor. If the assessment has been made to store more post-harvest, serious attention needs to be payed to reducing the cost of storage and carry-over costs associated with carrying grain. International market movements are more likely to occur in May-June following our harvest and local market changes would be expected during the cropping season (April-October) with the end of this range especially important to secure the new crop.

Price risk management versus grain selling

Price risk management is a component of the overall grain marketing program just like grain selling is. Price risk management is where much of the confusion surrounding grain marketing arises and is distinct from grain selling. Price risk management moves away from the simple process of setting a price on physical grain and executing transfer; it encompasses the overall management of price and is wider reaching in terms of the skills required and tools needed to be effective.

Increasingly farmers are seeking professional assistance in their price risk management programs and are doing so efficiently when they can identify exactly what it is they are seeking assistance for. Is it when to sell, how to sell, where to sell or administration around sales or a combination of more than one or all? The basics of it is ‘how do I know what tools are available and then how do I use them to manage price risk? (i.e. how to avoid ‘low’ prices and maximise sales at ‘high’ prices)?

Common clangers in decision making

One of the single biggest factors which creates confusion and anxiety around grain selling is the inability to make timely decisions. Not making a decision can be as risky as making the wrong one. Before we discuss developing and implementing better decision making frameworks, let’s look at several of the common factors that contribute to delays in making decisions.

Poor information

In this age of information one of the most critical skill that a business manager can develop is the ability to critically analyse information quickly and to put it into its correct context. In grain markets, prices and market movements on a daily basis occur as part of a complex interaction of short, medium and long term market drivers all influencing the market at any one time. What changes is that different drivers have more impact than others. To manage this, contextualise the relevance of any information into the timeframe of the decision and always ask the question ‘is this information actually relevant to my situation?’ In terms of market information sources, it is very important to have consistency in this as patterns will often emerge over time in different sources that makes them easier to interpret. Finally, less can be more. Too much information is generally more confusing than less. More relevant information consumed less regularly is much more useful.

A useful resource to put weather and global crop information into context is the global cropping calendar found here.

Lack of objectivity in the decision making process

Making decisions based on constantly evolving subjective feelings and thoughts is unfortunately a common occurrence in grain marketing and needs to be replaced by more critical, objective thought processes that are developed over time to suit an individual’s business. The cases where there is more than one key decision maker (more common than not), an agreed upon objective criteria for making a decision is really helpful to ensure decisions are timely and based on a mutual understanding between all parties, not just on one member’s ideas or strategy.

Concerns about production risk

In the context of forward selling, concerns about production risk is the single biggest limiting factor to stop price risk management before a crop is grown. There are two ways to minimise these concerns; reduce production risk or use pricing tools which reduce an individual’s exposure to production risk (see component pricing section).

Concerns about making the ‘wrong’ decision

Once production risk is reduced (i.e. grain is harvested), the concern switches into a fear of selling grain too ‘cheap’. This is especially true of grain in storage which replaces the production risk concern as the main reason for delaying or not making a decision. The disadvantage we often have in the Australian market is that once we harvest grain, other world crops are well and truly harvested and getting through their marketing programs so there is very little ‘risk’ premium built into prices anymore. There is a lag of several months between this time and when the market begins to price ‘risk’ in again into international prices.

Improved decision making frameworks

Now for the solution to making better decisions…

Well it’s not as easy as a one page solution in a GRDC paper! There are a plethora of formal decision making frameworks available (just search ‘decision making frameworks’ in a search engine). An individual or business will need to investigate and develop or adopt (and perhaps try a few different ones over time) their own decision making framework. To summarise though, the characteristics of an excellent decision making process that can be followed for large and small decisions is one that is:

-

Simple and consistent.

-

Scalable – used for big and small decisions.

-

Timeframe bound.

-

Objective.

One example which can be adapted to suit the development of grain marketing plans is that of SMART (Specific, Measurable, Achievable, Relevant and Time Bound) objectives. Further information can be found here.

Focussing in on the time aspect of the SMART objectives, it is vital that not only the decision itself is put in the context of time, but also any information and constraints relevant to the decision need to be put in a similar context. To assist in doing this, any grain marketing planning is useful to break down into timeframes as well. A simple model for this is to consider all plans and decisions in the context of short, medium and long term timeframes. Breaking the information and decisions down into manageable ‘units’ is important, as this is where the grain marketing plan comes into its own.

Framework for a grain marketing plan

There are three timeframes for a grain marketing plan (Table 1).

Table 1: The three timeframes for a grain marketing plan.

| Plan | Timeframes | Plan duration | Review frequency |

|---|---|---|---|

| Short term | Weeks | 1 month | Monthly |

| Medium term | Months | 1 year / 1 season | Quarterly |

| Long term | Years | Multiple years / Duration of rotation | Yearly |

Long term (multi-year)

There are a number of elements to consider in the development of a long term plan including:

- Rotations (crop types),

- sensitivity of business profit to grain price,

- marketing window, and;

- engagement of assistance.

Rotations (crop types)

Rotation selection for marketing, risk management and agronomic management, which also includes varietal selection based on your target markets. Analyse your past experiences with the market for each specific commodity; when is demand strongest, when is the market quiet, what are key drivers sitting behind that market? You will be surprised what you can remember when you try.

Consideration should also be given to yield variability and price averages versus price variability when considering the rotation set-up and income variation risk behind this.

The final piece coming out of analysing rotations should be the cost of production figures over the course of the rotation which will drive the long term target prices which in turn will guide the medium term (seasonal/yearly) plans as well as long-term time frame price risk management if those tools were to be adopted.

Sensitivity of business profit to grain price

Understanding the sensitivity of business profitability to grain price determines how much effort and focus needs to go into grain marketing and price risk management and the level of importance will dictate further choices in this plan and what kind of external assistance may be required.

Marketing window

How is the business going to be positioned to maximise the time that the grain can be priced over? What tools are required, administration and training requirements?

It is important to note that in this piece, designing a selling process that everyone in the business is comfortable with including the tools used and the timeframes; small and regular sales versus less often and larger sales (where timing is more critical). In practice it is often a mixture of these.

Engagement of assistance

Be clear what you are looking for help with. Is it planning of grain marketing (consulting), developing sales strategies

(advisory) or executing sales strategies (broker to make sales).

Medium term plan (yearly)

The main objective for the yearly plan is to determine some sort of sales plan taking into consideration cashflow requirements, grain storage options and overall price trends. Ultimately some rules are required around how much will be priced each month if prices are within the pre-determined price range and if they are not, what happens. These strategies will be based on what you know right now about the following market drivers:

-

World supply and demand.

-

Local supply and demand.

-

Critical market moving events.

World supply and demand

The main underlying driver on a seasonal basis is the world supply and demand for each commodity. What do plantings look like in the year ahead? The supply versus demand trends provide an idea of the global price ranges. The sowing period for each ‘marketing year’ starts in October in the year before, e.g. the 2017/18 crop year globally will run from July 2017 to June 2018. This crop will be sown in the northern hemisphere in October 2016. Decisions affecting the sale of the 2017 harvest Australian crop are already being made (sowing decisions based on price, agronomics, etc) in the northern hemisphere.

Local supply and demand

Seasonally our local supply and demand situation basically gets re-set each year; so understanding not just what supplies look like in the local area but also more broadly across the market zone/port zone/state (e.g. SNSW and Vic, Melbourne port versus Portland) needs to be achieved each year.

Whilst there are times of the year when this can change rapidly (i.e. spring), once harvest rolls around and grain goes into storage or is sold etc, a much clearer picture will emerge about how local supply (and demand) will influence markets.

Critical market moving events

Understanding on a rolling basis over the course of the year what are the major events/crop development stages which have the ability to move the market. These include winter crop plantings October/November, Australian harvest conditions (Nov/Dec), sub-continent sowing (Oct/Nov) and harvest (Feb/Mar), Australian plantings (Apr/May) and northern hemisphere harvest (Jul/Aug).

Short term (monthly)

Finally, the short term plan breaks down the much bigger piece of work into a manageable unit day to day plan. There is quite a bit of market intelligence gathering required to guide short term implementation. What’s happening in the local market, are we exporting a lot of grain or not much? How are local prices versus international prices (basis)? What’s happening beyond the farm gate; where is export/import parity in my key markets and how competitive is my price? Everytime you think about the market you need to ask yourself; which underlying long term and medium term drivers are in play, and focus your attention on what is actually driving the market. These change over weeks and months, not days.

Once a decision is made it is important to execute the action and don’t worry about small fluctuations in price, e.g. the amount of times a price will drop $1 in a day so a sale is not made, only for it to be $5 lower tomorrow. If the strategies are right just pull the trigger.

Within the month, the short term plan is developed from the medium term plan and an even more targeted strategy around prices versus volume sold is implemented. By commodity, a specific target price or band of target prices and percentage to sell within that month could be developed to bring discipline into the process.

Summary

After reading this paper you should have a better understanding of a number of key concepts relating to grain marketing. At the heart of this paper is a discussion about how decisions about grain marketing are made; improving these processes in a farm business should reduce some of the confusion surrounding grain selling. Developing these frameworks must be done to suit an individual business and its managers and is a long term development. Lastly, a framework for developing a grain marketing plan is introduced, which is designed to be used as template for a grower and adviser to begin the development of their own plan.

Contact details

Brad Knight,

bknight@geocommodities.com.au

Was this page helpful?

YOUR FEEDBACK