Wheat National Variety Trial Results 2015

Author: Steven Tillbrook | Date: 29 Feb 2016

Steven Tilbrook, Kalyx Australia

Key messages

Mace continues to increase in acreage and occupied the lion’s share of WA wheat sowings in 2015. Reliance on only one wheat variety is not without its risks and there are a range of varieties that growers can use to minimise risk, maximise profit and increase genetic diversity in their cropping program:

- Scepter looks like a potential replacement for Mace having similar agronomic character with improved leaf rust resistance and yield. Further evaluation is required as 2015 is Scepters first year in the NVT program. Cobalt and Tenfour were also top performers similar to Scepter, but at feed grade may have a very limited market.

- Zen performed well proving it as a quality replacement for Calingiri. In 2015 Zen was consistently higher yielding than Calingiri and also brings an improved yellow leaf spot, stem rust and stripe rust package.

- There are now a range of longer season wheats available that will yield well given the right seasonal conditions and in particular an early sowing opportunity. These include Trojan, Cutlass, Bremer, Magenta, Zen and Harper.

Aims

The National variety trial (NVT) program is a national program of comparative crop variety testing with standardised trial management, data generation, collection and dissemination. The program is supported by the Australian Government and growers through the GRDC and is managed by the Australian Crop Accreditation System Limited (ACAS). The NVT aims to generate independent information to growers about newly released crop varieties. The NVT system has been developed to complement the plant breeding programs. The NVT program will only test lines very close to commercial release.

The aim of the program is to evaluate a range of current and soon to be released wheat varieties established at a single sowing time and under regional, grower accepted, and standard practice. Growers are able to select varieties with new and improved quality, maturity and disease traits which in turn provide breeders with feedback on the direction they need to be taking their respective breeding operations in WA.

Method

The trials are distributed as evenly as possible across Australia in the main soil types and rainfall zones, and where possible, the trials are located with active grower groups to provide a focal point for the main grower group research sites. The trials are sown and harvested as close to or before district grower practice to ensure variety performance is similar to that seen by growers on their farms. The varieties in the trials are either currently available to growers or will soon have commercial release to market and are benchmarked against district standards and quality check varieties.

Field assessments of emergence, vigour, and days to flowering are conducted across all of the trials along with other opportune assessments that occur in different growing seasons e.g. disease, shattering. Following yield measurements all varieties have a CBH delivery standard analysis conducted on oil, seed & meal protein and moisture.

Data Analysis Method

P.V. (Production Value) is the individual Variety yield benchmarked against the overall mean yield for each region expressed as a percentage. Data for the last 5 seasons, 2011-2015, are used in the analysis to calculate the PV’s. All NVT data is analysed by SAGI.

Results

Table 1. Production Values (%) for wheat varieties in Agzones 1, 2 and 4.

|

Variety |

Agzone1 |

Agzone2 |

Agzone4 |

|||

|

PV % |

No. |

PV % |

No. |

PV % |

No. |

|

|

Scepter |

112 |

6 |

113 |

16 |

110 |

9 |

|

Hydra |

108 |

18 |

107 |

48 |

105 |

27 |

|

Cosmick |

106 |

12 |

106 |

31 |

105 |

9 |

|

Corack |

106 |

30 |

105 |

79 |

106 |

42 |

|

Mace |

105 |

30 |

105 |

79 |

104 |

43 |

|

Cobra |

105 |

24 |

105 |

64 |

104 |

35 |

|

Tenfour |

102 |

18 |

105 |

49 |

105 |

35 |

|

Zen |

105 |

18 |

104 |

48 |

101 |

27 |

|

Cobalt |

101 |

6 |

104 |

19 |

103 |

34 |

|

Cutlass |

100 |

6 |

102 |

16 |

104 |

9 |

|

Wyalkatchem |

103 |

30 |

102 |

79 |

101 |

43 |

|

Magenta |

103 |

30 |

102 |

79 |

100 |

43 |

|

Supreme |

101 |

18 |

101 |

48 |

101 |

27 |

|

Trojan |

100 |

18 |

102 |

47 |

101 |

26 |

|

Kunjin |

|

|

100 |

63 |

101 |

33 |

|

Envoy |

99 |

12 |

100 |

31 |

100 |

16 |

|

Bremer |

101 |

18 |

100 |

48 |

98 |

27 |

|

Westonia |

100 |

30 |

100 |

79 |

101 |

43 |

|

Espada |

99 |

18 |

99 |

47 |

100 |

25 |

|

Scout |

94 |

30 |

98 |

79 |

101 |

43 |

|

Emu Rock |

97 |

30 |

99 |

79 |

103 |

42 |

|

EGA Bonnie Rock |

100 |

30 |

99 |

79 |

99 |

43 |

|

Harper |

|

|

97 |

46 |

99 |

9 |

|

King Rock |

100 |

12 |

99 |

31 |

99 |

16 |

|

AGT Katana |

96 |

12 |

97 |

31 |

100 |

16 |

|

Wedin |

|

|

96 |

79 |

95 |

43 |

|

Calingiri |

98 |

30 |

96 |

79 |

95 |

43 |

|

Arrino |

96 |

12 |

97 |

31 |

99 |

15 |

|

Carnamah |

98 |

12 |

97 |

31 |

96 |

16 |

|

Estoc |

96 |

12 |

96 |

30 |

97 |

16 |

|

B53 |

98 |

6 |

97 |

32 |

95 |

18 |

|

Fortune |

97 |

30 |

96 |

79 |

96 |

43 |

|

Impress CL Plus |

99 |

24 |

96 |

63 |

95 |

35 |

|

Yitpi |

93 |

24 |

95 |

63 |

97 |

35 |

|

Justica CL Plus |

94 |

30 |

94 |

79 |

96 |

43 |

|

Clearfield STL |

96 |

12 |

95 |

31 |

93 |

16 |

|

Sabel CL Plus |

94 |

6 |

93 |

16 |

93 |

8 |

|

Yandanooka |

93 |

24 |

92 |

63 |

93 |

33 |

|

Grenade CL Plus |

90 |

30 |

91 |

79 |

93 |

43 |

|

Jade |

90 |

6 |

92 |

33 |

93 |

26 |

|

Kord CL Plus |

90 |

18 |

90 |

47 |

94 |

25 |

|

Impose CL Plus |

92 |

12 |

89 |

31 |

90 |

16 |

|

Zippy |

86 |

6 |

88 |

16 |

93 |

8 |

|

Mean Yield (t/ha) |

2.33 |

2.67 |

1.78 |

|||

Table 2. Production Values (%) for wheat varieties in Agzones 3, 5 and 6.

|

Variety

|

Agzone3 |

Agzone5 |

Agzone6 |

|||

|

No. |

No. |

No. |

||||

|

Scepter |

112 |

6 |

115 |

6 |

117 |

3 |

|

Hydra |

107 |

16 |

107 |

18 |

109 |

9 |

|

Cosmick |

105 |

11 |

105 |

12 |

107 |

3 |

|

Corack |

103 |

25 |

108 |

29 |

104 |

14 |

|

Mace |

104 |

25 |

108 |

29 |

105 |

14 |

|

Cobra |

105 |

25 |

104 |

26 |

104 |

11 |

|

Tenfour |

102 |

21 |

106 |

24 |

108 |

12 |

|

Zen |

104 |

16 |

105 |

18 |

108 |

6 |

|

Cobalt |

103 |

21 |

105 |

18 |

109 |

12 |

|

Cutlass |

106 |

6 |

105 |

6 |

104 |

3 |

|

Wyalkatchem |

102 |

25 |

104 |

29 |

103 |

14 |

|

Magenta |

104 |

25 |

100 |

29 |

103 |

14 |

|

Supreme |

101 |

16 |

102 |

18 |

101 |

3 |

|

Trojan |

102 |

21 |

98 |

24 |

103 |

12 |

|

Kunjin |

101 |

19 |

101 |

23 |

99 |

9 |

|

Envoy |

99 |

25 |

102 |

29 |

104 |

14 |

|

Bremer |

100 |

16 |

100 |

18 |

104 |

9 |

|

Westonia |

100 |

25 |

100 |

29 |

98 |

14 |

|

Espada |

99 |

14 |

99 |

17 |

98 |

9 |

|

Scout |

100 |

25 |

101 |

29 |

100 |

14 |

|

Emu Rock |

98 |

25 |

103 |

29 |

97 |

14 |

|

EGA Bonnie Rock |

98 |

25 |

98 |

29 |

97 |

14 |

|

Harper |

99 |

16 |

99 |

18 |

98 |

9 |

|

King Rock |

97 |

9 |

98 |

11 |

98 |

5 |

|

AGT Katana |

97 |

9 |

100 |

11 |

94 |

5 |

|

Wedin |

99 |

25 |

97 |

29 |

98 |

12 |

|

Calingiri |

98 |

25 |

95 |

29 |

97 |

11 |

|

Arrino |

96 |

9 |

|

|

|

|

|

Carnamah |

98 |

9 |

94 |

11 |

95 |

5 |

|

Estoc |

98 |

25 |

97 |

28 |

97 |

12 |

|

B53 |

96 |

11 |

91 |

12 |

98 |

6 |

|

Fortune |

98 |

25 |

96 |

29 |

95 |

14 |

|

Impress CL Plus |

94 |

15 |

95 |

18 |

94 |

9 |

|

Yitpi |

97 |

21 |

97 |

24 |

96 |

12 |

|

Justica CL Plus |

96 |

25 |

96 |

29 |

94 |

14 |

|

Clearfield STL |

97 |

9 |

92 |

11 |

96 |

5 |

|

Sabel CL Plus |

97 |

4 |

95 |

5 |

93 |

2 |

|

Yandanooka |

94 |

19 |

|

|

|

|

|

Grenade CL Plus |

92 |

25 |

92 |

29 |

88 |

14 |

|

Jade |

91 |

16 |

90 |

12 |

91 |

3 |

|

Kord CL Plus |

91 |

14 |

91 |

17 |

86 |

8 |

|

Impose CL Plus |

86 |

9 |

91 |

11 |

86 |

5 |

|

Zippy |

84 |

4 |

90 |

5 |

|

|

|

Mean yield |

4.16 |

2.65 |

3.51 |

|||

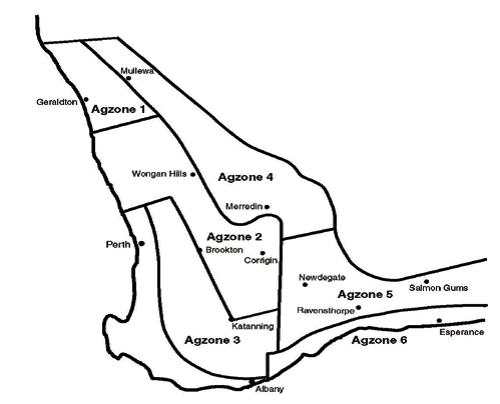

Figure 1. Agzones of the WA wheat belt.

Conclusion

The 2015 season brought varied conditions across the state producing site average yields from 1.47- 5.74 t/ha. Mace continues to be a solid benchmark for yield in WA but now has some potential alternatives/replacements.

- Growing only one variety is not without its risks and there are a range of varieties that growers can use to minimise risk, maximise profit and increase genetic diversity in their cropping program.

- Scepter looks like a potential replacement for Mace having similar agronomic character with improved leaf rust resistance and yield. Further evaluation is required as 2015 is Scepters first year in the NVT program.

- Hydra performed well again in 2015 performing slightly better than Mace but below Scepter in all Agzones.

- Zen was a top performer proving it as a quality replacement for Calingiri. In 2015 Zen was 11% higher yielding than Calingiri on a state basis and also brings an improved yellow leaf spot, stem rust and stripe rust package. A reduced powdery mildew tolerance needs to be closely managed but thus far has not appeared to be an issue.

- Cobalt and Tenfour returned some good results in 2015, similar to Scepter, but at feed grade may have a very limited market.

- There are now several long season wheats available for early sowing opportunities or frost management. Yitpi has remained a popular choice for a late maturing line in some regions (particularly frost risk areas). Trojan and Cutlass both look to be a possible alternatives in the Yitpi growing areas for early sowing options or frost risk management.

- Magenta, Bremer, Harper and Zen are all longer season wheats that will have their fit in WA.

- Clearfield or IMI tolerant lines continue to demonstrate a yield penalty relative to other current varieties and should be considered for their agronomic attributes. Impress CL Plus continues to be the best performer in Ag zones 1, 2 and 6.

Disclaimer: It is advisable not to make widespread recommendations or management decisions on variety replacement or retention based solely on the 2015 NVT data

Key Words

Wheat, varieties, National Variety Trials, grain yield

Acknowledgments

The author thanks the GRDC for funding the National Variety Testing project.

Grower Co-operators for providing trial sites

Grower Groups for providing research focus sites for the NVT

Kalyx Staff for planning and implementing the WA NVT program

Paper reviewed by: Matt Davey Kalyx Australia

GRDC Project Code: GIA00004,

Was this page helpful?

YOUR FEEDBACK