An International Benchmarking Comparison of Australian Crop Production and Profitability

Author: Ashley Herbert Agrarian Management | Date: 27 Feb 2017

Key Messages

Compared to other wheat growing regions in the world:

- Australian wheat production costs and profitability are comparable to that in other grain growing regions of the world.

- Australian wheat yields have the highest level of variation.

Aims

To compare the profitability and costs of wheat production in Australia to other regions in the world through the evaluation of data from the international cash crop benchmarking network, agri Benchmark for the seasons of 2011 to 2015.

Method

The aim of this paper is to present the results from a global benchmarking exercise over the last five years and provide some insight into how wheat production in Australia compares to that in other regions of the world. This analysis has been done using data from the agri benchmark network.

This is part of a GRDC funded project.

Agri benchmark is global network of professionals in agriculture from the major grain growing regions of the world. The aim of the network is to improve the understanding of grain production systems throughout the world through benchmarking. The network is administered and managed through the Thünen Institute of Farm Economics in Germany (www.agribenchmark.org).

Participating network members establish a “Typical Farm” for a defined region. These are virtual farms that reflect what would be considered typical for the targeted region in terms of scale, crops grown, rotations, inputs, operations, machinery, labour, costs and income. Each year the data is updated according to the prevailing conditions of the season.

The data is then compiled into a single database by the agri benchmark staff at the Thünen Institute. Financial data is converted into USD and EURO based on the average exchange for the year.

In this summary there are seven typical farms for Australia detailed below:

- AU4000WB (AUWB) – Kellerberrin district of the low rainfall central wheatbelt region of Western Australia.

- AU4500SC (AUSC) – Wittenoom Hills district in the high rainfall south coast region north east of Esperance, Western Australia.

- AU5500WA – Tenindewa district in the low rainfall region of the Northern wheatbelt of Western Australia.

- AU3500Vic – Sea Lake district in the low rainfall region of the Victorian Mallee.

- AU3000NSW – Gulargambone district of the Central West of New South Wales.

- AU22800SA - Freeling district North of Adelaide, South Australia.

- AU1550Qld – Warra district West of Dalby in South West region of Queensland.

AUWB and AUSC were established in 2009 and now have seven years of data in the global database. The remaining typical farms were initiated in 2014 and have four years (2012 – 2015) of data in the global database.

Results

Wheat

This is a summary of 42 typical farms which are located in EU (21), Canada (4), USA (1), Ukraine (2), Russia (1), Argentina (3), Uruguay (2) and Australia (7). While there are additional farms within the database, only the results of those with a continuous dataset for the five year period of 2011 to 2015 have been presented.

- This report includes summaries of:

- Yields and yield variability.

- Farm gate grain prices.

- Crop income and production costs.

- Physical inputs.

- Enterprise margins.

Yield

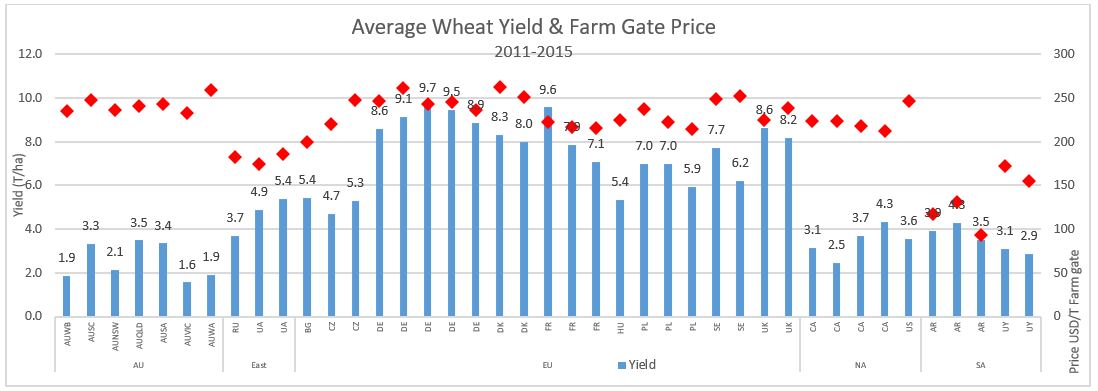

The five year average yields of wheat in this analysis range from 1.6t/ha (AUVic) to 9.7t/ha (EU) with the EU standing out as the highest yielding region with a range of 4.7t/ha to 9.7t/ha. Within this group the highest yields are achieved on the typical farms from the Western European countries (including the UK).

The feedback from the network partners in the countries where the production systems are still developing is that there is a wide variation in performance between individual farms due to production knowledge and access to working capital. Many farms in Ukraine and other Eastern European countries are constrained by insufficient working capital as well as limited agronomic technology. The implication is that these regions are effectively under producing and therefore have the capacity to increase production with greater adoption of modern agronomic technics and increased availability of working capital.

Wheat yields from the non EU farms ranged from 1.6t/ha (AUWB) to 5.4t/ha (Ukraine).

Figure 1: Average wheat yields and grain prices ($US/t farm gate) for the five years 2011 – 2015.

Wheat Price

Grain prices are presented on a farm gate basis per tonne nett of freight to end point and all selling costs. The price reflects the total value of grain produced including premiums or discounts for quality or grade. Details of the specific grades and discounts and premiums are not recorded in the dataset.

The wheat price has been relatively consistent across regions with $US31/t difference between the 25th and 75th price percentile. The median price for the dataset was $US225/t.

The prices for the Australian farms have been relatively high and consistent between farms. The combined average for the Australian farms of $US242/t compares very well to other regions and is just under the 75th percentile of the dataset.

Table 1: Average farm gate wheat price ($US/t) for the years 2011 – 2015.

Typical farm regions | Farm gate price ($US/t) | |||

|---|---|---|---|---|

Average | 25th Percentile | Median | 75th Percentile | |

AU4000WB | $236 | |||

AU4500SC | $247 | |||

AU3000NSW | $237 | |||

AU1550QLD | $241 | |||

AU2800SA | $243 | |||

AU3500VIC | $233 | |||

AU5500WA | $259 | |||

AUSTRALIA | $242 |

| ||

East Europe | $181 | |||

EU | $235 | $223 | $238 | $247 |

North America | $225 | |||

Argentina | $114 | |||

Uruguay | $164 | |||

All farms | $219 | $214 | $225 | $245 |

In general, the South American farms have recorded the lowest prices in the data set. In particular the Argentinian prices are extremely poor which has significantly limited the profitability of the enterprise.

Income and Costs

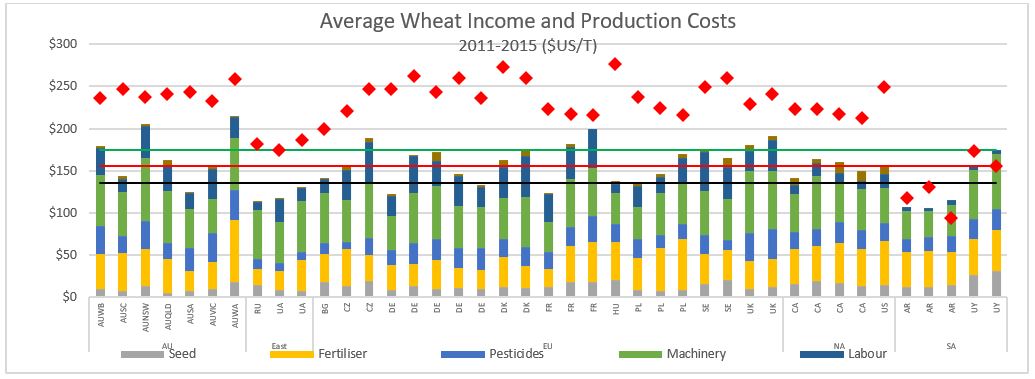

Crop income includes all proceeds from sales of grain and bi products such as straw. In most cases, grain sales make up the vast majority of the income on each farm.

Total crop income ranged from $US330/ha (AR) to a high of $US2 383/ha (EU). The EU region stands out as a distinct group with high income and high cost of production. Income ranged from $US1 034/ha to $US2 383/ha. Total costs ranged from $US700/ha to $US1 654/ha. For the non EU farms, income ranged from $US330/ha (AR) to $US903/ha (USA). Total costs range $US305/ha (AUWB) to $US636/ha (CA).

Comparing costs and income on a tonne of production basis reduces the level of variation between the farms and the regions. On this basis the EU farms are no longer distinctive as a group and the Argentinian farms are clearly the lowest cost producers. Total costs of production ranged from $US107/t (Argentina) to $US206/t (AUNSW).

Figure 2: Average wheat income and costs per tonne ($US) of production for the period 2009 – 2013. P25 & P75 refers to the 25th and 75th percentiles for the total production costs of the dataset.

One common feature across all farms is the high cost of fertiliser and machinery. While there is some level of variation between the individual farms these two items were consistently the highest cost items.

There is a high level of variation in costs per tonne of production within the Australian group ranging from the highest for the dataset (AUNSW $US206 and AUWA $US215) to some of the lowest (ex Argentina).

The high average cost for AUNSW is the result of the exceptionally poor yield in 2013 of 0.8t/ha. This will have a disproportionate effect on the average costs per tonne in the short term, assuming that such yields occur far less frequently than one in four years. The production costs for the individual years were $US165, $US431, $US123 and $US103/T.

Table 2: Average and median production costs per tonne of wheat production for the period 2011 – 2015.

Region/ Farm | Cost per tonne of production (USD) | |||||

|---|---|---|---|---|---|---|

Seed | Fertiliser | Pesticides | Labour | Machinery | Total | |

AU4000WB | $11 | $41 | $33 | $32 | $60 | $179 |

AU4500SC | $8 | $45 | $20 | $15 | $52 | $144 |

AU3000NSW | $14 | $43 | $34 | $38 | $74 | $206 |

AU1550QLD | $5 | $40 | $19 | $31 | $62 | $163 |

AU2800SA | $7 | $25 | $26 | $18 | $47 | $124 |

AU3500VIC | $10 | $31 | $34 | $35 | $41 | $154 |

AU5500WA | $18 | $74 | $36 | $25 | $61 | $215 |

AUSTRALIA | $10 | $43 | $29 | $28 | $57 | $169 |

East Europe | $11 | $26 | $10 | $17 | $56 | $120 |

EU | $13 | $36 | $22 | $33 | $53 | $160 |

North America | $16 | $46 | $21 | $13 | $49 | $154 |

Argentina | $13 | $41 | $17 | $4 | $34 | $109 |

Uruguay | $28 | $46 | $24 | $4 | $62 | $165 |

All farms | $14 | $38 | $22 | $25 | $52 | $155 |

The Argentinian farms have the lowest costs per tonne of production with an average of $US109/t (dataset median $US156/t) which is driven for the most part by the significantly lower machinery and labour costs. A key point of difference on these farms is the exclusive use of contractors for all cropping activities. According to the network partners this is common practice in the grain growing regions of Argentina.

As a region, Australia had the highest costs of production with an average of $US169/t ranging from a low of $US124/t to $US215/t. This represents a range of $US91/t.

Similarly, the EU group ranged from $US123/t to $US200/t averaging $US160/t.

The high production costs of the AUWA farm ($US215/t) is relatively consistent across years and is primarily due to a high cost structure across the board. Fertiliser in particular is the highest cost in the data set at $US74/t reflecting a relatively high input system.

East region farms (Russia and Ukraine) have a cost base of $US120/t which is approximately $US40/t less than the Australian average. The difference is primarily driven by low fertiliser, pesticides and labour costs. However, wheat prices recorded were approximately $US60 less which has eroded some of the competitive advantage.

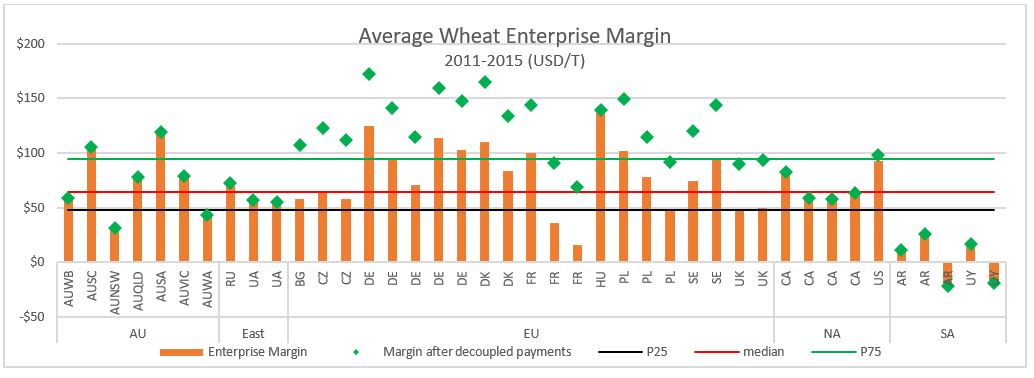

Enterprise Margin

Figure 3: Average wheat enterprise margin ($US) per tonne of production of wheat for the period 2011 – 2015 - including decoupled payments. P25 & P75 refers to the 25th and 75th percentile margin.

Wheat profitability on the farms from Canada, USA and Australia compare more favourably to the EU farms. The margin for AUSC and the AUSA were within the group of the highest margins at $US104/t and $US119/t respectively.

Profitability was highly variable within the EU group with margins ranging from $US16 to $US139/t. The median profit for the EU group was $US78/t.

The average profit margin for the North American farms was $US71/t.

Decoupled payments added $US37 to $US59/t to the profitability of the EU farms. This increased the median profit margin to $US127/t of the EU farms.

Despite having some of the highest production costs and lowest yields in the dataset, the profit margin on the Australian farms was just above the average for the dataset. This is attributable to the relatively high grain price achieved over the period.

Although the South American farms had the lowest production costs they also recorded exceptionally poor pricing for the period resulting in very low margins.

Interestingly, the average margins for the EU, North American and Australian farms are relatively similar ($US79, $US71 & $US73/t). However, when decoupled payments are taken into account the EU farms have a $US48/t advantage.

Table 3: Summary of wheat enterprise margin ($US) per tonne of production.

Typical farm regions | Wheat enterprise margin ($US/t) | ||||

|---|---|---|---|---|---|

Average | 25th Percentile | Median | 75th Percentile | + decoupled | |

AU4000WB | $57 | $59 | |||

AU4500SC | $104 | $105 | |||

AU3000NSW | $31 | $31 | |||

AU1550QLD | $79 | $79 | |||

AU2800SA | $119 | $119 | |||

AU3500VIC | $79 | $79 | |||

AU5500WA | $43 | $43 | |||

AUSTRALIA | $73 | $74 | |||

East Europe | $61 | $62 | |||

EU | $79 | $58 | $78 | $102 | $125 |

North America | $71 | $72 | |||

Argentina | $5 | $5 | |||

Uruguay | -$1 | -$1 | |||

All farms | $67 | $48 | $64 | $94 | $90 |

Table 3: Summary of wheat enterprise margin ($US) per tonne of production.

Conclusion

1. The lowest yielding farms were from the Australian group.

2. Australian farms were generally low yielding with moderate to high levels of yield variation between years.

3. Production on AUNSW was the most variable in the dataset.

4. EU farms were generally high yielding with relatively low levels of variation between years.

5. Australian farms achieved high grain prices.

6. Argentinian farms had the lowest costs of per tonne of production, lowest prices and lowest margins in the dataset.

7. Machinery cost per tonne of production were the highest single cost for all farms.

8. Profitability per tonne of production for the Australian farms was competitive with EU, Canadian and USA farms.

9. Low prices generally lead to low levels of profitability.

Acknowledgments

GRDC

Nic McGregor Agvise Management Consultants, Merredin WA

Brett Symes ORM, Bendigo Vic

James Hillcoat, Rural Directions, Freeling, SA

Rob Sizer, Agripath, Tamworth, NSW

Peter Wylie, Agripath Dalby, Qld

GRDC Project Number: AAM00001

GRDC Project Code: AAM00001,

Was this page helpful?

YOUR FEEDBACK