Fixed or variable - the sixty-four-dollar question

Author: Andrew Toole (Robinson Sewell Partners) | Date: 06 Jun 2017

Take home messages

- Trying to time the market is very difficult and unforeseen changes in the economic financial market can change the landscape overnight.

- Understanding the four emotive drivers to the decision making process.

- Do the sums and make it relevant to your business circumstances.

Introduction

Taking into consideration that economics is the only field in which two people can share a Nobel Prize for saying the opposite thing, there is plenty of heated argument as to whether now is the right time to fix interest rates or stick with variable rates as the better option?

The current Reserve Bank of Australia (RBA) cash rate is at a record low of 1.50% and over the past seven years, the market direction with interest rates has continued to remain in a downward trend.

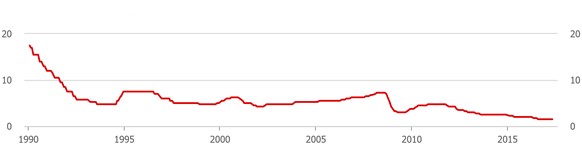

Since the major shakeup to the global economy which was sparked with the global financial crisis (GFC) which hit the Australian economy during 2008 and 2009, interest rates around the world plunged into freefall. The market recovered slightly in Australia in 2010 and 2011, but with the end of the mining boom which was supporting the growth in the Australian economy, interest rates have continued to remain under pressure and have fallen away to the current levels (Figure 1).

Figure 1. Reserve Bank of Australia cash rate (1990-current) (Source: RBA).

Interest rate movements have always been hard to predict and with the events that have unfolded over the past decade, this has become even more apparent. To add to this complexity, in the Australian markets we are now seeing more and more lenders acting independently of the RBA with interest rate rises being made by banks to protect their margins as their cost of funds becomes difficult to manage in a low yield market.

However, this paper is not about direction, but about motivation and what a borrower needs to consider when weighing up the decision as to whether to fix or remain variable with their interest rate exposure.

Background

The pricing of fixed interest rates is determined by market sentiment as to the likely level of rates into the future and is portrayed in the financial bond markets. Like all markets, the direction and effects of demand and supply with those that have a bullish view and those that have a bearish view is a battle that takes place daily. The markets often trade in a range, with sentiment swinging from one side to the other until a trend starts to emerge or a major effect occurs which changes the thinking to a more agreed path.

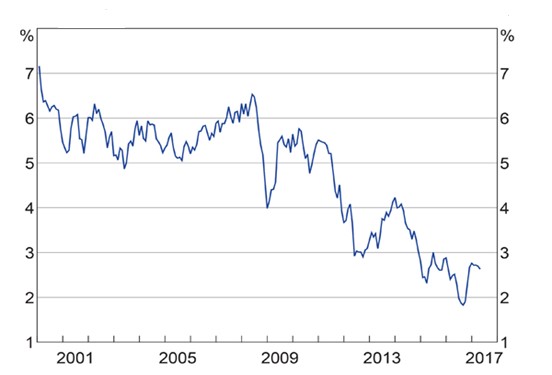

The 10 year Australia Government Bond market demonstrates how market forces come into play to set our fixed rate interest rates that banks offer to borrowers and key periods when major economic events have occurred can be reflected in the chart direction (Figure 2).

Figure 2. Ten-year Australian Government Bond Yield (Source: RBA).

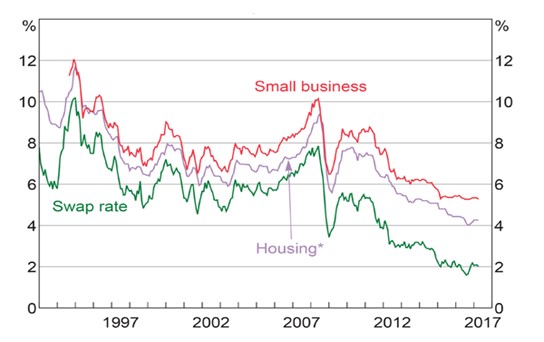

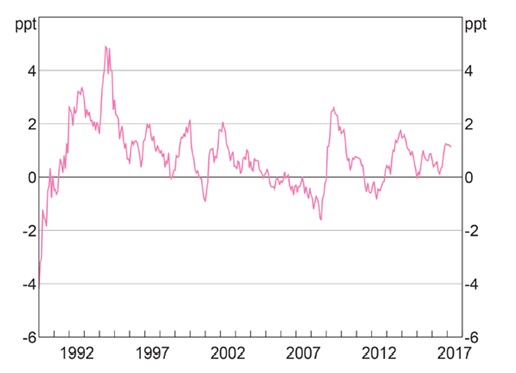

Figure 3 highlights the correlation with the bond market and the fixed interest rate pricing levels over the past 20 years and Figure 4 indicates the spread between the bond market and the fixed interest rate.

*Available to owner-occupiers

Figure 3. Australian fixed interest rates (3-year maturity) (Source: Bank’s websites, Bloomberg, Canstar Cannex, and RBA).

Figure 4. Spread between Australian 10-year bond yield and the cash rate (Source: RBA).

The markets are all about risk

Risk is the chance of an event happening and an impact is the result of that event occurring.

Although risk and impact go hand in hand when you make a decision, they each have a greater or lesser ability to affect your decision, depending on your own personal attitude towards risk and what is at stake.

Regardless of whether you choose to acknowledge it, risk and impact are present in every decision you make.

In the case of your mortgage and its rate type you have a simple decision; either fix your interest rate or not. So you need to consider both sides of your decision if you hope to make the right decision. If you do not fix, your interest rate will be variable, which is to say your lender can change it either up or down by as much as they like and as we have now experienced, whenever they like outside of changes with the RBA cash rate movements. Therein lies the risk of taking a variable rate mortgage.

So, the sixty-four dollar questions are:

- Are the banks likely to lift rates in the foreseeable future?

- If so, by how much and when is that likely to occur?

However, it is not all downside for the variable rate mortgage. Providing you are able to handle the risk and impact of rate increases, you will generally gain a powerful benefit from a lower daily interest rate (although this may not always be the case), more flexible offset options and a less costly option to vote with your feet when your lender lets you down. Quite often the impediment for borrowers to switch to another lender with a more attractive and suitable banking package is restricted by the harsh break costs that may apply with breaking a fixed rate contract prior to its expiry.

The cost of going fixed

The main reason for taking a fixed rate mortgage is to eliminate all the risk that comes with a variable rate mortgage, offering you a fixed repayment amount, with a known interest cost for a definite period of time.

This means that assuming returns on the business remain the same from the outset then there is simply no way you will lose the farm or be arguing over money because of interest rate movements on your loan during the fixed rate period because, quite simply, the rate, repayments and costs, do not change. However, that protection is usually not free.

Generally speaking, fixed rate loans will cost you anywhere between a little and a lot more than their variable rate counterparts depending on the market volatility and the expected movement of rates over the short and medium terms.

The banks and their experienced financial traders are very good at assessing the probability of where rates are likely to go at least in the short term and the margin between fixed and variable rates is used to influence borrowers to act accordingly. In some ways, it may be regarded as a bet against where the bank’s market analysts and traders have predicted the market direction of interest rates to be in three or five years’ time.

The other factor that needs to be considered and is often not recognised is that when a borrower takes on a fixed rate loan, they are effectively locking in the risk margin that the bank has assessed the business at the time of the contract. The risk margin is the margin that the bank applies to its base rate in measuring a business’s past and forecasted future performance and financial position in conjunction with set benchmarks and key performance indicators (KPIs). If a business improves this risk grade over time with greater returns and net worth then it cannot force the bank to recognise this under a fixed interest mortgage with a reduced pricing margin as the old higher margin is locked away.

To fix or float – the emotive responses that occur

There are four main drivers that can decipher your decision-making process and are linked to personality traits and emotions that we all experience. These are as follows:

- The Gambler: Too often consideration is taken on speculating that interest rates are going to continue to go up or down. An emotional response to this is acting on sentiment rather than economic rationality. If motivation to hedge interest rates is based on your thoughts that interest rates have bottomed and are on the way up for good, then rethink your philosophy on hedging. Your motivations, albeit with good intentions, may not be aligned with your business requirements. In the period around late 2009 to 2011, the market experienced a correction off the cash rate lows of 3.00% to a cash rate of 4.75% in the later half of 2011. Locking in during this period in the expectation that the worst was over and interest rates were headed higher meant that the subsequent falls of the RBA cash to 1.50% and subsequent reduced variable interest rate would have meant that savings in interest would have been missed.

- The Fearful: Fear of missing the bottom of the cycle and the fear of interest rates going up. Fear is a very powerful motivation and it is difficult to separate this emotional response to economic reality. After all it is a primal instinct for self-preservation. Smell your fear and then lock it in a sealed box.

- The Risk Taker: On the flip side, borrowers may let it all run, on the premise that rates may fall further even though their business may be extremely sensitive to interest rate movements and gross margin profit (or loss). The risk taker can take a skewed position on markets that may not be all too favourable when rates move against the play. Save your risk play over a game of 500 - it is much safer.

- The Rational Centurion: Completely independent from the emotional drivers and strapped into the decision-making chair of economic rationale. This is where a borrower needs to be. Here decisions are made on the following questions with a review of the business undertaken to ensure the answers obtained have a logical basis:

- What are my future capital requirements and movements over the next three to five years (the period where hedging takes place)? Is there a need to hedge when debt reduction is planned?

- What percentage of this capital requires flexibility to ensure capital mobility can be deployed without incurring substantial break fees?

- What is the real sensitivity of my business to interest rates? Can the predicted cash flow handle an increase in rates (with regards to the banking covenants and policy ratios)?

- What premium in interest rates am I willing to pay on day one with a hedge to remove a percentage of this? Calculate the economics (refer to example provided in The economics of hedging section).

- Does my business have a natural hedge to interest rates (in other words, does my business have assets that appreciate with inflation and/or increased profits are expected in an economy that is picking up speed)?

The economics of hedging:

The economics of hedging is best demonstrated with an example:

On a $5m borrowing, the following rates are provided to a borrower:

- Variable rate: 4.25%

- (benchmarked against 90 day Bank Bill Swap Rate (BBSW)).

- 3-year fixed rate: 5 .25%.

- 5-year fixed rate: 5.85%. .

If the borrower decides to hedge $1.5m for three years and $1.5m for five years, the borrower is paying a weighted average premium of 1.30% for $3m from day one over the first three years.

In simple terms, that is around five RBA rate rises before the hedge breaks even. But remember the business has paid a premium leading to this point. Therefore, the rates must continue rising five more times (now 10 in total) over the same amount of time it took to hit break even before the business breaks even in the premium paid.

Obviously multiple scenarios can be modelled out quite easily, but it demonstrates that the economics run deeper when applied to probability over a specific timeframe. Noting that in the end, the hedge will expire at some point and the business is back to the variable environment. So, whatever the interest rates are at this point of maturity, can the business handle high interest rates at all and what is the calculated risk and is this acceptable going forward?

Conclusion

There is no doubt that in a climate of so much uncertainty, cheap fixed rates have become increasingly attractive. However, you should remain mindful of the serious limitations of fixed rate loans before you race to sign on the dotted line. Check to ensure what limitations apply to extra payments and redraw and remember, just like the chance that rates will rise, there is a chance they will fall as well.

Regardless of whether you choose a fixed rate mortgage or not, how you arrange your loan and the features you choose will have a significant impact on your finances and your life, whether you notice it or not.

This is a serious topic, and we hope this paper has triggered some deeper thought. We are most willing to discuss these points in more detail with you if it strikes some curiosity and relevance to your business.

Contact details

Andrew Toole, Corporate Partner – Robinson Sewell Partners

PO Box 8664 Kooringal NSW 2650

0437 889 036

andrew@robinsonsewell.com.au

Was this page helpful?

YOUR FEEDBACK