Characteristics and habits of Top 20% farm business operators

Author: Paul Blackshaw (Meridian Agriculture) | Date: 16 Feb 2018

Take home messages

- Benchmark studies can be useful to compare your farm business to others to highlight areas for potential improvement.

- The Top 20% sample can reveal drivers of profit.

- Exploring the characteristics, personality and habits of the Top 20% growers can also reveal important reasons for their success.

Background

This paper discusses the findings from the Victorian High Rainfall Management Guidelines produced as part of the larger GRDC project “The integration of technical data and profit drivers for more informed decisions”. Data was captured from grain growers in the Victorian High Rainfall zone over three years and analysed to identify key management factors that affected profit drivers. It was complemented by a qualitative survey.

While benchmarking is a useful tool to provide a snapshot of the financial and production performance of a farm business, the stories behind the Top 20% growers can provide a useful and interesting snapshot into the characteristics and habits of highly profitable growers. This paper also discusses these characteristics and habits drawn from interviews of the Top 20% growers that contributed to the dataset used to develop the Victorian High Rainfall Management Guidelines, as well as the Agriculture Victoria Livestock Farm Monitor Project, along with general observations of many farmers by the author.

Results and discussion

The Management Guideline for the Victorian High Rainfall agro-ecological zone demonstrates that there is a significant gap in financial performance between the Top 20% growers and the average farming business within the zone. The Top 20% growers were selected based on Return on Equity (ROE).

The Top 20% farmers have generated an operational ROE of 4.9% during the three year period analysed between 2012/13 and 2014/15. This is over double the average business in the zone which recorded a ROE of 2.4% during the same time period.

Return on Assets Managed (ROAM) is an alternative ratio which can be used to measure financial performance. The Top 20% recorded an operational ROAM of 5.8%, compared to the average business in the dataset of 5.2% (Table 1)

Table 1: Victorian High Rainfall Zone — farm business performance.

Key Performance Indicator | Top 20% by ROE | Average of dataset |

|---|---|---|

Return on Equity (ROE) | 4.9% | 2.4% |

Return on Assets Managed (ROAM) | 5.8% | 5.2% |

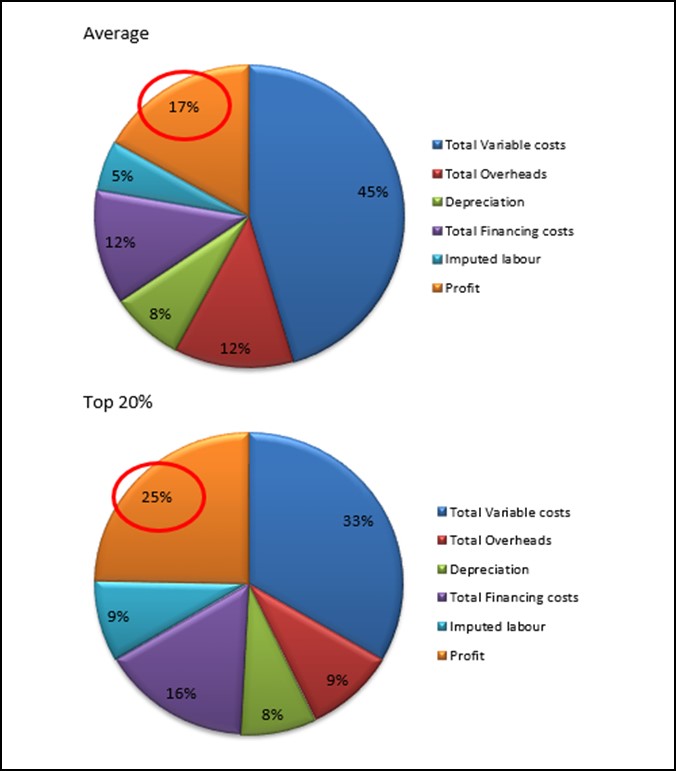

When considering the financial performance in terms of turnover, the Top 20% retain 25% of turnover as profit, compared to 17% achieved by the average grower participant (Figure 1).

Figure 1. Costs and profit of as a percentage of farm turnover for the Top 20% and average business.

Most farms in the Victorian High Rainfall zone run a mixed system with cropping and livestock. The Top 20% growers in the GRDC dataset run both enterprises in a highly profitable fashion.

There are a range of important profit drivers that are influencing variation in farm performance. The four primary profit drivers that are driving the differences in long term financial performance have been identified as:

- Gross margin optimisation.

- Developing a low cost business model.

- People and management.

- Risk management.

It is the interaction of these four primary profit drivers that is resulting in very different levels of financial performance being achieved. This paper will focus on gross margin optimisation and developing a low cost business model.

Gross margin optimisation

When compared to the average of the participants, the Top 20% growers achieved 5% higher cropping income per hectare from 6% lower variable costs per hectare. This contributed to them achieving 15% higher cropping gross margin (Table 2).

Table 2. Cropping gross margin.

Key Performance Indicator | Top 20% | Average of dataset | Comparison with average |

|---|---|---|---|

Crop Income/ha | $ 1,132 | $ 1,080 | 5% higher |

Crop variable cost/ha | $ 497 | $ 527 | 6% lower |

Cropping gross margin/ha | $ 635 | $ 553 | 15% higher |

Crop variable cost % of income | 44% | 49% |

The main driver of the optimised gross margin is the ability of the Top 20% to achieve additional yield from lower variable costs (Table 3). Higher yields and lower costs result in a 23% lower cost of production per tonne for wheat and 16% lower cost of production per tonne for canola (Table 3). Most variable costs are lower for the Top 20% farmer, except chemicals. This may indicate the importance of weed control in achieving higher yields.

Table 3. Cropping gross margin per tonne.

Key Performance Indicator | Top 20% | Average of dataset | Comparison with average |

|---|---|---|---|

Wheat yield – t/ha | 4.6 | 4.2 | 10% higher |

Wheat cost of production – per tonne | $ 173 | $ 225 | 23% lower |

Canola yield – t/ha | 2.3 | 2.2 | 5% higher |

Canola cost of production – per tonne | $ 334 | $ 400 | 16% lower |

The improved performance of the Top 20% can be attributed to many factors, however it appears that enhanced operational timeliness and excellent agronomic skills in areas such as summer weed control, moisture retention, timeliness of sowing, appropriate nutrition and good agronomy are key factors in achieving this improved performance.

Low cost business model

In addition to optimising gross margin the Top 20% farmers have also been able to develop a low cost business model. Table 4 shows that their overhead costs on a per hectare basis is 13% lower than the average. This tends to indicate an appropriate scale of operation and may also be influenced by the simplicity of the business. It is also influenced by lower finance, lease and equipment costs.

Table 4. Overhead costs

Key Performance Indicators | Top 20% | Average of dataset | Comparison with average |

|---|---|---|---|

Overhead costs per ha | $ 76 | $ 92 | 13% lower |

Overhead costs as a % of income | 9% | 12% |

Livestock Farm Monitor

Agriculture Victoria conduct a benchmarking study of the livestock industry each year. This examines the financial and productive performance of a range of livestock businesses across the state.

Table 5 shows that over a long period the Top 20% of participants in the Agriculture Victoria Livestock Farm Monitor report are able to achieve over three times the profit (EBIT/ha) than the average.

Table 5. Long term averages — 10 years of data state wide, livestock 06/07 to 14/15 (from Ag Vic Livestock Farm Monitor Report).

Average | Top 20% | |

|---|---|---|

Gross Income ($/ha) | $557 | $802 |

Enterprise/variable costs ($/ha) | $226 | $255 |

Overhead costs ($/ha) | $134 | $133 |

Owner/Operator Allowance ($/ha) | $98 | $324 |

EBIT ($/ha) | $100 | $324 |

Return to assets | 1.7% | 4.8% |

Return to Equity | 0.4% | 4.6% |

Stocking rate (dse/ha) | 13.3 | 16.7 |

As can be seen from both examples, it obviously pays to be in the Top 20% of farmers from a profitability perspective. It is also very difficult for famers to remain consistently in the Top 20%, with only small numbers being able to repeatedly be in the Top 20% for multiple years.

Characteristics and habits of Top 20% farmers (both grain growers and livestock producers)

While there can be some strong messages in the data, for example; optimising stocking rate in a livestock enterprise improves profitability, there are also some interesting observations about highly profitable farmers that cannot be observed from the data.

A range of participants of the Agriculture Victoria Livestock Farm Monitor report were interviewed to better understand the characteristics of highly profitable farmers. The group was made up of those who were able to repeatedly be part of the Top 20% sample across a number of years. In addition, a number of the Top 20% farmers in the Management Guidelines project were interviewed. The author has also drawn on a range of general observations of profitable farmers from many years spent sitting around the farm kitchen table.

A strong theme is that profitable farmers tend to farm to their personality. This means they are more likely to love what they are doing, and consequently be more successful at it. It also means that there is no strong message around which mix and size of enterprise is more profitable. The Top 20% sample is made up of big, complex, multi-enterprise businesses, as well as simple ‘mum and dad’ businesses only running one small enterprise. It really comes back to the increased likelihood of success if you farm to your personality. In some cases this may involve outsourcing tasks within the business that are not enjoyed by members of the business, to those who are experts.

For many, profit is a major driver, and these people who feel this way are likely to be found in the Top 20% sample. However, this may not lead to a fulfilling life, or positive work-life balance. Some farmers have commented that while they run a profitable enterprise, they are willing to forego the next step up in profit for some personal or lifestyle factors. This might include being home when kids get off the school bus or accepting that some money spent on the farm may not contribute to profit, but actually makes them happy.

Optimising profit is also linked to risk. Everyone has a different position on risk and this may be influenced by financial security, stage of life, health and family circumstances. Business and personal goals all influence the amount of risk an individual is willing to take and this position can change rapidly, sometimes triggered by sudden events. No risk position is right or wrong, it is what you are comfortable living with. While the Top 20% are almost always willing to take on risk, this may not be for everyone.

While there is no ‘recipe’ for the characteristics, habits or personality traits of highly profitable farmers, there are a number of themes that appear to be common in many. These can be roughly grouped as personal, farm system and business.

Personal

- Love talking about their farm.

- Driven and passionate.

- Hungry for knowledge.

- Mindset to manage ‘properly’.

- Appetite to take on risk.

- Part of a network/discussion/peer group (formal or informal).

- Found their ‘sweet’ spot.

- Not afraid to think outside the square — open/enquiring mind.

Farm system

- Push the system.

- Multiple enterprises, but not too many.

- Intimate knowledge of farm.

- Seek advice when required.

- Buy good genetics, but don’t get too hung up on it.

- Measure things that matter.

- Regular soil testing — use fertiliser judicially.

- Rotationally graze — to a degree (gut feel now that the skill is learnt).

- Operational timeliness.

Business

- Treat it like a business.

- Cash flow budget, some regularly update and compare budget to actuals.

- Make evidence based decisions.

- Business plan — usually written down and reviewed.

- Capacity to get through difficult times.

- Sell direct — if use an agent make them work for you.

- Use contractors/contract labour as required.

Conclusion

The data in benchmarking studies can provide some signposts to areas in business that drive profit, and can possibly be explored and addressed to increase farm profitability. However, the data only provides part of the story. The common personality and other characteristics of the Top 20% business operators can also be used to understand highly profitable growers better. Some of these habits and characteristics can potentially be adopted by those outside the Top 20%, but some are such an ingrained part of their personality it is impossible to change.

References

Cropping Zone Management Guideline – Victorian High Rainfall Zone, Grains Research and Development Corporation (GRDC)

Livestock Farm Monitor Report – Victoria, Agriculture Victoria

Acknowledgements

The research undertaken as part of this project is made possible by the significant contributions of growers through both data contribution and the support of the GRDC, the author would like to thank them for their continued support.

Contact details

Paul Blackshaw

Meridian Agriculture

Rutherglen

0427 546643

pblackshaw@meridian-ag.com.au

GRDC Project Code: RDP00013,

Was this page helpful?

YOUR FEEDBACK