Are Australian supply chains getting cheaper?

Author: Peter White, Ross Kingwell, Chris Carter (Australian Export Grains Innovation Centre) | Date: 08 Mar 2018

Take home messages

The costliness of Australia’s export grain supply chains has remained generally stable or decreased slightly in real terms over the past five years.

Complete cost component transparency is often lacking in Australian export grain supply chains, unlike what occurs for some of Australia’s competitors, and so perhaps greater or formal monitoring of supply chain costs is required.

Supply chain costs of new, low-cost competitor countries (Russia, Ukraine and Argentina) are likely to decrease further, as their production volumes increase and new infrastructure becomes operational.

Australia needs further improvements in grain yields, greater investment and operational efficiencies in supply chain infrastructure, additional regulatory reform and a greater intensity of cropping in higher rainfall regions to help lower the average cost of its export grain supply chains.

Aims

This paper reports on changes in the costliness of Australia’s grain supply chains that principally are devoted to exporting wheat. We also report the wheat supply chain costs of Australia’s principal competitors. The purpose of our analyses is to assess how well the Australian export supply chains are serving the interests of Australian farmers and exporters as they strive to compete against other low-cost bulk exporter nations that also serve nearby growing Asian markets.

As background, supply and demand for wheat has expanded rapidly over the past decade, creating opportunities for the Australian grains industry but also opportunities for grain exporters in other nations. Australia now faces significant price competition in many markets. Australian wheat production in 2016-17 reached record levels which tested the capacity of Australia’s storage, handling and transport system, but also helped keep downward pressure on wheat prices. Increasingly, wheat export prices are being influenced by low-cost producers in the Black Sea region and Argentina. Russia is now the world’s leading wheat exporter and has established a competitive position in Australia’s traditional markets. Also, following policy changes in Argentina, their wheat exports have surged. Much of this increased supply has been absorbed by demand growth in Asia and Africa, caused by growing populations, rising incomes and changing consumer preferences.

Method

Australia’s export grain supply chains are complex and varied. A range of supply chain options are available in every Australian state, with grain being exported in bulk or containers through 18 ports spread around Australia’s coastline. Geographic and logistical constraints affect the movement of grain through each region. Often a mix of transport modes applies, with road and rail services varying in capacity and quality and being subject to a range of state and federal regulations. Further, substantial variation in grain production and quality can occur from year to year, increasing the risks associated with long-lived investments in supply chain infrastructure and affecting the costs and pricing of supply chain services.

This study provides a general description of the main changes that have occurred in Australian supply chains over recent years. We also estimate the trend in supply chain charges compared with Australia’s major competitors. Supply chain costs are based on prices published by supply chain service providers (bulk handlers), weighted by the volume of grain passing through each port catchment zone. Catchment zone maps are published by all the major supply chain service providers. Distances from a receival site to port in each catchment zone are based on the shortest Google Maps® road distance.

Charges listed for services used in this paper do not necessarily reflect the commercial cost of providing the service, but simply represent the costs to growers and exporters who use the service to export grain. Published prices are only a reference and actual charges may, and do, vary depending on negotiations between the user and supplier of the service.

Results

Recent changes in the structure of Australian supply chains

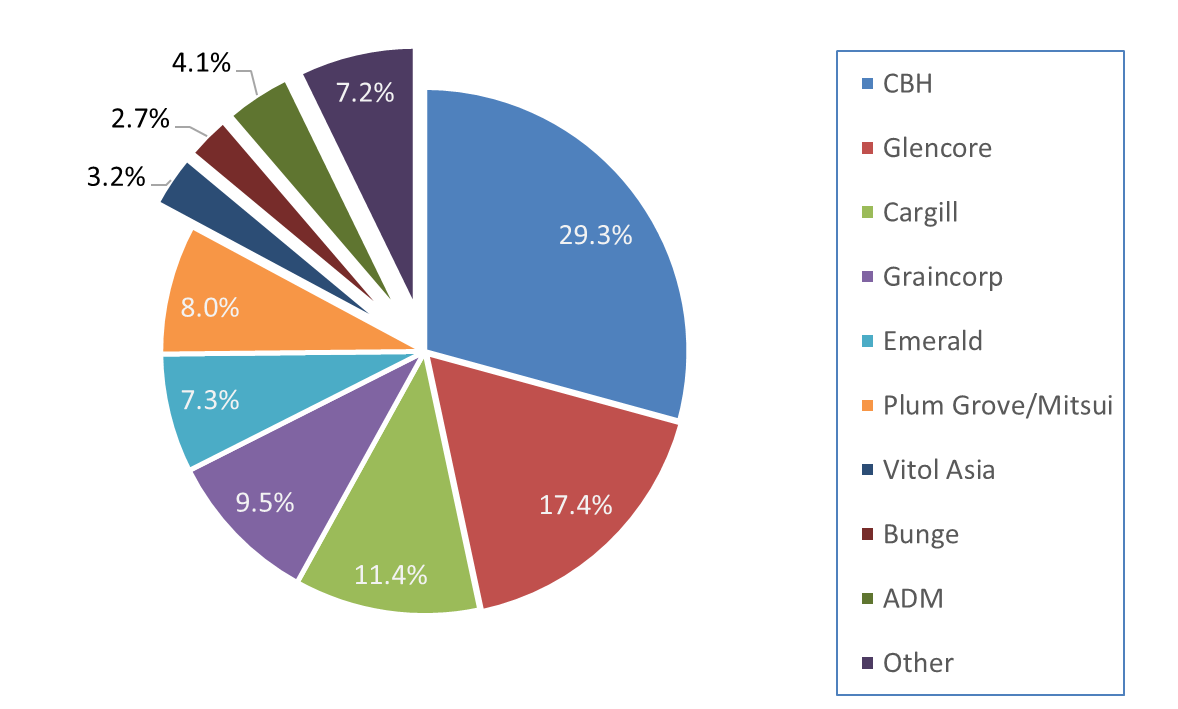

Grain Trade Australia list nearly 200 ordinary trading companies among its Australian membership in 2017. Of these, the top six companies exported about 80% of Australia’s wheat from 2013/14 to 2015/16 (ACF, 2017). Cooperative Bulk Handling (CBH) is the largest, exporting about 30% of Australia’s wheat followed by Glencore with a 17% share (Figure 1). The remaining four companies: Cargill, GrainCorp, Emerald and Plumgrove/Mitsui, have export shares between 8% and 12% each on average. From 2013/14 to 2015/16 the dominance of the top six exporters declined slightly from 86% down to 76%.

The dominant wheat exporters are also integrated marketing and bulk handling companies. Plumgrove/Mitsui is the only top-six wheat exporter that is not also a bulk handler. Kalish-Gordon et al (2016) show the reorganisation of the structure and ownership of Australian supply chains over the past 30 years. The number of major grain handling companies has halved from 11 to six, and, following the deregulation of wheat marketing in 2008, they are all now integrated marketing and bulk handling companies, and four of the remaining six (representing nearly 60% of total wheat exports) are foreign-owned.

Figure 1. Main Australian wheat exporters (Source: Australian Crop Forecasters (ACF))

Regionally, the presence of the major integrated marketing and bulk handling companies is even more pronounced than indicated by a national market share assessment. The recent entrance of new companies with new port infrastructure into Australian grain supply since 2014 has, so far, only posed a minor threat to the dominant position of incumbents; particularly for CBH in WA, Viterra in SA and Graincorp in Queensland.

Graincorp controls nearly all the port capacity for bulk grain export from Queensland. In WA, the bulk handling division of CBH owns and controls almost all the state’s warehouse storage, grain freight and port loading infrastructure, while its trading division marketed 40% of all grain exported in 2015/16. Its next biggest marketing competitor in WA is Glencore which marketed about 17% of the wheat exported from WA in 2015/16.

A similar situation occurs in SA with Viterra, the bulk handling arm of Glencore, controlling over 90% of the state’s port export capacity and the majority of its grain receival, storage and transport capacity. Glencore also markets about 36% of all grain exported from SA which is nearly three times its nearest competitor in the state; CBH.

Ownership and control of grain export infrastructure is more diverse in Victoria and NSW, where substantial new port facilities have been established and are operating, but grain handling is still dominated by GrainCorp. In these states Graincorp controls about 50% to 70% of the port and warehouse storage capacity and is also the largest marketer of grain. In 2015/16 Graincorp marketed about 20% of the grain from NSW and about 40% from Victoria.

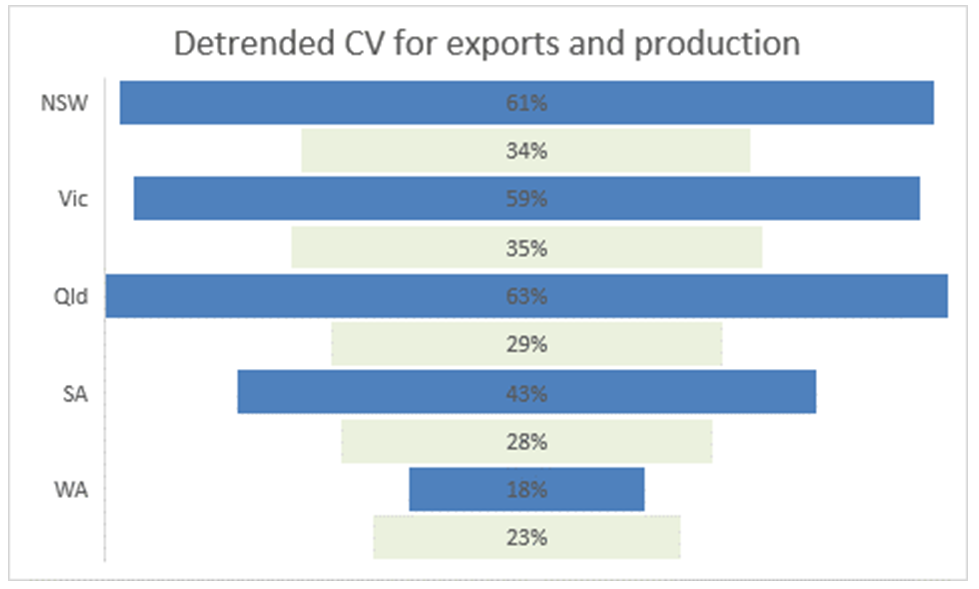

The difference in the structure of supply chains across Australia is partly driven by the size of the domestic market. Both WA and SA have relatively small domestic markets causing much of their total production to be exported; 88% and 66% for WA and SA respectively during 2006 to 2016. By contrast, in the other wheat producing states (NSW, Qld and Vic) domestic consumption often takes more than 50% of total production. As a consequence, the variation in the volume of wheat exports from WA and SA is lower than for NSW, Qld and Vic which reduces both the cost and risk of grain exports from WA and SA (Figure 2).

Grain storage

The size of the domestic market also influences the proportion of grain stored on-farm which continues to increase across Australia. Industry experts estimate that over that past five years the amount of grain stored in good quality steel silos in NSW, Qld and Vic has doubled. Significant amounts of grain have moved from temporary or poor quality shed storage into higher quality facilities. More than 80% of an average harvest can now be placed in permanent storage on-farm in these states. On-farm storage in SA and WA is at a lower level than in these other state, but continues to grow, albeit at a slower pace. About 240,000 tonnes of permanent storage have been added annually in WA over the past few years and more than 30% of an average harvest can be stored on farm in either permanent or short term storage (e.g. grain bags). The increase in on-farm storage has been driven by growers seeking to increase their marketing options and to facilitate their farms’ grain harvest logistics.

Figure 2. De-trended coefficient of variation in annual wheat production (green/pale bars) and exports (blue/dark bars) from Australian states from 2006 to 2016. Larger annual variation in the volume of exports relative to production (e.g. Qld 63% vs 29% ) indicate the extent to which factors other than production influence exports (e.g. domestic consumption)(Source: ABARES and AEGIC).

Warehouse storage capacity is undergoing significant change, with the major bulk handlers undertaking a planned 50% or more reduction in the number of receival sites. Old and inefficient sites are being closed whilst simultaneous upgrades are being made to several remaining prime sites. However, the charges for receiving grain across the receival networks are not substantially differentiated between sites, despite the cost to bulk handlers of receiving and storing grain at some inefficient sites reportedly being more than twice the receival fees.

Viterra is an exception as they classify sites as either Tier 1 or Tier 2, the latter attracting a 6% higher fee to receive grain. Differential transport charges from receival sites to port have been a surrogate mechanism bulk handlers use to attract grain to more efficient sites. In WA and SA where transport charges are listed, transport charges from efficient sites can be up to15% lower than those from less efficient sites. In Qld, NSW and Vic, despite lack of transparency in some key components of supply chain costs, cost differences are typically reflected in the price offered for the grain at the receival site.

Transport

Australia has 18 grain ports, most located a relatively short distance from production areas, although average distance to port is substantially shorter in SA at about 140 km compared with the average in NSW at 400 km. Shorter distances reduce the cost of transportation and increase the viability and flexibility of road transport. Appropriate investment and regulation of freight networks to optimise the different advantages of road and rail transport will be important for Australia, especially as technologies and requirements of grain transport evolve.

Long term climate trends appear to be shortening the average distance to port by increasing cropping intensity in high rainfall zones closer to the coast. This is supported by recent evidence from the ABS indicating the crop area is declining in some regions such as the northern parts of the WA cropping zone and eastern parts of NSW (Hughes et al, 2017). If these trends continue then grain supply chains will be affected, both in terms of the location of major infrastructure and the cost of grain transport to port.

Over the past four years the average share of rail has remained more or less unchanged, despite closure of some rail lines. The closure of two rail lines in SA’s Mallee district saw about 180,000 tonnes of grain move from rail to road, however operational efficiencies in the other parts of the SA rail network saw a slight increase in the proportion of grain transported by rail so that overall the modal share of grain transport to port in SA remained at about 50%. The closure of Tier 3 lines in WA and has seen the shift of some grain onto road transport. By contrast, the upgrade of rail lines in NSW and Victoria has seen some grain return to rail.

Road transport continues to become more competitive with rail over time. BITRI (2017) list a range of reasons for this including: the age and capacity of variable rolling stock, improved roads, weather events closing rail lines or restricting train speeds, and larger trucks. For example, the average truck size delivering into some receival networks has increased by about 20% from 2009/10 to 2016/17, reducing freight costs and the total number of vehicle journeys. BITRE also state that deregulation of grain export marketing has seen smaller shipments being moved on diverse pathways by a broader range of bulk handlers and export marketers which similarly favours road over rail.

Ports and regulation

Significant changes have occurred in the provision and regulation of port services over the past five years. The greatest additional export capacity has been added in NSW where an additional 4 million tonnes of capacity was added through construction of the Quattro terminal at Port Kembla and the Newcastle Agri-terminal. Construction of the Bunge terminal in WA added a further 0.5 million tonnes of export capacity in WA but this represents less than 5% of the export capacity already operated by CBH. Similarly, new mobile loaders operating at Port Adelaide and Geelong provided new, but, relatively minor extra capacity.

With the deregulation of wheat exports in 2008, provision was made for the Access Test to regulate export terminals. This test lapsed in 2014 to allow wheat exports to revert to normal regulation using general competition law and an agreed voluntary code of conduct. However, after industry consultation and review, the Wheat Export Marketing Act (Access Test) was replaced with the Port Terminal Access Code of Conduct in September 2014. This new mandatory code has slowed the normalisation of wheat export regulation in Australia. In addition, exemptions have created a more diverse set of regulations. Currently all terminals operated by Viterra in SA, as well as three ports operated by GrainCorp (Mackay and Gladstone in Qld and Portland in Vic) are subject to the full provisions of the code, while the remaining port terminals in Australia are exempt from significant parts of the mandatory code. In its 2017 Bulk Wheat Monitoring Report the ACCC stated that further exemptions were not, at that time, being considered and that the retention and improvement of the mandatory code was essential.

One advantage of the mandatory code has been that port terminal service providers have moved away from fixed capacity systems, such as the relatively costly auction system, to more flexible systems allocating capacity via long term agreements. This change has occurred more rapidly where port terminals were exempted from the full provision of the mandatory access code. Capacity allocation arrangements are likely to continue to evolve over time, particularly where exemptions to the code have been granted. As yet though, changes in port regulations have not been reflected in much change to port terminal access fees.

We are of the view that consideration could and perhaps should be given to expanding the monitoring of grain supply chains currently undertaken by the ACCC, to include grain transport and storage services. By illustration, effective monitoring of supply chain services has been shown in Canada to increase confidence in the integrity of service providers and to encourage reduced regulation that then stimulates greater flexibility and innovation for service providers.

Costs

Table 1. Estimated supply chain costs in Australia and other wheat export competitors from 2013 to 2017. Numbers in parenthesis indicate the proportional contribution to total supply chain costs Source: AEGIC and GRDC (nd-no data).

2013 | 2014 | 2015/16 | 2016 | 2017 | ||||

|---|---|---|---|---|---|---|---|---|

Dollars per tonne | Australia | Canada | Australia | Ukraine | Russia | Australia | Argentina | Australia |

Cartage farm-site | 8.9 (12%) | 10.7 (10%) | 8.9 (11%) | 4.3 (8%) | 3.5 (6%) | 7.8 (9%) | 2.9 (5%) | 7.8 (11%) |

Upcountry handling | 11.9 (16%) | 15.2 (14%) | 14.4 (17%) | 7.7 (14%) | 9.2 (16%) | 18.4 (22%) | 13.2 (21%) | 10.4 (15%) |

Storage | 6.8 (9%) | 17.7 (16%) | 8.9 (11%) | 2.9 (5%) | 5.1 (9%) | 9.0 (11%) | 1.4 (2%) | 5.0 (7%) |

Transport upcountry to port | 21.6 (29%) | 46.8 (44%) | 27.8 (33%) | 13.3 (23%) | 15.5 (28%) | 26.7 (32%) | 29.5 (47%) | 23.6 (33%) |

Port charges | 21.2 (29%) | 13.9 (13%) | 21 (25%) | 23.8 (42%) | 22.4 (40%) | 19.9 (24%) | 15.5 (25%) | 21.7 (30%) |

Levies and check-offs | 2.9 (4%) | 3.0 (3%) | 2.8 (3%) | 4.9 (9%) | 0.10 (<1%) | 2.8 (3%) | 0 (0%) | 2.8 (4%) |

Total supply chain cost | 73.3 | 107.3 | 83.8 | 56.9 | 55.8 | 84.6 | 62.5 | 71.3 |

Production cost | nd | 139.1 | 157.1 | 133.0 | 121.1 | 148.3 | 140.0 | 148.8 |

Supply chain proportion | nd | 0.44 | 0.35 | 0.30 | 0.32 | 0.36 | 0.31 | 0.32 |

Cost estimates for the major components of supply chains in Australia and its competitors are listed in Table 1 based on AEGIC and GRDC research from 2013 to 2017. The cost components vary from year to year due to a range of factors including exchange rates, yields, the relative proportion of grain exported from each catchment zone in Australia and assumptions underlying the estimates. Despite this variation, supply chain costs are consistently about 30% to 35% of the total costs for all countries and all years, except for Canada.

Total Australian supply chain costs are higher than most of its competitors, except for Canada, yet some components of Australian supply chains are generally competitive i.e. port charges. Transport from upcountry receival sites to port and port charges are the highest components of supply chain costs in all countries and typically represent 55% to 70% of total supply chain costs. These are costs growers have least control over, and these costs can be greatly affected by government policy, labour costs, regulation and investments by private firms and governments. Labour and energy are the two biggest input costs for bulk handlers. Hence, greater automation in the handling and transport of grain holds the potential to significantly reduce these costs; but such automation requires reliable, affordable regional telecommunication infrastructure, as well as regulatory change.

In Australia, charges for grain transport from up country receival to port have decreased on average by about 8% in nominal terms over the past five years, based on scheduled fees published by CBH and Viterra in WA and SA. Assuming an annual inflation rate of about 1.8%, then in real terms this represents a reduction in cost of about 12-13%. The published fees however may not simply reflect transport costs but also incorporate efficiency improvements at receival sites as well as the pricing policy of bulk handlers that aims to influence the delivery preferences of growers. However, offsetting these reduced costs is the fact that, on average, most growers now need to travel further from their farms to deliver grain to fewer receival sites.

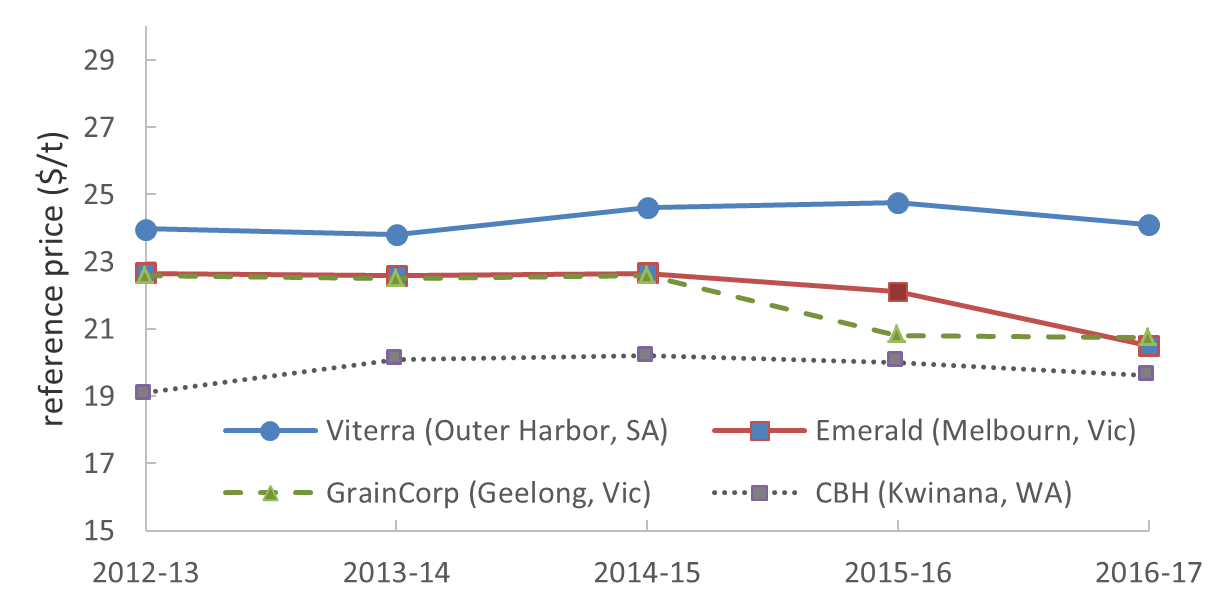

Fees for port services over the past five years have remained flat in nominal terms or have increased slightly. Considering inflation, the overall the real price of these services has decreased slightly or remained flat. However, the structure of port service fees varies considerably between bulk handlers and between years, so simple pricing trends are difficult to estimate (see figure from ACCC, 2017).

Figure 3. Reference price schedules of major port service providers. (Source: ACCC, 2017)

Conclusion

There is variation in the costliness of Australia’s export grain supply chains, with costs varying spatially and temporally. Over the last several years in Australia, most export grain supply chains have slightly reduced their costliness in real terms. Further improvements in grain yields, greater investment in infrastructure, and improvements in operation, regulatory reform and a greater intensity of cropping in higher rainfall regions will all help lower the average cost of Australia’s export grain supply chains. These improvements are essential to help preserve the international competitiveness of Australian grain exports, especially when acknowledging Australia’s grain export competitors are continuing to drive down their costs through major investments in on-farm and post-farm improvements.

Acknowledgments

AEGIC is funded by GRDC and the WA State Government.

References

ACCC (2017). Bulk wheat ports monitoring report 2016–17. Australian Competition and Consumer Commission. Canberra, ACT Australia. Available at https://www.accc.gov.au/publications/serial-publications/bulk-wheat-ports-monitoring-reports/bulk-wheat-ports-monitoring-report-2016-17

BITRE (2017) Trainline 5 Statistical Report, Bureau of Infrastructure, Transport and Regional Economics and Australasian Railway Association. Department of Infrastructure and Regional Development, Canberra, Australia. Available at https://bitre.gov.au/publications/2017/files/train_005.pdf

Hughes, N., Lawson, K., & Valle, H. (2017). Farm performance and climate: climate adjusted productivity on broadacre cropping farms. Australian Bureau of Agricultural and Resource Economics and Sciences Research Report 17.7, Department of Agriculture and Water Resources. Canberra, Australia.

Kalisch-Gordon, C. McKeon, D., Whiteley, C. Southan, M. Price, C. and MacAulay, G. (2016). State of the Southern Region Grains industry and Challenges to Innovation and Growth. Grain Growers Ltd, Sydney and Canberra, Australia.

Contact Details

Dr Peter White

(08) 6168 9929

Peter.White@aegic.org.au

Prof Ross Kingwell

(08) 6168 9920

Ross.Kingwell@aegic.org.au

Dr Chris Carter

(08) 6168 9907

Chris.Carter@aegic.org.au

® Registered trademark

Was this page helpful?

YOUR FEEDBACK