Market update - grains, forage and maize

Author: Ron Storey (Storey Marketing Services) | Date: 25 Jul 2019

Take home messages

- Predicting markets is impossible. The best we can do is consider a range of scenarios and plan for those most relevant to our own business.

- Eastern Australia operated in a ‘Relocation Market’ for grains through 2018/19 and given season conditions to date (especially in northern NSW and southern Queensland), this looks set to continue into 2020. That is, WA grain will continue to be shipped to Queensland to meet the deficit in that state due to resilient stockfeed demand (mainly driven by cattle on feed).

- Global grain prices play a key underpinning role in this ‘relocation’ market, and while there is no major problem yet in global supplies, there have been warning signals (mainly US Corn) over May/June 2019.

- Hay and forage markets remain tight with strong prices as we enter the 2019 winter period. If prices remain at these levels into spring 2019, then hay will provide a highly viable option for many grain farmers as forage stocks are very low.

- NOTE: At time of preparing this paper (early July 2019), there remains significant market uncertainties for northern hemisphere crops (especially US Corn) as crops enter harvest or grain fill stage. Therefore, while this paper will outline some key drivers of prices for our Australian 2019 harvest period, the more relevant and up-to-date information will be provided at the time of presentation in late July 2019.

Background

The Australian east coast supply and demand grain balance sheet has developed to a point where regular regional deficits occur. For example, Queensland, with a domestic demand base of around 2.5-2.8 million tonnes and production of around 1.5-2 million tonnes (using 5-year averages), is almost always in deficit. This means ‘imports’ of around one million tonnes (plus) from NSW even in normal years but given the 2017-2019 drought conditions in northern NSW and southern Queensland, the drawing arc for imports has extended to Victoria, WA and SA.

The prospects for 2019/20, given the repeat of a poor grain year once again for northern NSW and southern Queensland, are the pricing of grain to Darling Downs users will be ‘anchored’ by the export price in WA plus the cost of transport from WA ports through Brisbane to the Darling Downs consumers. This transport or relocation cost during 2018/19 has been consistently around $90-100 per tonne. The global or export price therefore is the major variable in determining where east coast grain prices will trade over 2019/20.

Main price drivers

Wheat price drivers – current (and these drivers change as the season unfolds)

Australia

- WA/SA the main supplier to the east coast of Australia in 2018/19; expected to continue for Queensland into 2020, although Victoria and Southern NSW are expected to contribute.

- Grain ‘relocation’ into the east coast will be a combination of sea freight and overland movements.

- How will the 2019/20 winter crop season unfold in spring?

International

- US Corn will be a driver of wheat prices, with feed wheat replacing corn in many global markets.

- Generally, the EU and the Black Sea are in good shape.

- Northern hemisphere wheat harvest is yet to come (imminent), but pending harvest weather there may be quality issues given the late planting and progress of the crop.

Barley drivers – current (and these drivers change as the season unfolds)

Australia

- Relocation from WA/SA to Queensland continues as stockfeeders include more barley in rations.

- Lack of the traditional China demand due to anti-dumping case.

- Relationship to wheat price alternative; tends to replace wheat in ration if discount greater than $20/t.

International

- US Corn crop outcome will largely determine international feed values.

- China has driven Australia’s export program for the last five years and often created a domestic shortfall. This looks highly unlikely in 2019/20 due to the anti-dumping case and the impact of the African swine flu (ASF) on China’s feedgrain demand.

- EU and Black Sea Northern competition – large crops.

Hay/forage drivers – current (and these drivers change as the season unfolds)

- While hay exporters set the benchmark with their indicative export prices around September each year, the domestic consumer market then takes over to secure the required volumes and types of fodder depending on how the spring pasture season unfolds.

- If the northern NSW and southern Queensland livestock markets hold up as in 2018/19, then demand for straw for roughage to be blended with grain is expected to remain strong.

Maize drivers – current (and these drivers change as the season unfolds)

- Decisions on 2019/20 maize summer crops will be assessed against water prices and the expected pricing for maize versus other crop alternatives.

- While there is a small volume of relatively inelastic demand, inclusion of maize in stockfeed rations appears to be viable when maize is priced at no more than $20-40/t over wheat alternatives.

And then there are the ‘black swan’ events….

While the above ‘drivers’ may represent the conventional wisdom about what to expect, history tells us that the unpredictable, unknown ‘black swan’ events, tend to be far more impactful on markets. These events fall outside the rational analysis of supply and demand calculations, they come as a surprise and can be very disruptive. These can include:

- Disease outbreaks such as ASF which has severely diminished the China pig population and has spread to other Asian nations.

- US/China trade and tariff war – already a significant impact on global soybean/oilseed markets, via tariffs on US soybeans, bans on Canadian canola to China, etc.

- Red meat market disruption – what if? – evidence of mad cow disease outbreak, either in Australia or elsewhere.

- Significant climate/weather development, causing major deficit in Indian summer monsoon.

- Global geo-political events conspire, perhaps through very strong or very poor resources demand, to see the A$ recalibrated to say 0.90 or 0.60 versus USD?

- etc, etc.

What is the 2019/20 harvest (forward) market saying today?

While it is some six months till 2019 harvest, the current forward grain markets indicate a significant drop in prices of $50+ per tonne.

Table 1. 2018/19 versus 2019/20 grain price quotes – (Indicative, early July 2019).

Port Zone | Wheat | Barley | Comments |

|---|---|---|---|

18/19 19/20 | 18/19 19/20 | ||

Kwinana WA | 305 265 (-40) | 310 260 (-50) | New crop 19/20 indicates WA export prices about $50 below current old crop values. Good start to season in WA |

Melb VIC | 375 305 (-70) | 360 275 (-85) | New crop 19/20 at $70-80 below current prices – reflecting good start to season in SE Aust and an expected surplus in Vic in 19/20 |

Bris QLD | 405 355 (-50) | 405 360 (-45) | New crop 19/20 prices reflect the expected drop in WA values, plus the approx. $100/t transport cost to Qld |

Table 2. 2018/19 hay prices – (as at early July 2019).

Location | Cereal Hay | Cereal Straw | Comments |

|---|---|---|---|

Darling Downs QLD | 600-650 | 380-450 | Reflects Qld livestock demand and capacity to blend straw with grain for suitable ration. Cost of transport for Vic/SA supply is approx. $200/t |

Goulburn Valley VIC | 380-440 | 180-220 | Reflects current short supply of fodder from 2018/19 hay crop, with strong demand from NSW and Queensland |

What price signal is being sent to producers?

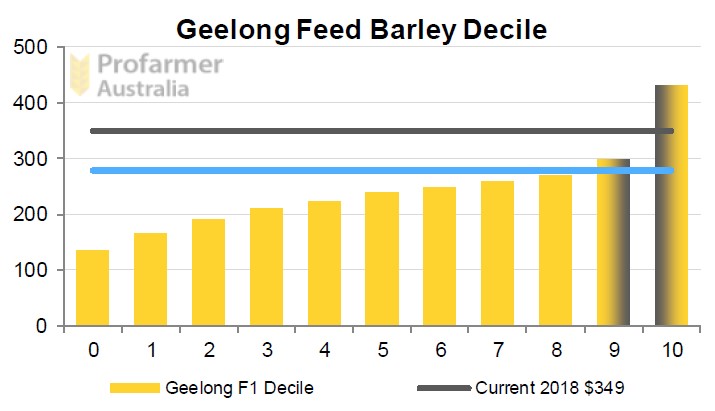

Figure 1 is a decile chart for Feed Barley (Geelong, Vic) which indicates that current prices ($349) are at Decile 10 level, and that new crop 2019 indicative price ($270) is at Decile 9 level. Historically, these prices remain very attractive to producers.

Figure 1. Decile chart for feed barley (F1) prices(Geelong, Vic).

Conclusion

Even though Australian grain prices during 2018/19 appear to be disconnected from global values due to the ongoing east coast drought, there remains a very real connection. The Australian market looks set to remain a ‘relocation” market for much of 2019/20, with north-eastern Australia (southern Queensland and northern NSW) caught in a poor grain production cycle with a simultaneous strong local grain demand, driven by livestock and red meat markets. This cycle necessitates export value grains in SA and WA being relocated to Queensland to meet the local deficit, adding a transport cost of $80-100 to those export values. Therefore, the local market in 2019/20 remains exposed to the eventual outcome of the northern hemisphere crops over the Jul-Sep 2019 period – something which is unknown and unpredictable at present. Not to mention the inevitable, unknown ‘black swan’ events which have a habit of being even more disruptive.

The hay and fodder outlook is more a function of local weather unfolding in our August-September spring period, when hay exporters will pitch their contracts to attract product for their export customer demand, and local consumers respond on how well our livestock-driven fodder demand features in 2019/20.

References

Data drawn from ABS, Profarmer Australia, Jumbuk Consulting

Acknowledgements

The author acknowledges the support of GRDC and the Irrigated Cropping Council in requesting this input to the GRDC 2019 Moama GRDC Grains Research Update.

Contact details

Ron Storey

Storey marketing Services

0418 332 431

ron@storeymarketing.com.au

Was this page helpful?

YOUR FEEDBACK