Why do one percenters matter so much? How small changes in management that affect prices, quality, yields or production costs can result in large impacts on profit

Author: Ross Kingwel (AEGIC) | Date: 06 Mar 2019

Take home message

Success in farming is not only about getting the big decisions right. It’s also often about getting the detail right as well! Seemingly small “one percent” decisions do matter, simply because we often operate at low gross margins. When gross margins are tight, small improvements in productivity significantly amplify how much profit is generated. Also, small changes in annual profit have a beneficial compounding effect over several years, helping support business growth.

----------------------------------------------------------------------------------------------------------

It’s part of the sporting coach’s lexicon: “Do the one percenters!” These are the little acts, on and off the field, that in aggregate are sometimes the difference between losing and winning. At least that’s the coaching mantra we are encouraged to believe. But does that coaching slogan apply to farming? It’s often sold to us in terms of continuous improvement, skill upgrades, machine upgrades, crop improvements and keeping an eye on the detail. Do these small changes really add up to much? Are we just being kept busy, or are these improvements an essential part of the real business of farming?

For businesses operating in fiercely competitive environments where margins are slim, such as is often the case in farming, the answer is ‘yes; one percenters matter’. In commercial environments where profit margins matter and where those margins often are tight or slight, then managerial ‘one percenters’ matter.

The business environment of Australian farming is highly competitive. Often an Australian farmer’s competitors are not just other farmers in Australia but overseas farmers as well. Australia’s farmers, by international comparison, largely rest on their own mettle. There is no featherbed of overly generous taxpayer support to bolster farm incomes; no subsidised crop insurance; no special set-aside or environmental payments; and no similar quality of education, health, social and communication services as is available to most city folk.

Australian farm businesses are shaped by their ability to remain internationally competitive, rather than by their political and social skill to garner substantial government support. Market forces ultimately determine which farm businesses prosper in Australia. In the long run it is the most efficient and prosperous businesses that survive. Almost by definition, businesses that establish, protect and grow their profit margins are those with sound commercial prospects.

Here are some illustrations of the importance of one percenters. Suppose you are a wheat producer and your farm-gate wheat price is $250 per tonne; your wheat yield is 2 tonnes per hectare and all your entire costs of production (i.e. variable, fixed and imputed costs) amount to $450 per hectare. Your profit per hectare calculation is:

Profit = wheat price x wheat yield – wheat costs of production

50 ($/ha) = 250 ($/t) x 2 (t/ha) – 450 ($/ha)

Therefore, if you had 1,000 hectares of wheat, your business profit would be $50,000.

Now imagine your skill as a manager improves and, like a good footy player, you capture a range of improvements that each are the one percenters. You lift your wheat price by 1%, through skilfully avoiding price downgrades via on-farm blending. You improve your crop yield by 1% through slightly better timeliness of sowing and slightly more effective weed and pest control. In addition, you lower your costs of production by 1% through negotiating better prices for some inputs and by slightly reducing inputs on your worst, very low-yielding paddocks. What’s the impact on profit? Do these three 1 percenters lift profit by 3%?

No, profit improves by almost 30%! Really? How come? Look at the figures in Table 1.

Table 1. The impact on wheat profit of three 1 percenters

Original base case | A 1% lift in the wheat price, a 1% increase in wheat yield; plus a 1% decline in production costs | |||

|---|---|---|---|---|

price | $/t | 250 | 252.5 | |

yield | t/ha | 2 | 2.02 | |

costs | $/ha | 450 | 445.5 | |

Profit | $/ha | 50 | 64.55 | »» 29% increase |

So, if this farmer grew 1,000 hectares of wheat his overall profit would jump from $50,000 to $64,550. That is a 29% jump in profit.

What about a mixed enterprise farm where livestock are also feature? Suppose you maintain a sheep enterprise on 500 hectares of pasture at a stocking rate of 5 DSE per hectare. The costs of production (i.e. variable, fixed and imputed costs) are $300 per hectare and the income (wool and sheep sales) per hectare is $375 per hectare.

Now suppose you lift stocking rate by one per cent through improved fodder management (e.g. introducing a dual-purpose crop). The increase in stocking rate means more wool and sheep sales. Moreover, through slightly improved grass weed seed management you lift the fleece quality and so increase the farm-gate wool price by one per cent. Yet despite the lift in sheep production, assiduous cost control allows you maintain your costs of production.

What’s the impact on profit? Do these 1 percenters lift profit by 3%?

No, profit improves by almost 9%! How come? Look at the figures in Table 2.

Table 2. The impact on sheep profit of a few 1 percenters

Original base case | A 1% lift (or decline) | |||

|---|---|---|---|---|

Stocking rate | DSE/ha | 5 | 5.05 | |

Wool price | $/kg | 10 | 10.1 | |

Wool production | kg/ha | 18 | 18.18 | |

Sheep sales | $/ha | 210 | 212.1 | |

costs | $/ha | 325 | unchanged | |

Profit | $/ha | 65 | 70.72 | »» 9% increase |

What about managing grain quality, to the extent that it is possible? Suppose you are a canola producer. Your farm-gate canola price reflects the oil content of the canola you grow. There is a base price for canola at 42% oil content but then an oil bonus or penalty applies worth 0.15% of the base price for every 0.1% oil, above or below the 42% oil content. The oil bonus is uncapped in SA, Vic, NSW and QLD; but in WA it’s capped at 44.5% oil. So, imagine the base price at the farm-gate is $525 per tonne and your yield is 1.3 tonnes per hectare and your entire costs of production are $600 per hectare. Your profit per hectare calculation is:

Profit = canola price x canola yield – canola costs of production

82.5 ($/ha) = 525 ($/t) x 1.3 (t/ha) – 600 ($/ha)

So, if you had 1,000 hectares of canola your enterprise profit would be $82,500.

But imagine you chased an improvement in the oil content of the canola by slightly better timeliness of sowing, slightly better weed control and better targeted N applications such that you were able to lift the oil content by 1%, without incurring yield reductions or production cost increases. Your profit is now:

92.74 ($/ha) = (525*1.015) ($/t) x 1.3 (t/ha) – 600 ($/ha)

This is a 12% increase in enterprise profit for a 1% lift in the quality of the canola, in terms of oil content increasing from 42% to 43%.

The profit results in preceding examples of wheat, sheep and canola production are attributable firstly to profit margins often being slight in the base cases. Any lift from a low base, ends up mathematically as a large percentage increase. Secondly, farm profit has multiplicative ingredients. For example, crop revenue comprises yields multiplied by crop prices. These multiplicative consequences, combined with additive impacts, fuel the magnitude of the percentage increases in farm profit.

The single year snapshots in the enterprise examples described above inadequately tell the dynamic story of profit impacts. The compounding effect of small changes can greatly affect farm profits. By illustration, suppose each year for 10 years you very carefully and thoroughly devote your energies to incremental improvement of your farm operations. For example, you sequentially lift your profit margin by one per cent each year for 10 years. If you farmed 3,000 hectares and your overall profit margin was $50 per hectare (i.e. $150,000 per year), then the additional profit you would generate over the 10 years would be $85,025. In the last year your farm profit would be over 10 per cent higher than if you just maintained your farm profit at $150,000.

So, sticking to gradual, persistent improvement in profit margin management can generate large payoffs. Small changes, small improvements, eventually can greatly matter.

Transformation versus incrementalism

An additional point worth emphasising about one percenters is the importance of balancing the need to invest in these incremental, persistent endeavours of small improvements versus transformative, breakthrough innovations that might transform farm profitability or enhance the biological resilience or sustainability of farming. Both types of investment are essential to preserve the domestic and international competitiveness of Australian agriculture.

There can be a tendency to resist investment in transformative activity, as it is perceived to be too risky or too expensive. There can also be an opposite tendency whereby media-savvy, innovation champions with rose-coloured goggles capture substantial funding, leading to underinvestment in essential incremental R,D & E (i.e. the one percenters) that form the main bedrock of farm profitability.

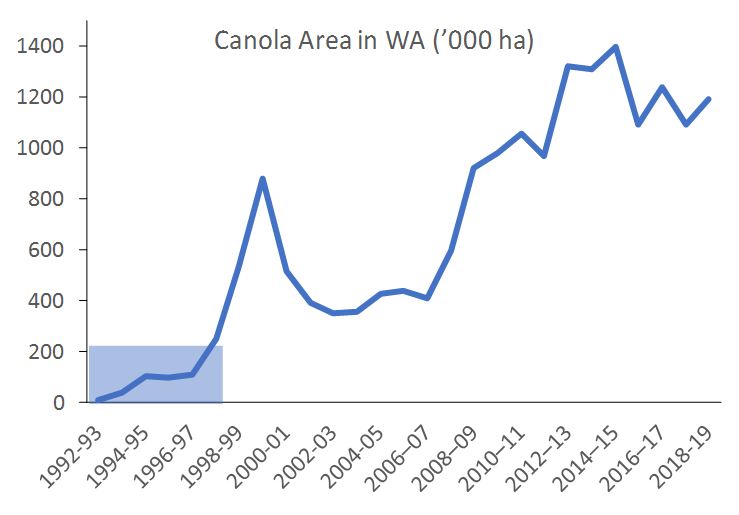

However, even transformative change can be incremental. Take the example of canola production in my home state of Western Australia. In the early 1990s the WA government and industry annually committed $140,000 to canola R&D. Two full-time canola specialists were employed. One investigated the rotational value of canola in farm systems, the advantages of herbicide-tolerant canola, and the identification of blackleg resistant and early flowering genetic material. The second researcher interacted with farmers to discover their information and agronomic needs in order to better inform future research.

Unfortunately, after 5 years of incremental effort (see the shaded area in Figure 1), there was not much evidence of the value to farmers from growing canola. However, persistence paid off as the maintained R,D&E effort led to canola being widely grown in WA agricultural regions. Canola production now injects over a billion dollars of sales revenue each year into the WA economy and farming systems in WA have been transformed by the inclusion of canola.

What is the simple message in this paper? It is that the wisdom of sports coaches does apply to farming, insofar as one percenters matter.

Key message: Success in farming is not only about getting the big decisions right. It’s also often about getting the detail right as well! The one percenters do matter.

Contact details

Professor Ross Kingwell

AEGIC

Economics & Business Analysis Manager

3 Baron-Hay Court

South Perth WA 6151

Ph: 08 6168 9900

email: ross.kingwell@aegic.org.au

Was this page helpful?

YOUR FEEDBACK