Optimising use of limited irrigation water on grain crops - getting the biggest bang per megalitre

Take home messages

- Here we document a calculator called ‘WaterCan Profit’ that is being developed with growers and advisors to support tactical and strategic economic decision-making associated with rainfed and irrigated crops

- Three case studies relevant to south-eastern Queensland are presented. Due diligence is warranted when extrapolating these results to other regions.

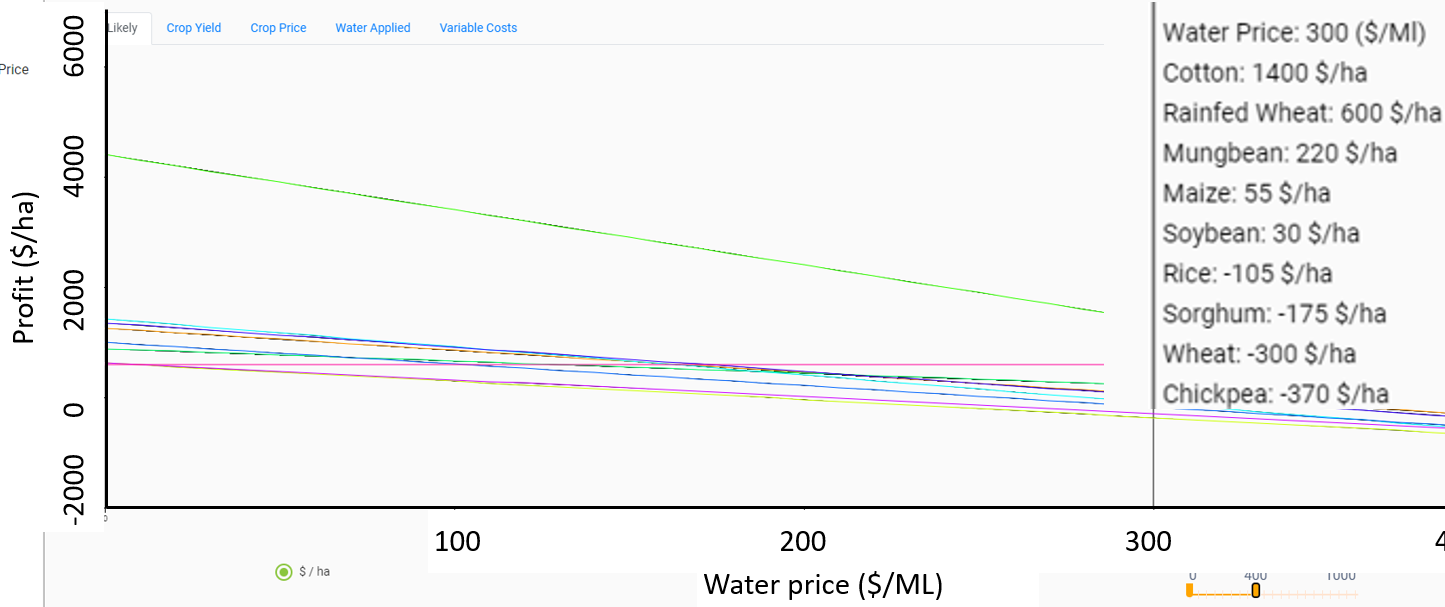

- On a per hectare basis, cotton and soybeans were most profitable up to a water price of $170/ML, after which cotton and rainfed wheat were generally more profitable.

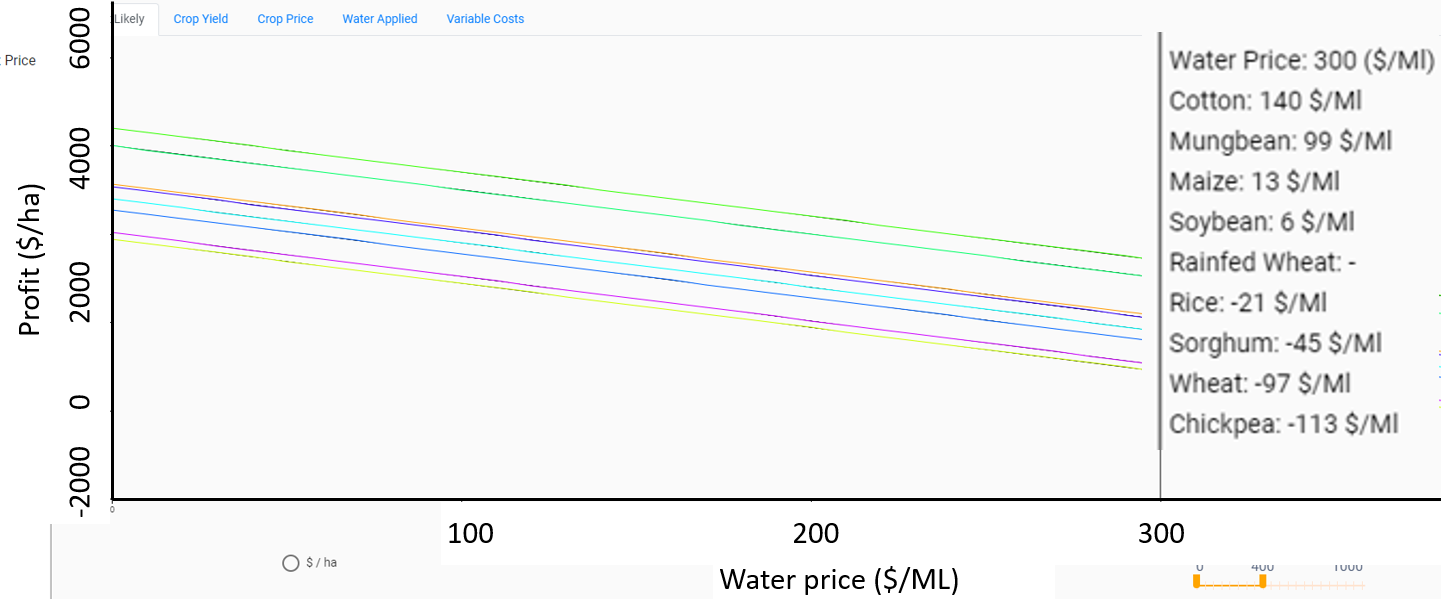

- In terms of gross margin per megalitre of irrigation applied ($/ML), cotton, mungbeans and maize were generally the most profitable options.

- The second case study optimised the use of irrigation water for a farm at Surat (500 km west of Brisbane). For a summer with average rainfall, the most profitable use of water over summer was irrigated mungbeans and cotton. During winter, the most profitable use of irrigation water was on chickpeas (in both $/ha and $/ML).

- For a low rainfall summer, the most profitable use of water over summer was mungbeans; the most profitable use of water in the following winter was again chickpeas

- Conserving irrigation water for summer was more profitable than using irrigation water in dry winters or springs

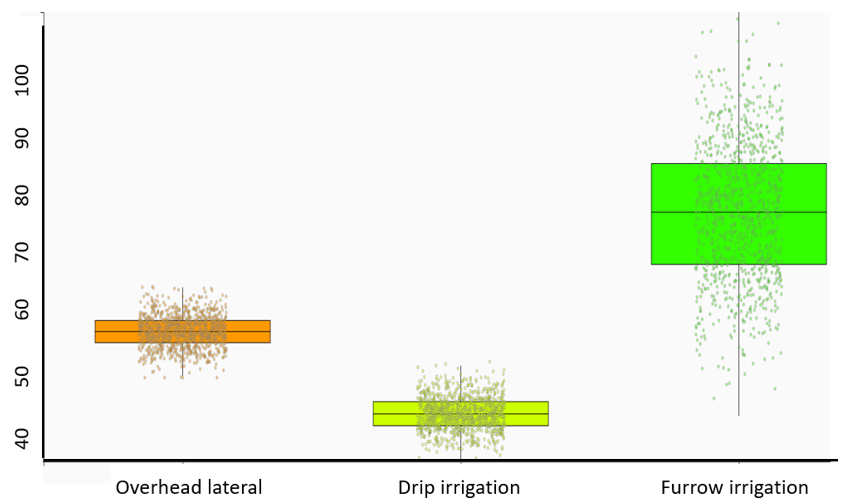

- The third case study examined long-term profitability as a result of investment in furrow, overhead lateral or drip irrigation for a farm in the Darling Downs, QLD. The net present value (NPV) and future wealth was greatest for the overhead lateral system, even though initial investment in this system was greater than that of furrow or drip irrigation systems.

- The long term internal rate of return variability (risk) associated with the overhead lateral was lower, because this system generally required less water and allowed irrigation on a timelier basis. In the long run, these factors collectively resulted in higher and less variable yields.

Background

In any given season, irrigated crop growers are faced with multiple and competing decisions. Profitability is a function of crop management decisions (sowing time, crop type, the amount and rate of irrigation water applied, fertiliser rate and timing), crop revenue (grain yield and grain price), variable input costs (water price, fertiliser, fuel and labour) and a number of other factors. Highly volatile climatic conditions, water costs and water allocations (often linked to the seasonal and political context) demand more informed crop and irrigation choices at the outset of the growing season.

While decision-makers often focus on tactical decisions such as crop management and irrigation and fertiliser scheduling, forethought and planning of longer-term strategic decisions can be overlooked. An example of this is an appraisal of the value of irrigation infrastructure over its productive life, for instance the investment worth of a flood-based system compared with an overhead lateral or pivot system. Economic assessments of this kind are often fraught with uncertainty as they are at the nexus of many agronomic, climatic, financial and social factors that are changing dynamically over time. To provide irrigated grain growers and advisors with a decision framework that accounts for these factors, we are developing a ‘calculator’ to be hosted on desktop and mobile apps. The calculator will allow users to answer questions such as:

- How does water price and seasonal irrigation requirement affect crop choice and crop gross margin?

- How do commodity prices affect crop choices for a given water price?

- What is the optimal use of irrigation water and crop area given seasonal and agronomic conditions?

- How does irrigation system (e.g. overhead laterals, flood irrigation, trickle) affect crop gross margins ($/ha) for varying water prices?

- What is the relative probability that the predicted economic outcome will occur, i.e. what is the risk or confidence associated with various scenarios?

With funding from GRDC and in concert with the Irrigated Cropping Council, Southern Growers and FAR Australia, this project uses a participatory approach wherein end-users decide on the economic questions to be addressed by the calculator. Through an iterative participative method, we have designed a prototype calculator called ‘WaterCan Profit’. The calculator has been tested with eight grower groups spread throughout the Murray-Darling Basin, South Australia, northern Victoria and Tasmania.

At the time of writing, WaterCan Profit is under development. A link to WaterCan Profit can be obtained on request from Matthew Harrison at matthew.harrison@utas.edu.au

Methods

WaterCan Profit: background

Three sections comprise WaterCan Profit:

(1) a ‘Water Price’ section that facilitates simple comparison of how yields, water price, crop price and variable costs influence crop gross margin, showing how changes in water price affect crop gross margins,

(2) an ‘Optimiser’ section that allows users to enter their irrigation type, farm areas, rainfall, soil type, crop and water prices, and expected yields accounting for expected seasonal outlook (dry, moderate or wet) specific to farm location, and

(3) an ‘Investment’ section that allows comparison of the effects of changes in irrigation infrastructure, and more broadly, farm capital investment. This section also accounts for water and grain prices, crop variable costs and farm overhead costs associated with irrigation (machinery, fuel, repairs and maintenance, council rates), other initial capital costs (e.g. earthworks), area of crop sown, interest rates on loans and water-use efficiency of irrigation infrastructure.

The Water Price and Optimiser sections of the calculator consider tactical questions, such as the economic viability of crop choices given water price, providing outputs that allow determination of the most profitable crop for the next growing season (e.g. summer irrigation) or year (i.e. crop choices for both summer and winter seasons). In contrast, the Investment section is designed for strategic analyses through computation of long-term profit (net present value, return on assets, wealth) over the life of the investment (e.g. 20 years).

Case study 1: Profit by water price comparison of irrigated crops

The first case study was designed to show trade-offs between grain prices, water and variable costs, and water applied for a range of irrigated crops on a case study farm in the Darling Downs, QLD, Australia. The Water Price section of WaterCan Profit was designed such that gross margins could be simply compared without the need for extensive farming systems information. Inputs used for the case study were derived from Brennan Kellar et al. (2013). Long term commodity prices and price ranges were sourced from https://www.indexmundi.com/ [Accessed 7 June 2020]. Queensland Government ‘AgBiz’ tools were used to derive representative ranges of crop variable costs.

Table 1. Grain yields, irrigation water applied, grain prices and variable costs for an irrigated farm in the Darling Downs, QLD (case study 1).

Yield | Water applied | Grain price | Variable costs | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Low | Med | High | Low | Med | High | Low | Med | High | Low | Med | High |

Maize | 10 | 11.5 | 12.5 | 2.9 | 4 | 6.1 | 260 | 280 | 320 | 1800 | 1965 | 2215 |

Chickpea | 2.5 | 3 | 3.5 | 2.6 | 3.3 | 4.4 | 455 | 510 | 560 | 745 | 910 | 1075 |

Cotton | 13 | 13 | 13 | 8 | 9 | 10 | 500 | 500 | 500 | 1900 | 2100 | 2250 |

Mungbean | 1.5 | 1.5 | 2 | 1.7 | 2.2 | 2.6 | 800 | 1100 | 1500 | 580 | 770 | 910 |

Rice | 9 | 9.5 | 10.5 | 4.4 | 5.1 | 6.4 | 260 | 330 | 445 | 1515 | 1710 | 1875 |

Sorghum | 5.5 | 7.5 | 8.5 | 2.6 | 3.9 | 5.3 | 250 | 300 | 310 | 1130 | 1255 | 1460 |

Soybean | 2.5 | 3 | 3.5 | 3.7 | 4.4 | 6.2 | 430 | 510 | 600 | 1050 | 1200 | 1310 |

Wheat | 4.5 | 5 | 5.5 | 2.2 | 3.1 | 5.2 | 255 | 320 | 385 | 840 | 970 | 1090 |

Rainfed wheat | 1.5 | 2.5 | 3 | 0 | 0 | 0 | 255 | 320 | 385 | 200 | 200 | 200 |

1 Yield for all crops except cotton shown in tonne/ha. Cotton yield is shown as bales/ha.

2 Prices for all crops except cotton are in $/tonne. Cotton price is shown as $/bale.

Case study 2: Optimisation of gross margins on an area ($/ha) or irrigation water ($/ML) basis

For case study 2, the optimiser section of WaterCan Profit was used to examine profitability on an area and ML basis for a farmer at Surat, approximately 500 km west of Brisbane, Australia. WaterCan Profit was used at the end of spring to make tactical decisions on the proportion of the farm to sow with different crops for the forthcoming growing season over summer (i.e. cropping area or irrigation allocation optimisation) and following winter cropping season. Based on a typical cropping rotation, in summer the farmer had a choice of irrigating cotton, mungbeans or sorghum. Sorghum could be sown early and harvested by early January, then harvested again after ratooning. Previous experience suggested a yield potential from the combined sorghum crops of 20 t/ha. After ratooning, the stubble could also be baled, given the high volume of biomass produced by a ratooned crop. During winter, the farmer had a choice of growing dryland or irrigated wheat, faba beans or chickpeas. The farming system details for the Surat property are shown in Tables 2-4. The analysis was conducted assuming summer rainfall would be either average or dry relative to long-term rainfall records for Surat (in all cases, winter rainfall was assumed to be average).

Table 2. Water price, paddock size and soil characteristics of the Surat farm used in case study 2

Variable | Value |

|---|---|

Water price ($/ML) | 90 |

Paddock area (ha) | 400 |

Plant available water capacity (mm) | 147 |

Soil depth (cm) | 122 |

Soil type | Heavy mixed alluvial |

Irrigation infrastructure | Centre pivot (sprinklers) |

Table 3. Long-term seasonal variation in rainfall, irrigation water allocation and initial soil water of the Surat farm used in case study 2

Dry season | Moderate season | Wet season | |

|---|---|---|---|

Summer rainfall (mm) | 218 | 324 | 450 |

Winter rainfall (mm) | 129 | 198 | 343 |

Irrigation water allocation (ML) | 0 | 2000 | 4000 |

Initial soil water % (mm) | 20% (29) | 45% (66) | 55% (81) |

Table 4. Crop grain prices, yields and variable costs used in case study 2. Yields and grain prices for all crops are expressed per tonne, except for cotton, which is expressed per bale.

Mung | Wheat | Cotton | Faba beans | Chick peas | Sorghum | Ratooned sorghum grain | |

|---|---|---|---|---|---|---|---|

Variable cost ($/ha) | 535 | 585 | 2100 | 535 | 665 | 1152 | 2100 |

Grain price dry season ($/t or ($/bale) | 1100 | 300 | 500 | 480 | 700 | 220 | 270 |

Grain price average season ($/t or ($/bale) | 1000 | 260 | 500 | 420 | 600 | 200 | 250 |

Grain price wet season ($/t or ($/bale) | 800 | 220 | 500 | 400 | 500 | 180 | 230 |

Yield in dry season (t/ha or bales/ha) | 2.0 | 5.5 | 13.0 | 4.0 | 2.5 | 12.0 | 12.0 |

Yield in likely season (t/ha or bales/ha) | 2.5 | 6.0 | 13.0 | 4.5 | 3.0 | 14.0 | 20.0 |

Yield in wet season (t/ha or bales/ha) | 3.0 | 7.0 | 13.0 | 5.0 | 3.5 | 16.0 | 25.0 |

Minimum irrigation (ML/ha) | 3.0 | 3.0 | 8.0 | 3.0 | 1.0 | 8.0 | 8.0 |

Maximum irrigation (ML/ha) | 3.5 | 3.5 | 10.0 | 5.5 | 1.5 | 10.0 | 10.0 |

Case study 3: Strategic decisions: investing in irrigation infrastructure

The third case study examined strategic decisions associated with changes in irrigation infrastructure for a mixed irrigation/dryland farming enterprise in the Darling Downs, QLD, Australia, following Maraseni et al (2012), CORE (2020) and Brennan-McKellar et al. (2012). Soil types ranged from light dispersible clays to heavy black alluvial cracking clays (vertosols) with high plant available water capacity. The analysis performed in this study assumed a cotton-wheat-cotton-maize four-year rotation for all irrigation systems. Wheat and maize grain prices and yields were assumed to vary between years based on historical averages, however cotton yields were assumed constant in line with lower inter-annual variability in this crop type (WaterCan Profit allows either cost variability between years or constant costs for entire analyses).

Irrigation water sources were from overland flows (authorised water harvesting) diverted from an unregulated watercourse. Harvested water was stored in authorised on-farm storage and distributed to irrigated paddocks by open channels. The study examined the long-term profitability associated with irrigating an additional 180 ha with either furrow-based irrigation, overhead lateral sprinklers or drip irrigation systems. Financial viability of the investment was measured using four metrics:

- Net Present Value (NPV): the sum of future net cash flows discounted to their present value

- Investment Worth: NPV minus the initial investment cost

- Internal Rate of Return (IRR): the expected compound annual rate of return earned on an investment (or discount rate that makes the NPV of all cash flows from a particular project equal to zero), and

- Payback period: the number of years required to recoup the investment funds, or to reach break-even point.

An irrigation investment was considered viable if the present value of the benefits was greater than the present value of the costs (i.e. NPV > 0). For the sake of simplicity, commodity prices and fuel costs were assumed, and overhead costs associated with irrigation infrastructure installation were assumed constant over the period of the analysis. Irrigation water costs were computed as the product of irrigation water applied and water price (these costs are computed internally in the ‘Investment’ section of WaterCan Profit).

Cost is often seen as a barrier to adoption of new technologies; the case study farmer managed financial risk by only investing in new irrigation when previous investments were paid off (CORE 2020). At the time of the study, the capital investment cost of furrow-based system was $1464/ha (20-year lifespan), lateral-move sprinklers $4083/ha (20-year lifespan), and drip irrigation $3583/ha (15-year lifespan) (Table 5). Overhead costs associated with irrigated land were assumed constant for all systems at $500/ha.year. Variables costs were adapted from Brennan-McKellar (2012) and IWUCVC (1987), assuming labour costs were the lowest for overhead lateral and drip systems and greatest for furrow irrigation (Table 5).

Table 5. Farm systems information used in case study 3 including crop rotation, grain and water price, variable costs and grain yield in low, medium and high rainfall years (shaded columns represent crop types). Prices and yields are expressed per bale for cotton and per tonne for wheat and maize.

Cotton (years 1, 3) | Wheat (year 2) | Maize (year 4) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

System | Variable | Low | Med | High | Low | Med | High | Low | Med | High |

Crop price ($/t or $/bale) | 500 | 500 | 500 | 220 | 250 | 310 | 180 | 240 | 280 | |

Irrigation price ($/ML) | 200 | 250 | 300 | 200 | 250 | 300 | 200 | 250 | 300 | |

Furrow | Yield (t/ha or bales/ha) | 10.6 | 10.6 | 10.6 | 6.0 | 6.5 | 6.5 | 9.0 | 10.0 | 13.0 |

Irrigation water cost ($/ha) | 1300 | 1625 | 1950 | 400 | 750 | 1050 | 600 | 875 | 1200 | |

Other variable costs ($/ha) | 1200 | 1500 | 2000 | 200 | 250 | 300 | 850 | 1100 | 1300 | |

Total variable costs ($/ha) | 2500 | 3125 | 3950 | 600 | 1000 | 1350 | 1450 | 1975 | 2500 | |

Irrigation applied (ML/ha) | 6.5 | 6.5 | 6.5 | 2.0 | 3.0 | 3.5 | 3.0 | 3.5 | 4.0 | |

Overhead lateral | Yield (t/ha or bales/ha) | 13.0 | 13.0 | 13.0 | 6.0 | 7.0 | 8.0 | 10.0 | 12.0 | 15.0 |

Irrigation water cost ($/ha) | 900 | 1125 | 1350 | 300 | 450 | 450 | 500 | 575 | 600 | |

Other variable costs ($/ha) | 840 | 1050 | 1400 | 140 | 175 | 210 | 595 | 770 | 910 | |

Total variable costs ($/ha) | 1740 | 2175 | 2750 | 440 | 625 | 660 | 1095 | 1345 | 1510 | |

Irrigation applied (ML/ha) | 4.5 | 4.5 | 4.5 | 1.5 | 1.8 | 1.5 | 2.5 | 2.3 | 2.0 | |

Drip | Yield (t/ha or bales/ha) | 11.0 | 11.0 | 11.0 | 6.0 | 6.5 | 6.5 | 9.0 | 10.0 | 13.0 |

Irrigation water cost ($/ha) | 1000 | 1250 | 1500 | 200 | 375 | 450 | 400 | 500 | 600 | |

Other variable costs ($/ha) | 840 | 1050 | 1400 | 140 | 175 | 210 | 595 | 770 | 910 | |

Total variable costs ($/ha) | 1840 | 2300 | 2900 | 340 | 550 | 660 | 995 | 1270 | 1510 | |

Irrigation applied (ML/ha) | 5.0 | 5.0 | 5.0 | 1.0 | 1.5 | 1.5 | 2.0 | 2.0 | 2.0 | |

Results

Case study 1: Profit by water price comparison of irrigated crops

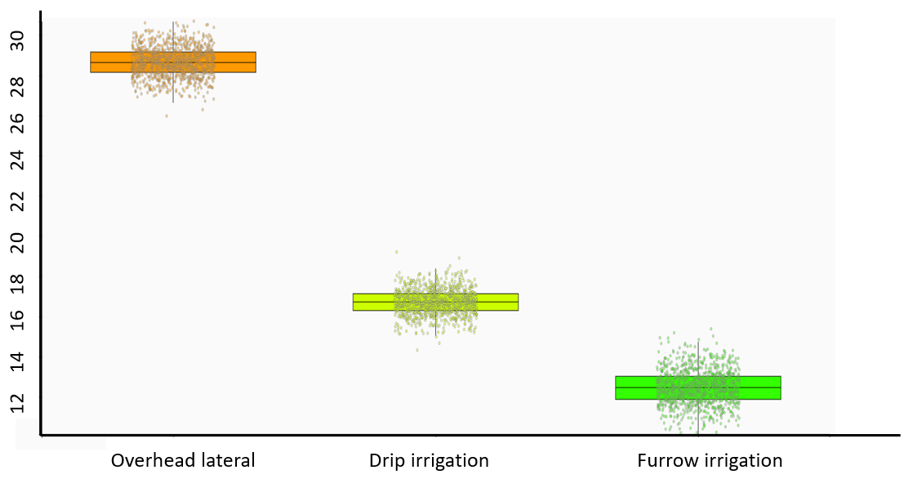

On a per hectare basis, cotton and soybeans were most profitable up to a water price of $170/ML, after which cotton and rainfed wheat were generally more profitable (Figure 1). Irrigated wheat and chickpeas were generally least profitable on a per hectare basis ($/ha). WaterCan Profit stacks gross margins in the graphical user interface (GUI) wherever the mouse is held (see vertical line in Figure 1). In terms of gross margin per megalitre of irrigation applied ($/ML), cotton, mungbeans and maize were the most profitable options (Figure 2). Most crops became unprofitable above a water price of $350/ML.

Figure 1. WaterCan Profit gross margin per hectare ($/ha) by water price ($/ML, x-axis) comparisons for several crops. Mouse-over ‘hover’ (shown by vertical line) allows simple comparison of crop profitability for a range of water prices. The above example is where the mouse was hovered over a water price of $300/ML and the corresponding crop profitability is automatically shown in descending order.

Figure 2. WaterCan Profit gross margin per megalitre ($/ML) by water price ($/ML, x-axis) comparisons for several crops. Mouse-over ‘hover’ allows simple comparison of crop profitability for a range of water prices. The above example is where the mouse was hovered over a water price of $300/ML and the corresponding crop profitability is automatically shown in descending order.

Case study 2: Optimisation of gross margins on an area ($/ha) or water ($/ML) basis

On either an area or irrigation water basis in a year with average rainfall, results from WaterCan Profit suggested that the most profitable use of water would be irrigated mungbeans and cotton (Table 6). The calculator includes outputs for the most profitable cropping area (e.g. 86% for mungbeans) and the most profitable use of water (e.g. 51% of water used on mungbeans). In winter, WaterCan Profit suggested that the most profitable crop would be chickpeas, although only 20% of the annual water allocation was suggested to be used on this crop. Across the summer and winter irrigation seasons, applying irrigation in summer would be more profitable than applying irrigation in winter.

Table 6. Optimal cropping areas computed using WaterCan Profit for the case study farm at Surat, QLD in an average rainfall year. The most profitable crop combination was irrigated mungbeans and cotton in summer, and irrigated chickpeas in winter (bold columns). Percentages in parentheses indicate either proportion of water applied across the farm (ML/ha) or optimal cropping areas (ha). Brown and blue columns denote summer and winter irrigation seasons, respectively.

Mung beans | Ratooned | Cotton | Ratooned sorghum | Wheat | Faba beans | Chick | Total | |

|---|---|---|---|---|---|---|---|---|

Price ($/t or $/bale) | 1,000 | 200 | 500 | 250 | 260 | 420 | 600 | |

Yield (t/ha or bales/ha) | 2.4 | 14 | 14.1 | 20 | 6 | 4.5 | 2.8 | |

Variable cost ($/ha) | 535 | 1,152 | 2,100 | 2,100 | 585 | 535 | 665 | |

Water cost ($/ha) | 90 | 90 | 90 | 90 | 90 | 90 | 90 | |

Water applied (ML/ha) | 3 (51%) | 9.0 | 10 (29%) | 9.0 | 3.0 | 3.0 | 1 (20%) | 2000 ML |

Irrigation cost ($/ha) | 270 | 810 | 900 | 810 | 292 | 292 | 90 | |

Gross margin ($/ha) | 1,597 | 838 | 4,035 | 2,090 | 682 | 1,062 | 920 | |

Gross margin ($/ML) | 532 | 93 | 403 | 232 | 210 | 327 | 920 | |

Optimal area (ha) | 343 (86%) | 0 (0%) | 57 (14%) | 0 (0%) | 0 (0%) | 0 (0%) | 400 (100%) | |

Profit ($) | 547,897 | - | 229,990 | - | - | - | 367,882 | 1,145,769 |

For a season with lower than average summer rainfall (but average winter rainfall), profit was diminished compared with a summer with average rainfall (cf. Tables 6 and 7). In such seasons, mungbeans were the most profitable summer crop, but restrictions on water allocations meant that no more than 50% of the paddock area could be sown (Table 7). In winter, WaterCan Profit again suggested that chickpeas would be the most profitable option (on both a $/ha and $/ML basis). The calculator suggested that 60% of irrigation water would be best used in summer, and the remainder in winter.

Table 7. Optimal cropping areas computed using WaterCan Profit for the case study farm at Surat, QLD in a summer with low rainfall. The most profitable combination of crops was irrigated mungbeans in summer (50% of farm area) and irrigated chickpeas in winter (100% of farm area), as shown by bold columns. Percentages in parentheses indicate either allocation of water applied across the farm (ML/ha) or optimal cropping areas (ha). Brown and blue columns denote summer and winter irrigation seasons, respectively.

Mung beans | Ratooned | Cotton | Ratooned sorghum | Wheat | Faba beans | Chick | Total | |

|---|---|---|---|---|---|---|---|---|

Price ($/t) | 1,100 | 220 | 500 | 270 | 260 | 420 | 600 | |

Yield (t/ha) | 1.9 | 11 | 13 | 11.5 | 6 | 4.5 | 2.8 | |

Variable cost ($/ha) | 535 | 1,152 | 2,100 | 2,100 | 585 | 535 | 665 | |

Water cost ($/ha) | 90 | 90 | 90 | 90 | 90 | 90 | 90 | |

Water applied (ML/ha) | 3 (60%) | 9.0 | 9.0 | 9.0 | 3.0 | 3.0 | 1 (40%) | 1000 ML |

Irrigation cost ($/ha) | 270 | 810 | 810 | 810 | 292 | 292 | 90 | |

Gross margin ($/ha) | 1,284 | 458 | 3,590 | 195 | 682 | 1,062 | 920 | |

Gross margin ($/ML) | 428 | 51 | 399 | 22 | 210 | 327 | 920 | |

Optimal area (ha) | 200 (50%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 0 (0%) | 400 (100%) | |

Profit ($) | 256,885 | - | - | - | - | - | 367,882 | 624,767 |

Case study 3: Strategic investments in irrigation infrastructure

The net present value was greater for the overhead lateral system compared with drip and furrow irrigation. This demonstrates that - using the input prices for the case study conducted here - the overhead lateral system would be the most profitable in the long term, while furrow irrigation would be the least profitable (Table 8, Figure 3). Investment worth followed similar patterns to those in NPV. Payback periods (or time to reach positive cumulative net cash flow) are calculated in WaterCan Profit using the mean of 1000 random samples. Payback periods were lowest for furrow irrigation, because cash flows of cotton sown in the first year were in excess of the net cost of the investment. Lower payback periods for furrow irrigation are reflected in a high internal rate of return (Table 8). Payback periods were the longest (and internal rates of return the lowest) for the drip irrigation system, due to relatively lower yields and shorter life associated with this form of irrigation.

Table 8. Net present value, investment worth, internal rate of return on investment and payback time associated with investment in furrow, overhead lateral or drip irrigation for a case study farm in the Darling Downs, QLD

| Furrow | Overhead lateral | Drip |

|---|---|---|---|

Net present value ($/ha) | 12,479 | 28,647 | 16,717 |

Investment worth ($/ha) | 11,015 | 24,565 | 13,134 |

Internal rate of return (%) | 77 | 58 | 44 |

Payback period (years) | 1 | 3 | 4 |

Figure 3. Net present value associated with investment in overhead lateral, drip or furrow irrigation for a case study farm in the Darling Downs, QLD. Y-axis is shown in ×$1,000/ha. Horizontal lines in boxplots indicate 75th (upper), 50th (mid) and 25th (lower) percentiles; points show individual data.

Over the life of each investment, the furrow irrigation system the greatest median internal rate of return (IRR, i.e. the expected compound annual rate of return that will be earned on an investment), but the IRR variability of the furrow system was much greater than that for both other systems. The variability associated with the overhead lateral and drip irrigation systems were lower, as these systems generally required less water, allowing irrigation on a timelier basis, which in the long run resulted in higher yields. The IRR of the drip irrigation system was less than that for the other systems due to (1) lower lifespan (15 compared with 20 years for the other systems) and (2) lower yields and income relative to the initial financial outlay.

Figure 4. Percentage internal rate of return associated with investment in overhead lateral, drip or furrow irrigation for a case study farm in the Darling Downs, QLD. Horizontal lines in boxplots indicate 75th (upper), 50th (mid) and 25th (lower) percentiles; points show individual data.

Discussion

Which part of WaterCan Profit should you use?

The first and second sections of WaterCan Profit deal with tactical questions. For simple comparisons in the absence of farm systems and management information, the Water Price section of the calculator is most appropriate. For tactical (seasonal) questions regarding optimal use of water on a ML or area basis, the Optimiser section is most appropriate. Both the Water Price and Optimiser sections could be used on a mobile device, as they engender questions that users may wish to answer in the field. In contrast, the Investment section allows contrasting of strategic investment decisions. As this part of the calculator deals with much larger finance quanta compared with the Water Price and Optimiser sections, such strategic analysis may be less suited to a mobile device and more suited to a desktop or office analysis.

For all parts of the calculator, users are strongly encouraged to contrast multiple scenarios and test multiple input values. In this way, users can gauge sensitive variables that have a larger effect on gross margin (in contrast to those variables that have little effect).

For any decision-support tool (or similar), the magnitude (or absolute value) of any output is of lesser importance; it is the relative difference between scenarios that is important. We have facilitated such comparison in the Investment section by showing plots of several investments concurrently. In future, we aim to enable such comparison in the other parts of the calculator.

Case study 2: optimal water or area usage?

A fundamental attribute to the successful use of any decision-support calculator is how to mimic a real situation. Before applying the calculator, users should identify the output they would like to contrast. Data for irrigated ratooned sorghum and sorghum stubble in Table 4 were entered as a single crop in the Optimiser section: variable costs, yields and irrigation water were entered as the sum of each variable for the two crops. If the ratooned sorghum stubble were entered separately, WaterCan Profit calculated that the irrigated ratooned stubble was more profitable than the grain from the sorghum crop. Of course, in reality sorghum stubble will not be available without having first sown a sorghum crop. Note that grain prices used here for sorghum may be greater than long-term averages due to the recent drought conditions experienced in south-eastern Queensland.

It was shown that ‘optimal profitability’ depended on whether the metric was assessed on a $/ha or $/ML basis. In our interviews with farmers and advisors in NSW, QLD, Victoria, SA and Tasmania, we found that most irrigators compute profitability in terms of $/ML. Nonetheless, to account for different decision-making preferences, WaterCan Profit has options for optimising water use on either an area or irrigation water basis. In case study 2, both optimal water and area pointed to the same cropping system when the climatic outlook was the same. For example: for a summer with moderate rainfall, irrigated mungbeans and irrigated cotton were most profitable in terms of $/ha and $/ML. However, in a dry summer, mungbeans were the most profitable crop, followed by irrigated chickpeas in winter. The key point here is that the most profitable cropping system will vary depending on climatic outlook (i.e. whether the forthcoming season will be wet or dry); WaterCan Profit users are encouraged to contrast climatic scenarios to help inform their decisions.

In all cases tested here, the most profitable use of irrigation water was over summer, with the Optimiser section of WaterCan Profit suggesting that 60-80% of an annual water allocation should be used for irrigation during summer. This is a key take-home message.

Case study 3: Strategic irrigation infrastructure investment decisions

Many models or apps are built to support tactical decision-making at the farm level. In contrast, WaterCan Profit allows both tactical and strategic decision making, the latter comprising a scenario analyses of investment in irrigation infrastructure. While the main output metrics of WaterCan Profit are economic/financial, profit is only one of several variables a farmer may consider in deciding whether or not to invest in irrigation infrastructure. Indeed, the third case study farmer intended to invest in surface irrigation (drip or overhead lateral) to allow greater flexibility, increased cropping intensity, reduced labour, improved water-use efficiency, fewer paddock passes and greater terms of trade (CORE 2020). Variation in soil type, land topography, availability and sources of water, lifetime of irrigation infrastructure, on farm storage capacity, size of area being irrigated also need consideration (AgVIC 2020). For case study 3, it was shown that investment in lateral move systems allowed higher water-use efficiency than flood irrigation through greater ability to water when required and to a specified amount (Montgomery 2020), which can have implications for crop quality (e.g. better cotton fibre quality eventuates when crops are maintained under irrigation for longer periods such as that allowed by the overhead lateral system).

The case study farmer also speculated that nitrogen-use efficiency was improved for the overhead lateral and drip systems compared with the furrowed system, though data related to N were anecdotal (CORE 2020). While WaterCan Profit can account for many of these factors (e.g. differences in labour, variable costs, crop rotation, double cropping etc), the calculator cannot account for all the above factors. Indeed, no model or decision-support tool can account for every factor: if it did, it would not be a model, but would be reality.

Here it was shown that overall lateral irrigation systems had the greatest NPV, followed by drip irrigation systems. Although drip irrigation systems generally have higher irrigation efficiency than flood or sprinkler systems, their flow rates are relatively low (IWUCVC 1987). As well, the case study farmer suggested that such systems have relatively short lifespan due to damage by pests (mice and crickets) and soil movement of self-mulching clays (CORE 2020).

Conclusions

Through three targeted case studies with real farms in south-eastern QLD, this paper has shown that:

- For a gross margin calculation in the absence of detailed farm systems information (i.e. using the Water Price section of WaterCan Profit) cotton and soybeans were most profitable on a per hectare basis up to a water price of $170/ML, after which cotton and rainfed wheat were generally more profitable

- For the case study farm at Surat in a summer with average rainfall, the most profitable use of water over summer was irrigated mungbeans and cotton, while the most profitable use of water in winter was on chickpeas (on both a $/ha and $/ML basis). For a low rainfall summer, the most profitable use of water over summer was mungbeans; the most profitable use of water in the following winter was chickpeas

- Conserving irrigation water for summer was generally more profitable than using irrigation water in dry winters or springs

- Investment in overhead lateral systems was generally more profitable than investment in either drip or furrow-based systems, and long-term variability in internal rate of return of the overhead lateral system was lower because this system generally used less water and allowed irrigation on a more timely basis

- Users of WaterCan Profit are strongly encouraged to use the calculator with real case studies and considered input values.

Where to next?

We will continue to engage farmers and further refine WaterCan Profit such that it is designed to meet the needs of irrigated grain growers in Australia. Interactive training online sessions will be held in late 2020, where end-users will bring their mobile devices and own scenarios as case studies. This approach will help users understand how to use the calculator but will also provide developers within insights into deficits in functionality, bugs and counterintuitive parts of the calculator. In this way, we will develop a series of real-life case studies and use these as defaults in the new release of WaterCan Profit.

References

AgVIC (2020) Agriculture Victoria. About irrigation. [Accessed 8 June 2020].

Brennan-McKellar L, Monjardino M, Bark R, Wittwer G, Banerjee O, Higgins A, MacLeod N, Crossman N, Prestwidge D and Laredo L (2013) Irrigation costs and benefits. A technical report to the Australian Government from the CSIRO Flinders and Gilbert Agricultural Resource Assessment, part of the North Queensland Irrigated Agriculture Strategy. CSIRO Water for a Healthy Country and Sustainable Agriculture flagships, Australia. [Accessed 7 June 2020].

CORE (2020) The World’s largest collection of open access research papers. [Accessed 8 June 2020].

IWUCVC (1987) Irrigation water use in the central valley of California (1987). Division of Agriculture and Natural Resources, University of California. Department of Water Resources. [Accessed 8 June 2020].

Maraseni TN, Mushtaq S, Reardon-Smith K (2012) Climate change, water security and the need for integrated policy development: the case of on-farm infrastructure investment in the Australian irrigation sector. Environmental Research Letters 7, 034006.

Montgomery J (2020) Water management case study: increasing irrigation water use efficiency at Boggabri. [Accessed 8 June 2020].

Acknowledgements

The research undertaken as part of this project is made possible by the significant contributions and the support of the GRDC; the author would like to thank them for their continued support.

The authors would like to acknowledge the support and collaborative work of the Irrigated Cropping Council, Riverina Plains, Southern Farming Systems, Mackillop Farming Group (MFMG), the Maize Association of Australia (MAA), the Irrigation Research and Extension Committee and FAR Australia.

This project is part of the Optimising Irrigated Grains Initiative led by the GRDC.

Contact details

Matthew Harrison

Tasmanian Institute of Agriculture

Ph: 03 6430 4501

Email: Matthew.harrison@utas.edu.au

GRDC Project Code: UOT1906-002RTX,

Was this page helpful?

YOUR FEEDBACK