Fast Graphs for slow thinking– an example using nitrogen

Fast Graphs for slow thinking– an example using nitrogen

Author: Peter Hayman (SARDI Climate Applications), Barry Mudge (Mudge Consulting) | Date: 06 Feb 2024

Take home messages

- N budgeting using 40kg N/t of wheat is simple, widely used, and robust. However, the rule is usually applied to a single target yield and only considers the year of application. The single target yield makes it hard to think clearly about risk and the annualised focus ignores carryover and /or long-term rundown of N.

- When choosing a single target yield, a grower has one chance in 10 of selecting the right rainfall decile. Concern about applying too much N contributes to conservative rates which have been identified as an important cause of the gap in actual and potential yield and profit.

- The N theme in RiskWi$e is working with farming systems groups in a co-learning exercise to better understand the risk-reward relationship of different approaches to N fertiliser decisions over the 5-year project. Some groups are examining a long-term strategic approach using N Bank that considers the N requirement of the farming system in the context of its soil and climate. This has the attraction of a simpler set and forget approach to N management rather than tactically responding to the economics and climate of a single season.

- For growers and advisers who do want to consider a seasonally responsive approach to N management, we have developed the Fast Graphs for Slow Thinking spreadsheet (Figure 2), which uses the 40kg N/t wheat rule to consider the upside and downside by budgeting across all 10 deciles. We also encourage users to vary the rate of N carryover and see how this changes the risk and reward outcome.

- Seasonal climate forecasts are best understood as increasing the likelihood of some deciles and decreasing the likelihood of other deciles. This contrasts with the media headlines of ‘El Niño outlook for a dry spring’ and the quest for a forecast of a single decile. The Fast Graphs for Slow Thinking spreadsheet has been designed to examine the shift in probabilities.

Introduction

Annie Duke was a professional poker player who then pursued an academic career in decision making. She famously said, “How life turns out is determined by luck and the quality of our decisions”. Notably we can only control the quality of our decisions and this paper provides an example of a decision-making process used to improve the quality of decision making where both chance and skill are involved. To illustrate this example the authors have used the decision of nitrogen application.

Overview of Riskwi$e and N theme

RiskWi$e (RiskWi$e - GRDC) runs from 2023 to 2028 and seeks to understand and improve the risk-reward outcomes for Australian grain growers by supporting grower on-farm decision-making. RiskWi$e was a response to grain growers drawing attention to the increase in risk associated with grain production. RiskWi$e is working through Action Research Groups (ARGs). In South Australia, grain growers from Eyre Peninsula are involved via the AIR EP ARG. The Central ARG is led by Hart Field Day Site and includes the Mid North High Rainfall Zone (MNHRZ); Murray Plains Farmers (MPF); Northern Sustainable Soils (NSS); and Upper North Farming Systems (UNFS). The Mallee and South-East are covered by the ARG led by the Birchip Cropping Group and include Mallee Sustainable Farming (MSF) and the Coomandook Ag Bureau.

Groups are addressing a range of themes including sowing decisions, enterprise agronomic and financial decisions and managing the resource capital. Nitrogen decision is a common theme for all groups. The N theme of RiskWi$e is one of several GRDC investments in N because getting decisions about N management more right, more often will improve grain grower enduring profitability. Evidence from the GRDC paddock survey project, along with analysis of protein levels in wheat and barley receivals, indicate that N deficiency is an important contributor to the yield gap for Australian grains. While it is rarely economic to chase maximum yield, there is good reason to suspect that N deficiency is causing a profit gap as well as a yield gap. In RiskWi$e, the N decisions theme is working with the ARGs to take a whole-of-system approach to assess N decision strategies encompassing fertiliser and legume use. Part of the approach is to ‘challenge the annualised thinking associated with N applications and budgeting that arguably amplify perceived risk’. This paper complements a paper in these proceedings by James Hunt, (leader of N theme in RiskWi$e) who has written a clear summary of the basics of N budgeting.

The simple rule of 40kg N per tonne of wheat is useful ‘bucket chemistry’ which highlights the substantial upside of N in a good season. N budgeting involves estimating the demand of N from the crop (20kg plant N per tonne), the supply of N from the soil (50% efficiency in our example) to provide a total soil N supply required (40 kg soil N per tonne) and balancing any shortfall in soil N with added fertiliser N. Later in this paper, we will raise some problems with the ways that N budgeting has been applied. However, there is a lot to like about this simple rule. Using common units of kg N/ha for crop N demand and supply of N from soil and fertiliser makes budgeting possible. Prior to N budgeting, growers were confronted with a soil test of nitrate in parts per million, kg of fertiliser product and yield in t/acre or bags per acre. The simple maths of a budget is empowering. For example, if someone reports a 4-tonne crop (soil mineral N needed is 4t/ha x 40 kg soil N/t = 160 kg N/ha) coming from 50kg starting soil N and 50kg/N as fertiliser, agronomists and growers immediately question the source of the extra 60kg N/ha. The robust simplification of these biological based maths also provides for a simple economic assessment. When there is enough water for an extra tonne of wheat, 40kg of N is an excellent investment. If we assume a urea price of $700/t, one kg N is about $1.50 (700 *.46) and 40 kg N is $60. If we also assume $10/ha as application cost, then $70 N cost is a good investment for a tonne of wheat.

Estimating the supply of N can be challenging

Estimating the supply of N usually relies on deep N soil testing, although many agronomists use estimates based on paddock history. In the future, it is likely that protein monitors will be used with yield maps to provide a map of N removed from different parts of the paddock. The protein content of the grain, especially in a good season, is very informative with protein content below 11.5% often indicating N supply limited yield (G. McDonald, review published in Unkovich et al., 2020). In broad zonal terms, high yield high protein (>12.5%) is likely to have received more N than the crop required, low yield low protein (<11.5%) and high yield low protein (<11.5%) did not receive enough N to maximise yield, while an area with low yield high protein (>12.5%) maybe constrained by factors other than N. The N removal maps, sometimes referred to as N off-take maps can be loaded into spreaders to ensure N replacement accounts for the variability in N removal and sub-paddock yields can be improved.

Estimating N mineralisation can be challenging and is discussed in more detail by Hunt et al in these proceedings. One approach for paddocks with a long cropping history is to exclude in-crop mineralisation from the N budget because an over-reliance on in-crop mineralisation will rundown soil organic carbon. In addition, N mineralisation and N immobilisation often approximate each other (cancel out) in paddocks with a long cropping history. Other N budgeting approaches include Yield Prophet®, which will include mineralisation and immobilisation in the N limited yield or the rule of 0.15kg N/ha per mm of growing season rainfall (GSR). The exact number for the supply of N will be uncertain, especially with spatially variable soils.

Estimating the crop demand for N is difficult because of the uncertain finish to the season

Estimating the target yield of an irrigated crop is relatively easy. Picking a target yield for dryland grain crops is difficult. The water limited yield in medium rainfall zones ranges from less than 1t/ha in a poor season to close to over 8t/ha in a good season with a corresponding N requirement of 40 to 200 kg N/ha. In the low rainfall zone, these numbers might be adjusted to 0.5t/ha to 5t/ha, and in high rainfall, 4t/ha to over 12t/ha.

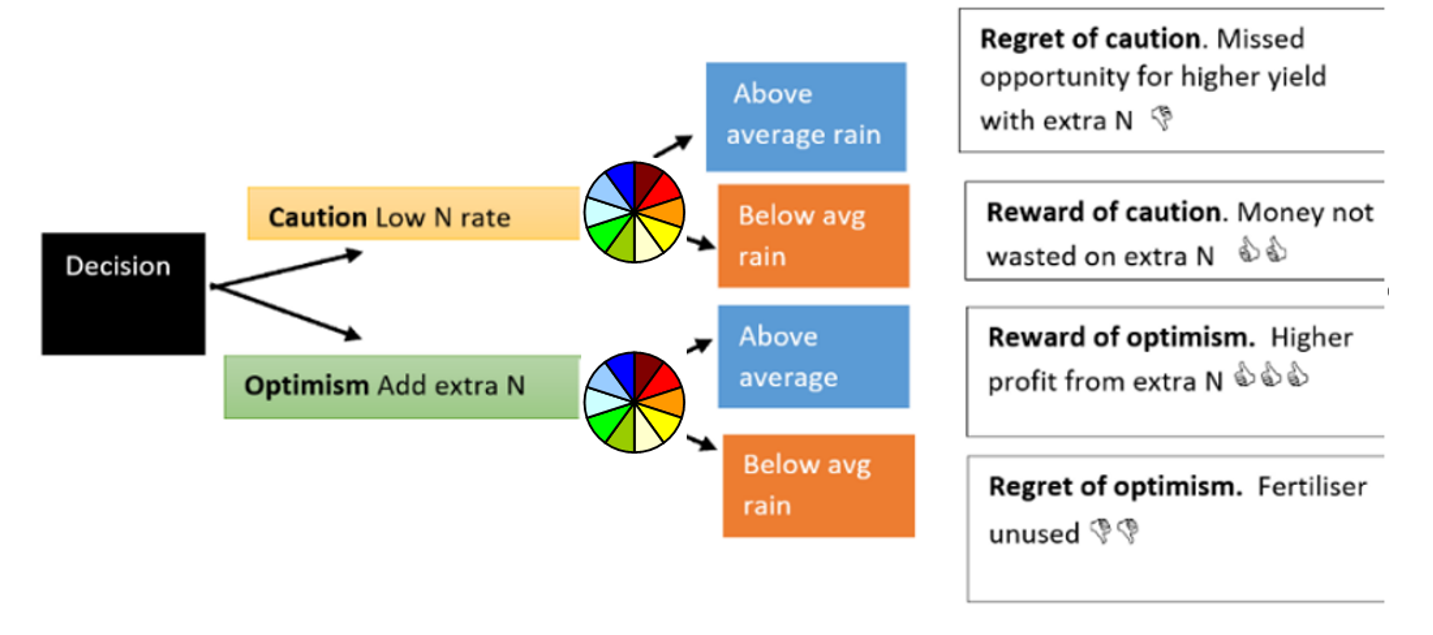

Figure 1. A simple N decision tree that considers an in season tactical decision to add extra N. In this example above and below average rainfall have equal probabilities of occurring but the rewards and regrets of optimism are greater than the rewards and regrets of caution.

When using a rainfall decile to estimate the target yield, there is one chance in 10 of being right. A grower can aim for decile 3 and receive a reward of caution for the lower N rate in a dry finish, but a regret of caution when missing out on the potential returns in an above average finish. Alternatively, a grower can be optimistic and pick decile 7 and enjoy the reward of optimism if the season turns out to be wetter than average but face a regret of optimism in a dry finish. Most of us are loss averse: we care more about losing money than gaining money. Some growers and advisers point to the time dimension, where the up-front cost (risk) of N is immediate and certain, whereas the gains (rewards) from N are uncertain and lie in the future. The longer-term costs of under fertilising and running down soil N and soil carbon are even more diffuse and lie further into the future.

Looking beyond the horizon of the year of application with N Bank

N budgeting is usually treated as a problem to be solved within the year of application. If 40kg N/ha are added with the hope of an extra 1t/ha and the season turns out drier and only 20kg/ha was needed for 0.5t/ha, cost of the unused 20kg of N is written off as a loss. This ignores the experimental evidence showing a portion of unused nitrogen is usually available for the next crop. A review of long-term experiments that used labelled 15N shows 66% of applied fertiliser N is recovered over a 3-year period, with 44% on average in year one and 22% on average recovered in the follow years (Vonk et al 2022). Therefore, in any one year the soil provides the bulk of the crop N requirement, and this highlights the need to pay attention to the soil N reserve and soil organic matter.

The planning horizon of this tactical approach is within the year of application and is part of the ‘annualised thinking’ that arguably amplifies the risk. An emerging alternative is a more strategic approach to nitrogen decisions, and one such approach is to use N banking. A grower using the N bank approach still needs an estimate of pre-sowing soil N and must make operational decisions about the timing of topdressing to ideally coincide with rain but is spared the angst of worrying about trying to get N exactly right each year by dealing with the uncertainty of the finish to the season. This is a simple rule with a ‘set and forget’ approach) and estimates the target winter mineral N bank that is necessary for your soil and climate. In this approach, fertiliser N is used to top up the winter mineral N pool to the N banking target. (Hunt et al 2023.

A grower and adviser can choose to be completely strategic (e.g., fertilise the farming system) and ignore what is happening in any season, or they can be completely tactical (e.g., single crop and year focus) and fine tune with as much information as possible from soil probes, models and seasonal forecasts along with the price of wheat, cost of nitrogen, the farm cashflow and interest rates. If being completely tactical, it is important for enduring profitability to keep an eye on the long-term N balance, which is often negative in many cropping systems (Norton and Elaina vanderMark 2016). Different growers will find the strategic or tactical approach more appropriate for their business and personality. It is also possible to set a longer-term strategic horizon and respond tactically in some years.). The rest of this paper addresses a tactical approach. If a grower chooses to be tactical, rather than choosing a single target yield, it is not much extra work to consider a range of outcomes and weigh the choice against these outcomes.

Getting tactical decisions more right, more often with decision analysis

The process of decision analysis is an established approach from applied economics for dealing with decision making under uncertainty. Although grain growers might not use terms like reward and regret of optimism and caution, they understand the concepts through lived experience. One response is that the decision tree shown in Figure 1 does little more than describe the dilemma of the post-seeding N decision with no solution. If we don’t know whether the rainfall will be above or below average, we don’t know which branch to take.

Decision analysis is a formalised way of weighing different futures. The simple decision tree in Figure 1 uses thumbs up and thumbs down to rank the four outcomes, but with a few assumptions these can be converted to profit or loss as $/ha. If the chance of above or below average is taken as 50%, we can then compare the probability weighted average for both branches of the tree. An argument that a decision can only be made with perfect knowledge of the future ignores the numerous ways that decisions are made in so much of modern life, including aviation safety, health, internet searches and artificial intelligence.

Not all decisions that grain growers are making can be squeezed into a numerical decision analysis framework. Many decisions are routine and best practice, such as summer weed control to conserve soil water and mineral nitrogen. Other decisions may be regarded as minor and are not worth the time and effort (e.g., fungicide seed dressing in high rainfall cropping systems). Some decisions are too complicated, such as crop sequences for a paddock with hard-to-control weeds and their seed bank. These could be solved with extensive numerical analysis but might be better completed by using a checklist and conversation with an advisor who has had to tackle this problem previously. Then there are other decisions where extensive numerical analysis is unhelpful, such as succession planning. These are complex because the solution depends on other humans. N budgeting offers a simple approach for tactical, post-seeding N decisions. The main reasons the decision is difficult is because (i) the climate uncertainty elevates the crop response uncertainty, and (ii) the nitrogen price is often a high proportion of gross margins which amplifies the economic uncertainty. Although we don’t know what the coming season will be, grain growers have access to:

- a robust N budgeting rule (e.g., 1 t wheat requires 40 kg of soil mineral N/ha, while 1 t of canola requires 80 kg N/ha),

- local historical rainfall records, which are the envy of many other parts of the world,

- robust water-use conversion functions for wheat, barley and canola (see paper by James Hunt in these proceedings).

- Widespread understanding of deciles as a concept of probability and risk,

- seasonal forecasts that are far from perfect but much better than guessing and are presented as probabilities.

Fast Graphs for Slow Thinking

Fast Graphs for Slow Thinking is a reference to the book ‘Thinking Fast and Slow’ by Daniel Kahneman (winner of Nobel Prize for economics). Kahneman distinguishes between fast thinking, which is instinctive, recognises patterns and jumps to conclusions, and slow thinking, which is more deliberative and logical. Fast thinking is efficient, and part of that efficiency is the quick creation of a coherent, plausible narrative. Comparing the upside and downside of a decision involves weighing a range of possible futures. This is mentally demanding, but relatively easy in a spreadsheet. Our idea is to get the information quickly into a graph that shows the upside and downside of the N investment (we estimate less than 20 minutes), so that we can then have a useful conversation about the risky decision. This follows the advice of Professor Bill Malcolm, the Farm Management economist from the University of Melbourne: ‘simple figuring and sophisticated thinking’.

This version of Fast Graphs for Slow Thinking wasn’t developed as another decision support system for nitrogen; the aim was to explore how the upside, downside and probability weighted average of N decisions are changed by the cost of N and price of wheat, levels of carryover N, and seasonal climate forecasts. In doing this, we were testing the usefulness of a simple decision analysis to run the N budget across deciles, rather than pick a single target yield.

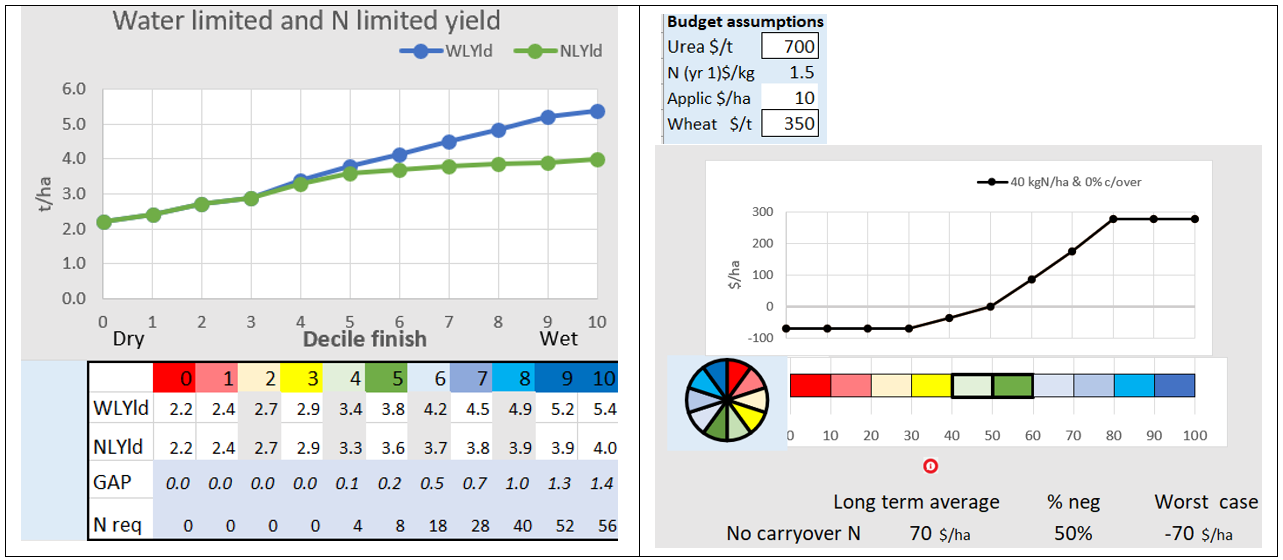

Figure 2. Screenshot of Fast Graphs for Slow Thinking, showing the water and nitrogen limited yield (left hand panel) and the profit by decile graph (right hand panel). The profit by decile graph is for the application of 40kg N, which is similar to aiming for decile 8 where the gap between the water and N limited yield is 1t/ha.

Using Fast Graphs for Slow Thinking, if we assume: (i) no carryover of N, (ii) urea $700/t, (iii) application cost of $10/ha, (iv) wheat price at $350/t and a rainfall decile 1 to 10 yield response for added fertiliser N from 2.2 to 4.0 t/ha (Figure 2), the worst case is a loss of $70/ha ($60 of Urea for 40kg N + $10 for application). The best case is 1t of wheat at $350 less $70, and a profit of $280/ha. The upside wedge is substantially better than the downside, and the probability weighted average profit is $70/ha (Figure 2 right hand panel at the bottom).

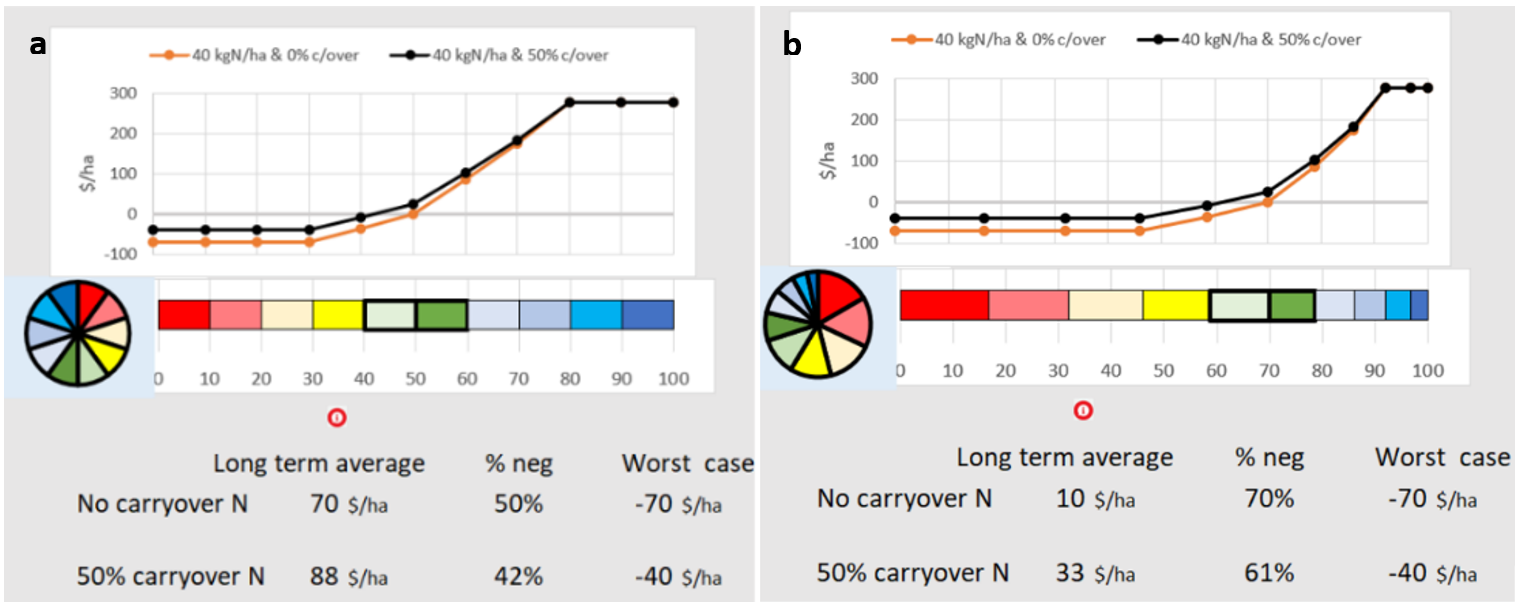

Figure 3. Figures 3a and 3b show the return (profit/ha y axis) from adding 40 kg N/ha assuming urea is $700/t, urea spreading is $10/ha and wheat is valued at $350/t. In Figure 3a the rainfall decile outcomes (coloured rectangles on the x-axis) are equally distributed. In Figure 3b the probability of receiving mean rainfall (coloured rectangles on the x-axis) is shifted from 50% (equally distributed deciles) down to 30% (skewed distribution of deciles to the dry end). In both graphs the orange line with orange circles shows returns ($/ha) from each decile assuming no N carryover into subsequent years. The black line with black circles shows the impact of 50% of applied N carrying over into the following year.

In the graphs the considerations for carry over N include (i) a proportion between 0% and 90% of the unused N will be available for subsequent crops, and (ii) the N carried forward to the next crop is valued as the saving in N fertiliser. Figure 3a and 3b show how carryover N of 50% reduces the loss in poor seasons but has no impact in good seasons because there is no unused N in rainfall deciles 8 and above. The long-term average improvement in this example for N carryover is $18/ha ($88/ha – $70/ha) where there is an equal distribution of rainfall deciles (figure 3a) and $23/ha ($33/ha – $10/ha) where there is skewed distribution of rainfall deciles toward the drier outcomes (figure 3b).

A shift in the odds from 50% chance of above median rainfall down to only 30% will adjust the shape of the upside and downside (Figure 3a compared with 3b). Importantly, a forecast doesn’t change the position on the y-axis (e.g., possible profit). If the season finishes as a poor season in the drier deciles, there will be a loss; if the smaller chance (figure 3b) of a good season occurs, the grower will have a substantial return. A forecast doesn’t change the future, it changes the likelihood of different future outcomes occurring. In other words, the forecast changes the width of the downside and upside wedge, not the height. If we assume 50% carryover of N, the climate outlook change from >50% of mean rainfall down to >30% of mean rainfall reduces the probability weighted average from $88/ha down to $33/ha (Figure 3a compared with 3b). The spend was $72/ha ($62 on urea plus $10 on spreading) so a profit of $88/ha where we have 50% N carryover represents a $1.00 dollar risks for $2.07 reward (income) and $1.07 profit using the long-term average (Figure 3a). In this scenario the loss is generated in 42% of the years experienced. The drier outlook (Figure 3b) represents a $1.00 risked for a $1.40 reward (income) and $0.40 profit where the loss occurs in 61% of years. This is explained by the scewed distribution of the seasonal decile outlook (figure 3b).

As the psychologist Paul Slovic says, ‘our emotions are not good at arithmetic, we tend to think of future events as 100% or 0%’. Revising the likelihood of deciles based on a forecast is easily done in a spreadsheet and growers easily recognise patterns of shifts in graphs, especially if they were involved in providing the underlying information.

We started this paper arguing that N budgeting could benefit from looking beyond the horizon of a single year and considering a range of outcomes. Topdressing decisions in 2023 were difficult because many growers had removed a lot of grain in 2022, had a good start, followed by widespread rain in June but a forecast for increased chance of dry conditions and discussion of El Niño. Looking beyond the horizon of the single year, with the understanding that not all unused N will be lost and an appreciation of the benefits of building soil N, are enough for some growers to take a set and forget approach of N bank. Other growers are interested in the coming season as well as the long term. As with the example in Figure 3b, because an El Niño outlook doesn’t eliminate the upside, the wetter deciles often contribute to a positive probability weighted average. This highlights the benefits of considering both the upside and the downside of N budgets.

Conclusion

The RiskWi$e project is about better understanding risk and reward in all parts of the grain farm and is therefore more than an initiative about N risk-reward. It does however provide a rich opportunity for conversations about the risk and reward of N use in our grain production systems. Because getting N topdressing exactly right is almost impossible due to the variable climate, it is better to consider the consequences of erring on the side of applying a bit extra N or too little N. The cautious approach of too little N can have a substantial cost of missing the opportunity of turning 40kg of N to 1t of wheat. The long-term cost of applying less N than is replaced by a legume phase is a run-down in soil N and soil carbon.

The strategic approach of using N banking is attractive as a robust ‘set and forget’ rule. The N bank method sets a winter mineral N target for your soil and climate combination and the grower simply tops the existing winter mineral N level up to the pre-determined mineral N target. If the carryover N from last season is high, then the mineral N top up is low and vice versa. A proportion of growers in a proportion of years will want to tactically adjust their N. Budgeting tactically across deciles takes a bit longer than budgeting for a single target yield, but we have found that once growers see the graph showing the upside and downside, decision making becomes easier.

‘Fast Graphs for Slow Thinking’ could complement N banking to adjust the target when there is a forecast for increased odds of dry (deciles 1 2 and 3) or wet (>= decile 7). The GRDC funded Local Climate Tool (forecasts4profit.com.au) shows that for many sites in South East Australia, El Nino or Positive IOD leads to a doubling of the chances of being in the bottom two deciles and La Nina or Negative IOD a doubling of the chance of decile 9 and 10. GRDC investment in projects with the Bureau of Meteorology have contributed to seasonal forecasts showing the chance of deciles rather than just above or below median.

The end point is more complete conversations about risk and reward which are improved by insights from the behavioural sciences. Our contention is that the applied economic tool of decision analysis has a role, not so much in the answer it provides, but in the conversations we have about probability, recency bias, loss aversion and planning for a single, most likely future. Fast Graphs for Slow Thinking is one approach to simulate thinking for improved decision making.

References

Hunt, J, Murray, J and Thompson H - Nitrogen banking - a long term approach to risk.

Norton R and vanderMark E (2016). Nitrogen performance indicators on southern Australian grain farms. Proceedings of the 2016 International Nitrogen Initiative Conference, "Solutions to improve nitrogen use efficiency for the world", 4 –8 December 2016, Melbourne, Australia.

Vonk WJ, Hijbeek R, Glendining MJ, Powlson DS, Bhogal A, Merbach I, Silva JV, Poffenbarger HJ, Dhillon J, Sieling K and Berge H (2022). The legacy effect of synthetic N fertiliser. European Journal of Soil Science. 73. 10.1111/ejss.13238.

Unkovich M.J., Herridge D.F., Denton M.D., McDonald G.K., McNeill A.M., Long W, Farquharson, R. and Malcolm, B. (2020) A nitrogen reference manual for the southern cropping region. GRDC publication. Accessed via

Acknowledgements

The research undertaken as part of this project is made possible by the significant contributions of growers through both trial cooperation and the support of the GRDC, the authors would like to thank them for their continued support. Graeme Sandral (GRDC) contributed to the farming systems aspects of N fertiliser in this paper.

Contact details

Peter Hayman

SARDI Climate Applications

Peter.Hayman@sa.gov.au

0401 996 448

Barry Mudge

theoaks5@bigpond.com

0417826790

GRDC Project Code: CSP2303-015BGX,