Lentil trading and marketing

Lentil trading and marketing

Author: William Alexander (Australian Grain Exports) | Date: 13 Aug 2015

Take home messages

- Lentil prices are volatile and prices can move quickly.

- Don’t be greedy!

- The higher the price goes up the further it can fall.

Introduction

- As with all commodity trading it all revolves around supply and demand.

- If supply cannot keep up with demand then prices will rally.

- If supply outweighs demand then prices will fall.

- So we need to be aware of what is happening in all producing and consuming countries.

- Supply and demand analysis is crucial to this business.

Global production

- The major producing nations of lentils are:

- Canada

- India

- Turkey

- Australia

- We keep a close eye on these origins to see how their crops are progressing.

- Problems or fluctuations in relation to production in these origins can have a big influence on price.

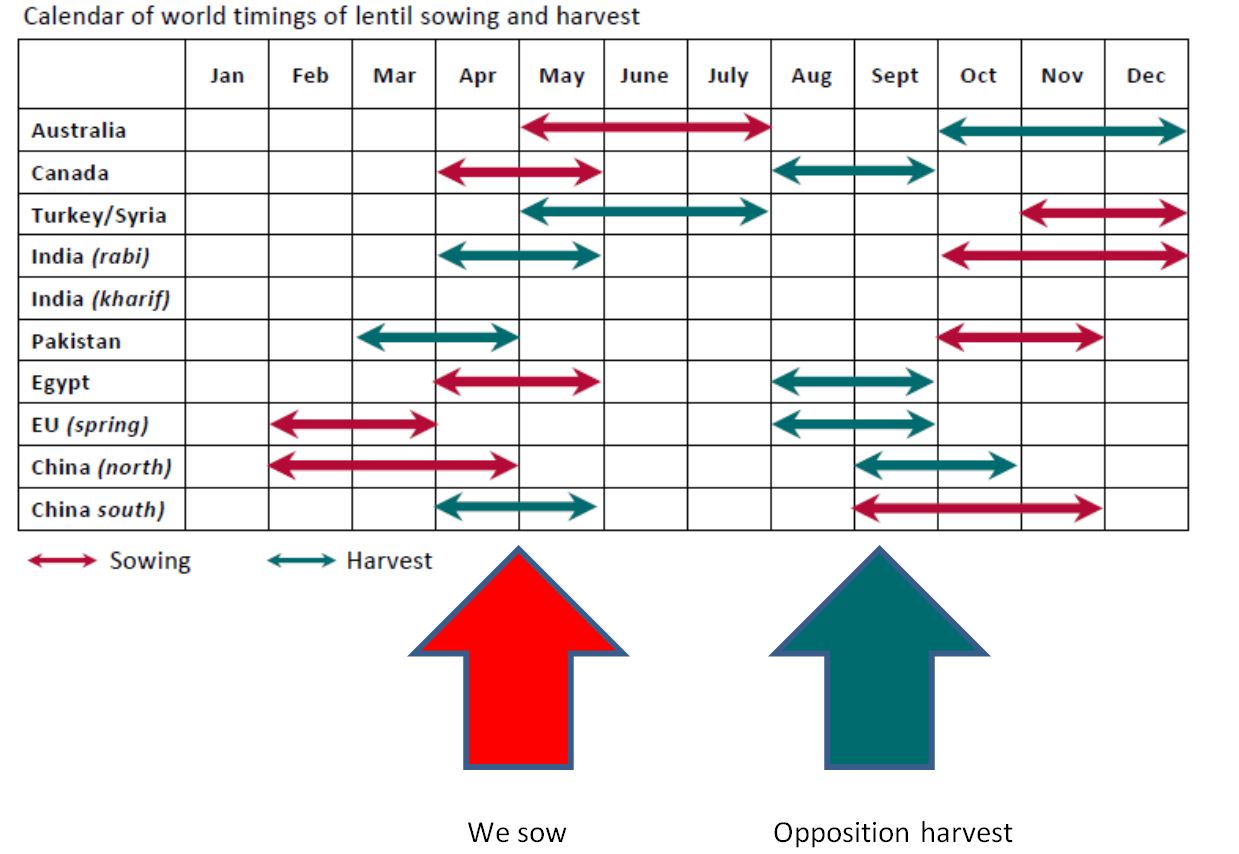

Figure 1: Calendar of world timings of lentil sowing and harvest and when we sow in relation to this.

Factors affecting supply

- The weather

- Timing – delayed harvest

- Yields – drought and weather damage

- Quality – weather damage

- Shipping

- Timing – Canadian logistics

- Price

- Higher prices will increase plantings

World lentil production (%)

Figure 2: World lentil production (2009 – 2013 average = 4.457 million tonnes, Source: FAOStat).

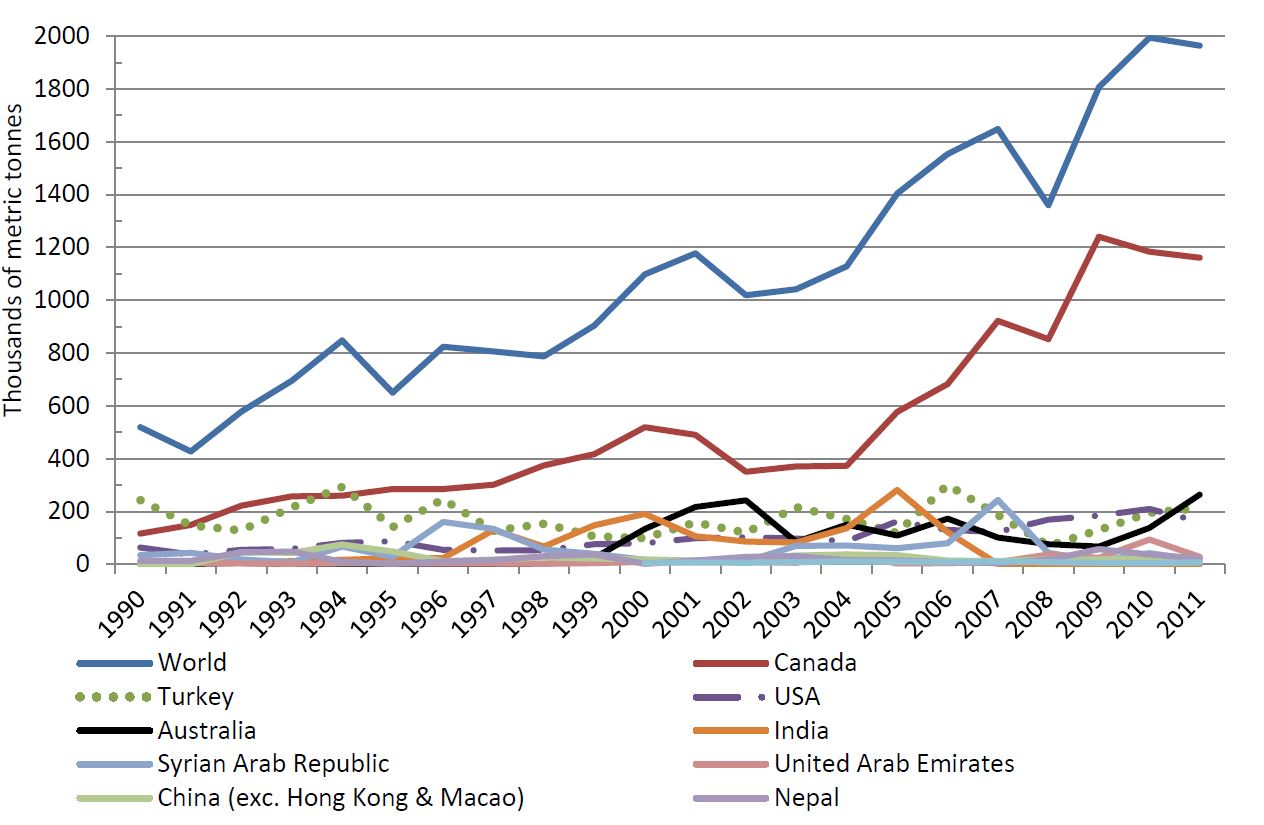

World exports of lentils (1990 – 2011)

Of the exporting countries, Canada has the advantage of volume of supply and exports. Turkey and the Middle Eastern countries have an advantage in supplying most of the European market, while Australia and Turkey have an advantage over Canada into the Indian sub-continent due to proximity and domestic shipping speed. Canada has an advantage over Australia into the USA (with mainly green lentils), European and Mediterranean markets.

Figure 3: World exports of lentils (1990 – 2011, Source: FAOStat).

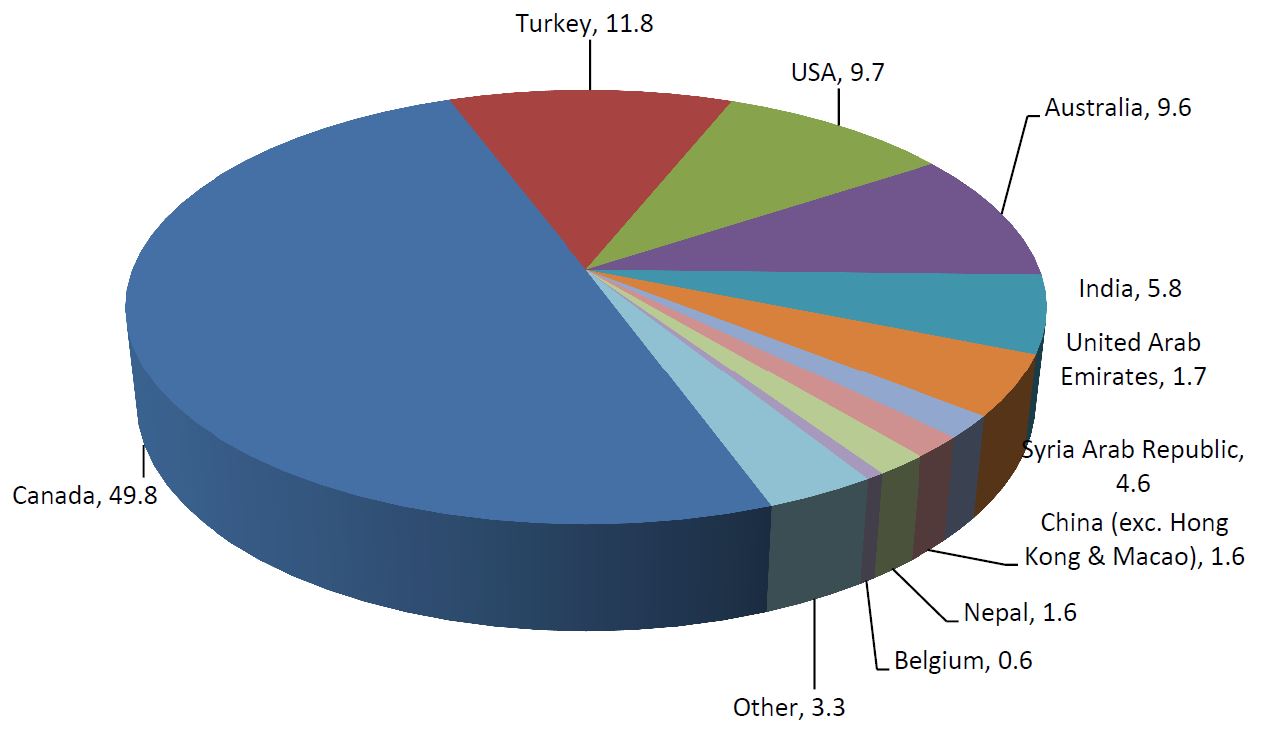

Major exporters of lentil as a percentage of world exports (2001 – 2010)

Top five exporting countries; Canada, Turkey, USA, Australia and India (Figure 4). Together these five countries represent 86.7 per cent of the world market. Total exports from 2001 to 2010 averaged 1.413 million tonnes/year.

Figure 4: Major exporters of lentil as percentage of world exports (2001 – 2010).

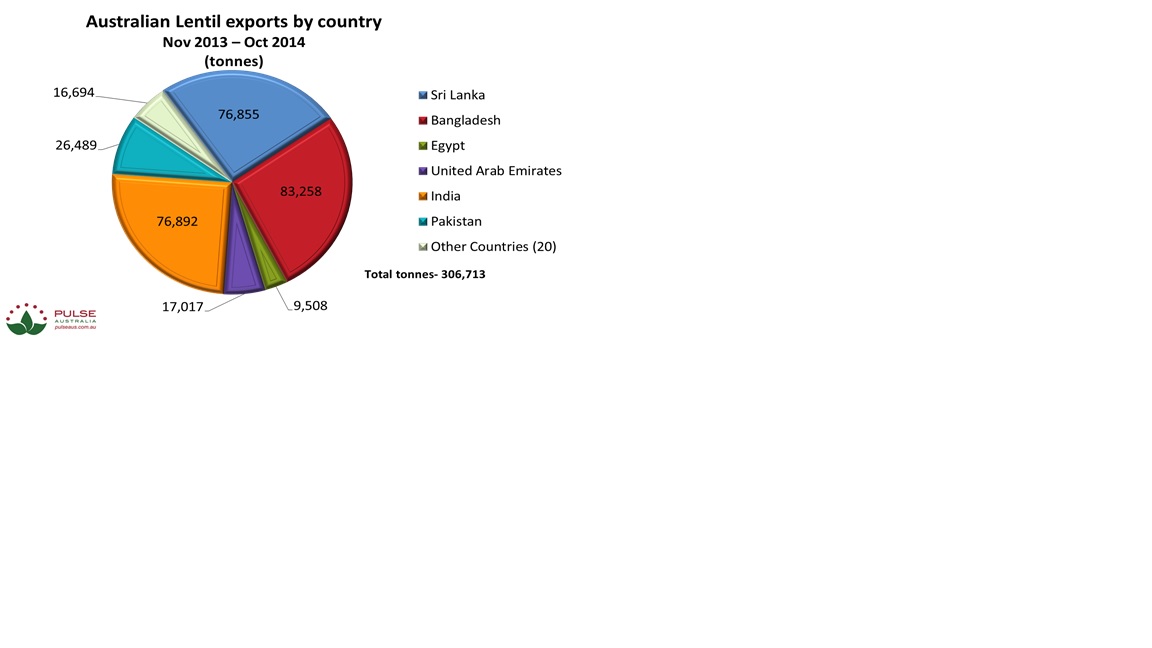

Australian red lentil demand

- The following countries are most important for red lentil demand:

- India

- Pakistan

- Bangladesh

- Sri Lanka

- Dubai

- Egypt

- Different countries will take different types of red lentils depending.

Distinct red lentil market ‘types’ (sizes)

| Seed coat colour | Seed size and type | ||||

|---|---|---|---|---|---|

| Small red* | Medium red* | Large red* | Medium green* | Large green** | |

| Grey | Nipper1 PBA Bounty1 PBA Herald XT2 PBA Hurricane XT1 |

Nugget3 PBA Ace3 PBA Blitz3 PBA Bolt3 Cassab3 Cumra3 Digger3 |

PBA Jumbo4 PBA Jumbo24 |

- | - |

| Tan | Northfield1 |

- | - | - | - |

| White-green | - | PBA Flash3 Cobber3 |

Aldinga4 |

Matilda5 PBA Greenfield5 |

Boomer6 PBA Giant6 |

1: SRP = small red (premium round)

2: SRS = small red (split)

3: MRD = medium red (dual purpose)

4: LRS = large red (split)

5: MG = medium green

6: LG = large green.

Red lentils by size

- Bangladesh takes a predominance of small lentil types

- consumed whole, as splits or as footballs.

- Sri Lanka takes a predominance of large seeded red lentils.

- Medium sized red lentils go to a wide range of countries.

- Market demand and prices can differ markedly

- depending on which country is buying and when.

- Premiums or discounts can apply to small or large seeded red lentils over the medium sizes

- demand, availability and supply quantities.

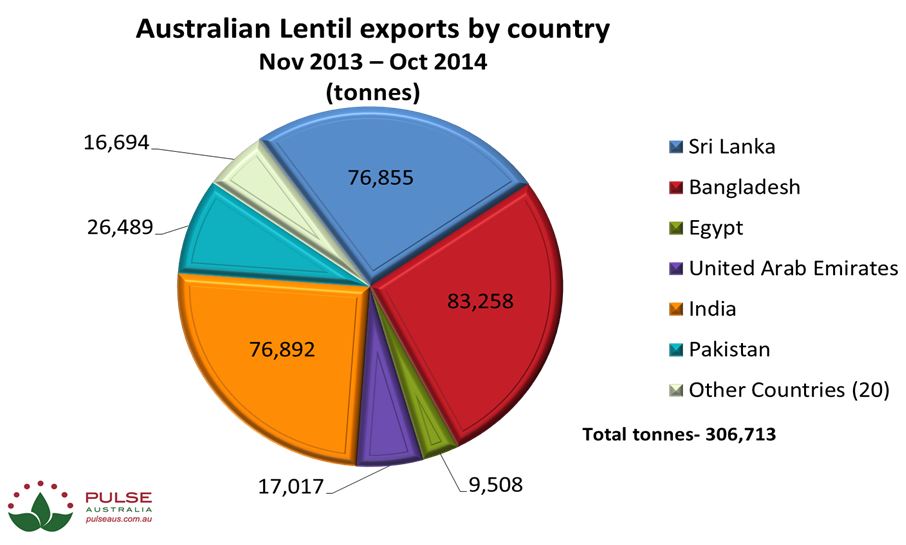

Export destinations of Australian lentil by country

Figure 5: Australian lentil exports by country (November 2013 to October 2014).

Exporting red lentils

I buy and sell a few different ways

- Delivered: Farmers sell into a packing site or storage facility.

- In store: Buy from anyone else in third party storage.

- DCT: Delivered Container terminal – product is packed into boxes of 25mt and sold to an exporter.

- CFR: Sold into the destination market.

- Bulk: ????

Trading basics

- I will take a long, short or neutral position depending on my view/strategy.

- If I feel lentils are overvalued and oversupplied I will sell and go short.

- If I feel lentils are undervalued and undersupplied I will buy and go long.

- If I am indifferent I will do nothing.

- My view will be based on supply and demand analysis and price discovery.

Trading risks

- Market moves against me.

- Weather.

- Price risk & working capital.

- Execution risk.

- Counterparty risk.

Contracts

- Firm price / firm tonnage: This contract normally offers the best price of the day but the grower is committed to deliver the nominated tonnage.

- Minimum price hectare contracts: These contracts offer the grower a minimum guaranteed price for the total production from the area contracted. There may be a maximum tonnage included in the contract. This contract offers the grower the security of a minimum price but does commit them to one buyer. Part or the entire contract can be priced at any time prior to delivery i.e. committed to FIXED PRICE / FIXED TONNAGE. These contracts are popular with growers.

- Closed loop: none at moment. This type of marketing arrangement requires that the total production from the crop is to delivered to the buyer. The company holding the rights is the only one that can supply the seed or contract the crop.

Marketing hints

- Lentils are volatile and prices can move quickly.

- Don’t be greedy!

- The higher the price goes up the further it can fall.

Marketing – green lentil

- Green lentil represents <1% of Australian lentils.

- Green lentil are 50% of the huge Canadian lentil crop.

- Green lentils are exported to many smaller market destinations – Algeria, the Americas (Colombia, Mexico, Venezuela, Brazil, Chile) and Europe (Spain, Turkey, Greece, Italy).

- By contrast, red lentils go to – Asia (Bangladesh, India, Pakistan, Sri Lanka) and the Middle East (Egypt, United Arab Emirates, Saudi Arabia).

National pulse standards

- Pulse Australia compiles Pulse Standards after extensive consultation.

- These standards are the minimum required, and may change.

- The export standards are the basis for sales.

- Buyers may negotiate outside standards to suit the market.

- Standards are available on the Pulse Australia website.

Whole red lentil minimum standards

Receival (grower delivery)

- CSP – 7.2.1 Red lentil No 1 grade receival - farmer dressed

- CSP – 7.3.1 Red lentil No 2 grade receival - farmer dressed

Export (trading contracts written on)

- CSP – 7.2.2 Red lentil No 1 grade export - farmer dressed

- CSP – 7.2.3 Red lentil No 1 grade export – machine dressed

- CSP – 7.3.2 Red lentil No2 grade export - farmer dressed

- CSP – 7.3.3 Red lentil No 2 grade export – machine dressed

Split red lentil minimum standards

Receival (grower delivery)

- none

Export (trading contracts written on)

- CSP – 7.4.1 Split Red lentil No 1 grade export - machine dressed

- CSP – 7.4.2 Split Red lentil No 2 grade export – machine dressed

- CSP – 7.4.3 Red lentil No3 grade export - machine dressed

Contact details

William Alexander

william@australiangrainexport.com.au