Managing the dollars and cash flow - the mountains and the moguls

Author: Kelvin Tyler (BMO Business Centre) | Date: 01 Sep 2015

Take home messages

- Develop and monitor plans, adapt them after seeking advice when particular skillsets are needed.

- There are numerous options available structure the farm business and its financial flows including tax. Getting the optimum set-up requires understanding the pros and cons of each.

- A good succession plan will provide a layer of protection for your family business.

Introduction

Managing your dollars and cash flow is a little like going on a trip to the snow. Your cash flow can be like going up the chair lift and down the mountain. It can be exhilarating and it can be scary. There are times of lots of ‘powder’ and times when you are ‘skating on thin ice’. To successfully navigate the mountains and the moguls, we recommend adopting these five strategies:

- You need a plan:

- Understanding cash flow v profit.

- Budgeting.

- You need to be prepared to adapt:

- ‘What-if’ analysis.

- Tax planning.

- You need to seek the right advice.

- You need the right people using the right equipment.

- You need layers of protection.

You need a plan

So what is cash flow? A dictionary will tell you ‘the total amount of money being transferred into and out of a business, especially that which is affecting liquidity.’ Basically it is the ins and outs of the bank account. Whether big or small, every business will have it and it is all relevant to that business itself. And the aim of the game is to have excess cash flow. Because that means you are able to pay all your expenses, meet all your loan commitments, pay your taxes and hopefully have some left at the end to enjoy for yourself (such as having a holiday or investing for retirement).

When the cash flow is negative, you need to go back to the plan, adapt if needed, hone in on your skills, and keep calm.

Understanding the difference between profit and cash flow

Firstly let’s look at a situation where you have excess cash flow. In this case, you would assume to have made a profit for the year. This is normally the case, but the two are different.

Now as accountants there is one ‘phrase’ we hear all the time: ‘where did all the money go?’

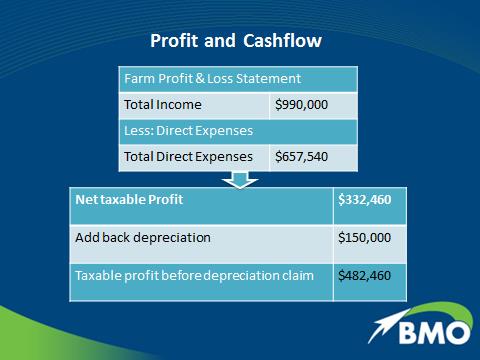

It is usually at interview time when we sit down with a client and run through the figures with them. I will say something like: ‘Great results Ted, you have had a pretty good year and currently showing a taxable profit of $332,460.’

Nine times out of 10 Ted will say to me from the other side of the table: ‘But, where did the money go?’

This is the difference between profit and cash flow, and the best way to explain this is with a quick example (Figure 1).

Figure 1: Difference between profit and cash flow.

Budgeting

So as mentioned earlier, we need to start with a plan. You need to combine the nasty words starting with ‘C’ and ‘B’ – that is cash-flow and budget. Before the start of the financial year, you need to put all projections down on paper to see and test some ideas.

- What is the estimated income?

- What is the estimated costs?

- What crops require different input costs?

- What crops produce better return or more cash flow?

- When are loan payments due?

- When are interest payments due?

- What is the time lag between spending the money on the crop and receiving some income from the sales?

- Do we need or can we afford any more equipment?

I’m probably not an average accountant. I am also a grain farmer. While I love nothing more than working with figures and problem-solving to reducing clients’ tax, I also love being out in the spray coupe at 4am watching the sun rise over the crop. My brother and I have more than 1200 hectares acres of dryland cropping in the Blaxland-Irvingdale district, just east of Dalby. So I will be the first person to put my hand in the air and say that budgets can be painful. But, without a plan you plan to fail. You need to revisit your budget on a monthly timeframe.

Remember cash flow is king. You need to know when the big payments are due so there is sufficient cash flow to make them. Be prepared for any possible shortfalls so you can either shift the timing of some expenditure, increase the overdraft, grow a different crop or do some contracting.

Cash-flow budgets can come in many different formats, shapes and sizes depending on what system is used. Some people (such as accountants) love excel or a spreadsheet, some of you may use a bookkeeping software like Banklink, Xero, Phoenix, MYOB, Quicken etc. These programs can assist in preparing budgets.

April is as an optimum time to be budgeting.

How is this done? I find the easiest way to start is to prepare a report based on each of the previous 12 months (Table 1). Even though things will change, doing this will help identify the seasonal differences. It will also highlight when those ‘chunky’ payments fall due including interest, loans, insurance, registrations and large pre-season costs such fertiliser and maintenance.

Table 1: Example budget.

| Example of a 2014-15 Crop Schedule | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Winter Crops |

Estimated | Per HA | Total | ||||||

| CROP | HA | Planting Date | Harvest | Banking | Yield | Tonnes | Price | Total $ | |

| Barley | 200 | End May | OCT | Nov | 4 | 800 | 200 | $160,000 | |

| Wheat | 200 | End May | NOV | Dec | 4 | 800 | 260 | $208,000 | |

| Winter Total | 400 | $368,000 | |||||||

| Summer Crops | Estimated | Per HA | Total | ||||||

| CROP | HA | Planting Date | Harvest | Banking | Yield | Tonnes | Price | Total $ | |

| Mung Beans | 100 | DEC | April | May | 12 | 120 | 600 | $72,000 | |

| Sorghum | 500 | OCT | March | April | 45 | 2250 | 200 | $450,000 | |

| Summer Total | 600 | $522,000 | |||||||

| CombinedTotal | 1000 | $890,000 | |||||||

| Contracting | $190,000 | ||||||||

| TOTAL INCOME | $1,080,000 | ||||||||

Be prepared to adapt

The most important thing with a budget is to detect the highs and lows of your cash flow so you can be prepared. The next most important thing is to not throw the budget away. Even if the only reason you did the budget in the first place was to keep your bank manager happy at review time, keep it, bring it out often and learn from it.

The best way to make sure you don’t get out of control, is to constantly reassess by checking the plan. If the weather or commodity prices change, then perhaps increase or back-off the fertiliser rates, or maybe grow a different crop to suit the conditions if there is still time.

‘What-if’ analysis

When preparing a budget you should also do some ‘what-if’ analysis on different crops, yields and dollars so you can get an understanding of how the outcome could be affected by the season at hand. It doesn’t have to be that technical. For instance, we sometimes just use a simple little Excel spreadsheet (Table 2).

Table 2: Example of a 2014-15 crop schedule.

| Farm Example | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Flow - Monthly 1 July 2014 - 30 June 2015 | |||||||||||||

| Jul 2015 | Aug 2014 | Sep 2014 | Oct 2014 | Nov 2014 | Dec 2014 | Jan 2015 |

Feb 2015 | Mar 2015 | Apr 2015 | May 2015 | Jun 2015 |

TOTAL | |

| Income | |||||||||||||

| Barley | 160,000 | 160,000 | |||||||||||

| Wheat | 208,000 | 208,000 | |||||||||||

| Mung Beans | 72,000 | 72,000 | |||||||||||

| Sorghum | 450,000 | 450,000 | |||||||||||

| Contracting | 10,000 | 10,000 | 10,000 | 10,000 | 20,000 | 20,000 | 20,000 | 100,000 | |||||

| Other | 0 | ||||||||||||

| Total Income | 10,000 | 10,000 | 10,000 | 10,000 | 160,000 | 228,000 | 20,000 | 0 | 0 | 450,000 | 72,000 | 20,000 | 990,000 |

| Less: Direct Expenses | |||||||||||||

| Accountancy | 700 | 700 | 700 | 700 | 2,800 | ||||||||

| Bank Charges | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 1,200 |

| Electricity | 800 | 800 | 800 | 800 | 3,200 | ||||||||

| Fertiliser | 10,000 | 40,000 | 40,000 | 90,000 | |||||||||

| Freight & Cartage | 5,000 | 5,000 | 10,000 | ||||||||||

| Fuel, Oil & Grease | 2,000 | 2,000 | 2,000 | 2,000 | 15,000 | 5,000 | 2,000 | 5,000 | 2,000 | 2,000 | 15,000 | 10,000 | 64,000 |

| Insurance - Business Package | 25,000 | 25,000 | |||||||||||

| Insurance - Public Liability | 5,000 | 5,000 | |||||||||||

| Insurance - Work Cover | 2,500 | 2,500 | |||||||||||

| Interest - Bank Term Loan | 70,000 | 70,000 | |||||||||||

| Motor Vehicle Expenses | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 3,600 |

| Rates & Land Taxes | 2,800 | 2,800 | 5,600 | ||||||||||

| Repairs & Maint - Plant & Equipment | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 48,000 |

| Salaries & Wages - Employees | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 48,000 |

| Seed | 15,000 | 15,000 | 30,000 | ||||||||||

| Spray & Chemicals | 20,000 | 30,000 | 20,000 | 20,000 | 90,000 | ||||||||

| Superannuation - Employees | 370 | 370 | 370 | 370 | 370 | 370 | 370 | 370 | 370 | 370 | 370 | 370 | 4,440 |

| Telephone & Internet | 350 | 350 | 350 | 350 | 350 | 350 | 350 | 350 | 350 | 350 | 350 | 350 | 4,200 |

| Total Direct Expenses | 14,320 | 56,920 | 11,120 | 14,620 | 59,920 | 59,120 | 31,820 | 14,920 | 16,120 | 14,620 | 64,920 | 149,120 | 507,540 |

| Operating Profit (Loss) | (4,320) | (46,920) | (1,120) | (4,620) | 100,080 | 168,880 | (11,820) | (14,920) | (16,120) | 435,380 | 7,080 | (129,120) | 482,460 |

| Less: Capital and Development | |||||||||||||

| Drawings | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 60,000 |

| Tax paid - from last years Tax Return | 30,000 | 30,000 | |||||||||||

| 2 New Utes - purchased for cash | 90,000 | 90,000 | |||||||||||

| Bank loan - Principal Reduction | 100,000 | 100,00 | |||||||||||

| Loan Repayments - Header | 40,000 | 40,000 | 80,000 | ||||||||||

| Loan Repayments - Tractor | 30,000 | 30,000 | 60,000 | ||||||||||

| Loan Repayments - Planter | 30,000 | 30,000 | 60,000 | ||||||||||

| Total Capital and Development | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 105,000 | 105,000 | 5,000 | 5,000 | 5,000 | 35,000 | 195,000 | 480,000 |

| Net Surplus/Defecit | (9,320) | (51,920) | (6,120) | (9,620) | 95,080 | 63,880 | (116,820) | (19,920) | (21,120) | 430,380 | (27,920) | (324,120) | 2,460 |

| Opening Balance | 0 | (9,320) | (61,240) | (67,360) | (76,980) | 18,100 | 81,980 | (34,840) | (54,760) | (75,880) | 354,500 | 326,580 | |

| Surplus/Defecit | (9,320) | (51,920) | (6,120) | (9,620) | 95,080 | 63,880 | (116,820) | (19,920) | (21,120) | 430,380 | (27,920) | (324,120) | |

| Closing Balance | (9,320) | (61,240) | (67,360) | (76,980) | 18,100 | 81,980 | (34,840) | (54,760) | (75,880) | 354,500 | 326,580 | 2,460 | |

Also don’t forget to budget for living costs, including food, off farm expenses, schooling, taxes, personal loans, medical costs, etc. You need to know if you can afford to live. Sometimes budgets can lead to some tough decisions.

So the budget is done, it is April, the weather was actually with us this year and you get the feeling you will actually exceed the budget. Yes it can happen. So what to do?

Option one: carry on to the end of June, send your books to the accountant who diligently prepares and lodges your financials, and presents you with a $40,000 tax bill.

Option two: since it is only April, you still have time to see your accountant before the end of June and do a tax update. A tax update is a process we follow towards the end of the financial year. As accountants, we get the last nine months’ actual figures (which is quite easy as you will have lodged all the BASs on time), and we then sit with you to estimate the income and expenses for the last bit. We add it all together and we can then accurately estimate the profit, and therefore, tax on the projected outcome.

If, at the tax update meeting, you are advised you are likely to be facing a tax bill of approximately $40,000 you have two choices:

- Accept your fate and donate your hard-earned proceeds to the big house in Canberra where you are so confident it will be used wisely and spent on necessary things (like Bronwyn Bishop’s helicopter).

- Discuss with your accountant legal ways of reducing your tax bill before the end of July.

Tax planning

Some strategies you can use to reduce your tax liability include:

- Putting money into a Farm Management Deposit (FMD), which will become even more attractive from the 01st July 2016:

a. Up to $800,000 per individual,

b. off farm threshold will be increased to $100,000,

c. able to offset business loans, therefore equivalent interest rate,

d. can withdraw an FMD under 12 months in times of drought without effecting the previous year tax return,and;

e. FMDs are a great way to ‘level out profit and therefore reduce tax’, there is no limit how long they can stay in an FMD and the only real catch is you must continue to operate some sort of primary production income. An FMD only becomes taxable again when you bring it back out of the FMD term deposit and use the money, the amount bought back is then taxable income – hence most people bring them back in less profitable years such as during drought or floods etc. This reduces your taxable income and hence tax, but more importantly it gives the business some cash to continue operation. FMDs can help set the business up for a rough or lean year. - Prepayment of expenses. For example you may go and fill the fuel tanks, order a few more shuttles of Roundup, get some fencing material or buy some fertiliser. In other words, pulling some expenses that you were likely to incur in July/August the next financial year into the current financial year.

- If you are in drought conditions and you have a large profit because you have had to sell down your livestock herd then there is a part of the legislation that allows you to defer the profit on the forced sale.

- If you have sheep and in the current year you had a ‘double wool clip’, then you are allowed to defer the profit from the second clip.

- You may be looking to upgrade or get some new equipment, with some careful planning there are ways to maximize the deductions on doing this – such as using a one year lease.

- You can now get an immediate claim for all fencing and waterworks (such as contours and dams).

- Once upon a time silos had to be written off over 25 years or more. They then came back to what was equivalent of about eight years and now they can be claimed over three years.

- There may be ways of distributing income to other family members depending on your structure or family circumstances.

- Maybe it is time to start paying some of the kids a wage for working on the farm.

- Putting money into superannuation This can be a sensitive topic for some, while others love the idea. It’s important to realise that superannuation itself is not an investment. Superannuation is a vehicle (and often a very tax effective vehicle) that is used to make investments. Remember, super itself is not bad, but the investments inside super can be good or bad.

- Look at and manage your invoicing cycle. Monitoring if grain and cotton are on hand. Each scenario has a different tax effect.

- Sometimes you can use Primary Production Averaging to help reduce tax and it is possible to use that tax saving to offset debt. For example:

John and Debbie are in a farming partnership in equal shares. For the simplicity of calculating their primary production averages I’ll assume that neither of them have any off-farm income. The farm has seen some lean years in recent times, with seasonal conditions working against their cropping enterprise. Times have been so tough that the partnership has produced tax losses for John and Debbie in the last three straight years. At the end of June 2014 they each had accumulated income tax losses of $90,000 to bring forward into the 2015 income tax year.

Their income average table for the last four years is identical for both. (This rarely happens in practice!)Year Amount 2011 5,000 2012 0 2013 0 2014 0 Finally some good fortune has come their way with a rare combination of good grain prices and good yields for 2015. Income tax wise the partnership produces a $350,000 taxable income from 2015 to be distributed half each to John and Debbie. This means that each will receive $175,000 taxable farm income. After deducting the 2014 accumulated tax losses carried forward of $90,000 their taxable incomes for 2015 will be $85,000 each. Without PP averaging (ordinary taxpayers) would have tax to pay of $19 397 plus Medicare levy each.

Applying averaging over the past five years means an average taxable income of $18,000. As the tax-free threshold is currently $18,200, this means their average rate of tax is nil, as there is no tax to pay on a taxable income of under $18,200. So a nil rate is multiplied against the current 2015 taxable income of $85,000 with the result that there is no income tax to pay for John and Debbie (just the Medicare levy).

Now obviously this example could be a little extreme. But you get the idea; in this scenario averaging has created a tax saving of almost $40,000. This could be used to direct offset debt – tax free. However, just note averaging can work against you as well should the scenario be in reverse.

All of the tax saving strategies just discussed could vary slightly or a lot, depending on your business trading structure. For example, it varies depending on whether you are a sole trader, partnership, company or trust. Timing is also important. Some of the methods of claim will also be affected depending if you are Cash or Accruals. I have seen people missing a $100,000 tax deduction simply due to a few days timing. Therefore, it is important to seek some advice from your accountant and maybe your financial provider.

Seek out the instructors – get advice

Think about your wheat, barley or sorghum crop. Let’s say you have a great-looking crop with plenty of sub-moisture and it is looking really well. Then one day you walk out and see some odd looking bugs in the heads that you have never seen before. What do you do? Ring your agronomist.

It’s no different in the financial world. If you are making a change, making a decision, buying something or selling something, or changing your budget significantly, ring your accountant. Don’t follow what someone else did and hope that it is right.

Don’t just stop at using agronomists and accountants. Consider seeking advice from:

- Financial planners – why not look at some off-farm investments? If you do have any spare cash or even enough for a deposit, an off-farm investment can make a lot of sense. Especially if they are set up in a way that the income earned from them covers the majority or all of the costs. This way they are not a financial burden on the farm and can produce another form of revenue stream or equity asset in the future. Things such as a package of good shares, unit, house, commercial shed can all work well if in the right area and set up correctly.

- Banks and lenders – it is always good to make sure you are getting the best deal, whether it be via a best interest rate and reduced fees, load payment structure, flexibility or drawback access. Talk to your banks and lenders (also use your accountant in this discussion) to check if there is a better option that can save you dollars.

- Solicitors – make sure any major purchases or sales that involve contracts are reviewed by both your accountant and solicitor to make sure all is well. Especially if you are dealing with mines or coal seam gas companies. It is also vital that you have wills and power of attorneys, and make sure they are updated with any new major purchases or sales, additional kids, new spouses etc. If you die without a will then the public trustee can come in to administer the estate. That could be time consuming and costly, and worse still it is possible that the people you want to end up with (or not end up with) your assets could be different to your intentions. Also remember with power of attorneys, of which there are financial and health types, that you can have more than one person and can have different people for different roles.

Professional bodies – it is always good to look at the various organisations and groups around to see what research they have already done. Why re-invent the wheel, which can be costly and time consuming. Have a look at what papers and research material is already out there being provided by the likes of GRDC, Kondinin Group, Agforce, various agronomy agencies, other bodies linked to dairy, horticulture, beef cattle bodies such as Australian Lot Feeders Association and the - not to mention all the other breed purpose associations, etc. All these bodies will have material available that may cover the topic you need assistance with.

The right people using the right equipment

So back to the original question of ‘How to manage your cashflow?’ How does one do that in the physical sense? We have already looked at setting and reviewing budgets. What else do we do? How do we do it? Who should do it, and what skillsets do they need?

In my opinion, the most important thing is that the person managing the cashflow has the passion to do it. Let’s face it, a budget is not worth the paper it is printed on and bookwork can be done badly (which will cost you money), if the person doing it does not have an interest. Find the person in your family business whom has the strongest interest for this area and train them.

Preparation of budgets, doing bookwork, even monitoring your own profit along the way can be done quite easily, and most accountants are happy to help train along the way.

It is like everything in life. If a person has an interest or passion then you can easily train them in the skills they require. It all comes back to attitude.

Once you know you have the person with the passion on the job, then you need to equip them appropriately.

There are also a lot of computer packages out there that can help if that is what you like.

For example:

- Banklink – this system automatically downloads from your bank so there is no reconciling, there are three different levels ranging from the simplest form of using a pen and paper and sending it to your accountant, to fully interactive where you can code yourself, complete your own BAS if you choose, create budgets and prepare reports including, Cashflow, Profit & Loss, Budgets and Actual to Budgets so you can track your progress monthly.

- Xero – it is similar to Banklink, but however it is internet-based. An advantage is you can access it anywhere in the world at any time if you have internet service. It also has a lot of add-on apps that can do different things such as stock control, debtors, creditors, etc.

- Phoenix – it can be used on your own system or on the internet, fully incorporated program that you input all your financial information allowing you to complete your BAS and budgeting etc. Has heaps of different reports and is specifically designed for the farming, grazing, and horticulture. It also links to farm mapping, livestock control and transfers.

- You then have numerous other programs like Quickbooks and MYOB, most of these programs are aligned to ‘in town’ business rather than rural but they can easily be adapted and I have many clients using them. They are however more accrual-based packages and can therefore be a bit more difficult and time consuming.

Don’t spend a lot of money on a program if you’re not going to use it.

At the end of the day – no matter what system you use – make sure you set it up the way you want it. I do not believe it should be set up to solely suit the accountant. You own the system, it is your set of figures and therefore it should be set up to be easily able to retrieve the information you want to get out of it. If you are going to use the system solely for BAS and tax preparation only, then yes, ask your accountant how they would like the chart of accounts organised. That may be quickest and simplest for them and therefore the cheapest for you.

However, if you want to use the system for more management then set it up to suit you. For example, as accountants preparing tax returns, we don’t need to know if fertiliser is bought for wheat or sorghum. We don’t mind where the Roundup® is used and we don’t need to know what paddock is planted. This is because for compliance (tax and BAS), we just need to bring it back to a gross income minus all expenses. However, if you want to set your book-keeping up to calculate a gross profit margin per commodity or per paddock, then we’d encourage you to do it. As accountants we can work with that easily and still get all the data we need to do the tax and BAS. In fact, most accountants (and I know I certainly do), love to help assist with the more involved management because this is a lot more fun and beneficial compared with tax and BAS.

A good accountant should be able to help develop your chart of accounts to best suit your needs and to best obtain the information you want, whether it is to get a gross profit per commodity, work out which tractor is more costly to run, which employee is costing you more.

All of this can be easily achieved with the correct chart of accounts and reporting methods.

Using such methods, we can help with:

- Assessing what crops or livestock lines are more profitable than others.

- Get reports to easily assist with the completion of those annoying bureau of statistics forms.

- Your budget setups and monthly monitoring.

- Detecting any upcoming cashflow shortages.

- Staffing requirements.

- Contractors versus employees.

- Deciding on repairs versus new capital items.

- Contractors versus buying the equipment yourself (refer to GRDC factsheet).

- Leasing versus chattel mortgage versus hire purchase versus loan.

- Deciding whether to buy or to borrow.

While we are talking about software and computer programs, don’t forget that you can use your smart phone for more than just calling people. Some good smart phone apps that farmers I know use are:

- Winter Cereal Nutrition – the Ute Guide by GRDC.

- Field Peas – the Ute Guide by GRDC.

- Insect ID – the Ute Guide by GRDC.

- Weed ID – the Ute Guide by GRDC.

- Pestpoint – pest identification.

- Graincorp – grain selling prices.

- Mobil Netlube - oil recommendations for different vehicles (you can search a vehicle and it will recommend what oil to use).

- Rain Log - enter in your rainfall and keep track of YTD, etc.

- Notability - for taking notes and drawing diagrams - you can then email your notes to someone.

- Units Plus - conversion calculator.

- Grain Storage - working out capacity of silos.

- JD Link – monitor your tractor (fuel, oil, idle time, temp, power used, any faults or error codes, servicing and where it is).

- Measure Your Land – area calculator.

- Flashlight – turn your phone into a torch at night.

- Not to mention the numerous weather apps.

Make sure you have layers of protection

So where to from here? You have set out your budget, adapted your cash-flow, planted your crop. You need to also create a buffer around you in case things go wrong. Having layers of protection around you is about making sure you have in place a risk management plan.

So what kind of protection should we have on the farm? There are obvious things such as general insurance for your tractors and equipment, and crop insurance. I’m going to focus on a few other areas that sometimes get left out. These are areas that will be a risk buffer.

- Registering assets on Personal Properties Security Register (PPSR).

- Workplace health and safety.

- Personal insurance.

- Getting entity structures right.

- Succession planning.

Registering assets on PPSR

The Personal Property Securities Act 2009 (PPSA) commenced operating from 30 January 2012.

- It implements important changes to rules affecting ownership of personal property.

- The PPSR has replaced more than 70 different Commonwealth, State and Territory Acts and registers.

- It allows you to register your interest in personal property into one single national register, which were previously unable to be registered.

- While registration is not compulsory, if you do not register, you may not be able to enforce your interest.

What is personal property?

- It includes almost everything except land and fixtures on that land (such as buildings).

- It excludes your family home.

- Includes plant and equipment, motor vehicles, boats, planes, crops, livestock, art.

There are ways to protect yourself from this rather ugly PPSR act. My suggestion is if you do have livestock agisted or your equipment is on other people’s property then you should seek more information from your accountant or solicitor.

Fairwork and workplace health and safety

As another risk management measure, if you have staff you need to make sure that you are up-to-date with the correct awards, workplace health and safety and the Fair Work Act. This is one of the most scariest areas at the moment and one that can certainly upset things.

Personal insurance

I have no doubt that most of us will have some sort of insurance in place, with the most common being plant and equipment. Most of us will have the cars, utes, tractors and headers, etc insured. Most of us will also have some sort of public liability insurance on the property as well. However what is the most important item that really should be insured, but is often overlooked? It is you!

Now I am not a financial planner and hence legally cannot give advice on types of insurance. However I can say from personal family experience the immense importance of it.

As a real quick summary there are four basic types of personal insurance:

- Life: this is the obvious one and the one payment you do not want to receive – because you would be dead. However, the funds can be critically important to your loved ones left behind.

- Total Permanent Disability.

- Trauma Insurance. The latest facts show 50 per cent of all Australians will be diagnosed with cancer by the age of 50. More than 43,000 people die from cancer each year.

- Income Protection. There are income protection options for farmers.

You need to seek advice about insurance from an authorised financial planner. If you haven’t had an appointment about this for a while, please consider doing so.

Entity structures

Managing risk is also about ensuring you are using the right structure for you.

I believe there are at least three main things to think of when choosing a business structure:

- Tax consequences.

- Asset protection.

- Ease of succession.

Sole trader:

Sole trader pros:

- Cheap to setup: all you need is basically an ABN and a bank account and you are ready.

- Simple to use and operate.

- Can use business losses to offset other income: because you are trading in your own name then all your income is in your name as well. The ‘business loss’ provision is mainly of use when you have other income activities such as contracting or off-farm wages for example, if you worked one day a week down the road at a neighbour’s feedlot than this would be deemed wage income. You could use any possible ‘loss’ from the farm to reduce the wage income to reduce the overall tax position.

- Can access primary production averaging.

- Can access Farm Management Deposits.

- Can access Capital Gains Tax exemptions: these are important if you sell a major capital asset such as the farm. There can be some huge tax savings and they can be easily factored into succession planning. I could easily spend an hour on Capital Gains Tax – hence see me later if you have any questions.

- Future succession planning: there is a special farming land exemption in the stamp duty Act which allows for farming land held in individual names to be handed down from parents to their children on any ‘gifted’ portion amount.

Sole Trader cons:

- Minimal tax planning: every taxable dollar earned is taxed in the owner’s name as there is no-one else or entity to share it with.

- Minimal asset planning: because the actual business trading and all the assets (being both business and personal assets) are held in the individuals name than all the assets are up for grabs. The sole trader has to be solely reliant on adequate insurance.

- Be careful not to choose a sole trader entity just because it is cheap and simple. Be careful that the money saved in setting up and running the structure does not cost you a lot more down the track!

- Need to be mindful of Non Primary Production income if wanting to put in extra superannuation. I am sure it will be no surprise to you, but the Australian Tax Office does have some weird rules at time. One of these we like to call the 10 per cent rule. Basically it means that if you have both wage and business income then you cannot put in extra deductable superannuation in your own name if your wage income is more than 10 per cent of your total income.

Partnership:

Partnership pros:

- It can split the income between the people of the partnership, which for reference are not limited to just two people. You can even have a partnership of two or more discretionary trusts, etc.

- If they have a partnership agreement (highly recommended) then they can also use the partner’s salary. A partner’s salary can be used to pay extra funds to one or more partners for extra work performed. However the use of salaries comes with an ATO warning. They have sent letters to all accountants in Australia saying they know we are doing it, they know it is allowed, but they are not happy. We see this as a bit of a shot across the bow, and to makes sure that we are not ‘pushing the limits’ so to speak.

- Cheap to set-up and operate: the only major extra cost is the partnership agreement which is needed to pay a partner’s salary, but it is also extremely important if there is conflict or a partnership split. It is even more relevant if the partnership is of people who are not family members.

- Simple to use and operate because it is no more difficult than a sole trader.

- Can use business losses to offset other income –because a partnership is not a legal entity.

- Can access primary production averaging.

- Can access Farm Management Deposits for tax planning.

- Can access Capital Gains Tax exemptions.

- Future Succession Planning: can hand down family farm land to children stamp duty free if gifted.

Partnership cons:

- Can only tax plan between the partners.

- Minimal asset protection: this structure can even be worse than a sole trader because it is possible that if one partner goes down then so do all the others. This is more relevant in non family dealings.

Companies:

Company pros:

- Company pays income tax at a flat rate of 30 per cent from dollar $1. They are really good for high income businesses. However, you need to be mindful of how the incremental tax rate works.

- Can only access some Capital Gains Tax (CGT) exemptions.

- Great asset protection if setup and used correctly: a company is a separate legal entity, so it can be sued at law. Therefore, it’s great for setting up a more risky business in the company and make sure all assets such as plant and equipment, land, houses, etc are held in another entity.

- Can superannuate business owners if they are employees because you can be an employee of the company.

Company cons:

- More expensive to setup and maintain: needs a company register, Australian Securities and Investments Commission fees, more tax returns and legislation to abide by.

- Must be more careful when operating: be mindful of Fringe Benefits Tax and personal drawings and borrowings which can cause higher and extra tax.

- Cannot distribute out business losses to offset other income.

- Cannot access primary production averaging.

- Cannot access Farm Management Deposits for tax planning.

- Can not access the 50 per cent CGT discount.

- Cannot hand down family farm (land) to children stamp duty free if gifted.

Discretionary trust - also known as the Family Trust

Firstly a bit of quick history on ‘What is a Discretionary Trust’. Trusts only come into existence when they have something to look after. This is normally known as the settlement amount.

A trust needs someone to tell it what to do and how to do it. This is called a trustee. A trustee can be an individual (one or more), or a company trustee. The main advantage of a company trustee is greater asset protection.

A trust must have some assets to look after on behalf of someone. These people are called beneficiaries and are able to share in the splitting of both income and capital distributions from the trust.

Family Trust pros:

So what are some of the advantages of a trust?:

- Can split the income between the beneficiaries of the trust: the discretionary trust gives heaps of flexibility with income splitting, you can split in any ratio and it can change every year if desired. For example, you can split it 100 per cent to mum or dad, or 50/50 or 60/40 or 80/20, whatever you like. You can also bring in the kids when they are old enough.

- Individual beneficiaries can access primary production averaging.

- Individual beneficiaries can access Farm Management Deposits for tax planning.

- Individual beneficiaries can access Capital Gains Tax exemptions. There are more hoops that have to be jumped by the trust, so consult your accountant before making any sales or acquisitions that could affect CGT.

- Good asset protection if set up and used correctly. However make sure you separate the ownership of major assets and private assets from the actual business.

- Can superannuate business owners if they are employees.

- Can be useful in succession planning by changing trustees or directors if corporate trustee –this means you can transfer from the business more cost effectively to children. However it is a bit like the CGT rules in that there are some hoops to jump through and it is always best to plan this strategy well in advance with consultancy from your accountant.

Family Trust cons:

- More expensive to set up and maintain.

- Simpler to use than a company, but still need to be mindful of personal expenditure and borrowings from the trust in some scenarios.

- Cannot distribute out business losses to offset other income.

- Cannot hand down family farm (land) to children stamp duty free if gifted.

So we now have a quick idea on what different structures can do. These can be of particular importance when entering into succession planning.

Succession planning

I am not going to discuss succession planning in any detail because once again that is a whole topic in itself. However, I would like to point out a few important take home points:

- Succession planning should not start after the funeral.

- Succession planning should not be ignored.

- The younger generation are looking for open, honest communication about their future much earlier than when their parents ever were.

- The younger generation is no longer happy to run with the promise of ‘When I die mate this is all yours.’

- Communication is the key.

- There are ways to commence succession planning without handing over the farm. In fact it might be that you do not wish to hand over an asset, especially when the current Australian statistics show there were 48,000 divorces last year. There are ways of doing succession planning without putting the assets at risk.

A succession plan is a process that you should start as early as possible. A good succession plan will provide a layer of protection for your family business.

Conclusion

So remember, the steps to successfully managing your dollars and your cash flow are:

- Having a plan.

- Being prepared to adapt.

- Seeking the right advice.

- Getting the right people using the right equipment.

- Managing risk with layers of protection.

Going up and down the cash flow hills can be exhausting and stressful at times, but if you put the above strategies into place you will be able to work your way out of the valleys and eventually you’ll find yourself sitting on top of your own mountain enjoying the view.

Contact details

Kelvin Tyler,

BMO Business Centre

07 4662 3722

Disclaimer: Information provided in this paper is general in nature. In preparing information BMO Accountants has not taken into account any particular person’s objectives, financial situation, or needs. Readers should, before acting on this information, obtain financial advice specific to their own individual circumstances.

Was this page helpful?

YOUR FEEDBACK