Faba bean marketing and the Middle East

Author: Nick Poutney | Date: 31 Jul 2014

Take home messages

- Egypt represents 70% of Australia’s total faba bean export market.

- The greatest influence on Australian faba bean price is the size and quality of the French and UK crops

- Visual appearance of the faba bean is extremely important as consumers evaluate the colour, uniformity of size and purity prior to purchasing.

Introduction

As the result of a number of agronomic benefits, we are witnessing an increased interest in faba bean production in the irrigated cropping regions. I’ve been invited today to discuss the marketing options for the faba bean crop and the international dynamics we need to be aware of when producing faba beans for export. I’d like to spend some time to point out important characteristics of the Australian crop dynamics and export program and to look at the international price influences that directly impact the prices in Australia at harvest.

Lastly, I will demonstrate the handling process of faba beans in Egypt, which should demonstrate why care needs to be taken in Australia when handling faba beans to minimise damage and preserve their quality.

This season, GrainCorp successfully executed its first bulk shipment of faba beans through Portland’s bulk export terminal. This involved a tremendous effort from our storage and logistics business who managed the logistics of accumulating the beans into port. Most beans were sourced from Bordertown, South Australia and Horsham, Victoria and around 25% of the shipment was delivered from farm, direct into the port.

I’m very proud of our achievements and so I’ve included an image (Figure 1) of the MV Sainty Vitality while under load in Portland, Victoria in March 2014. We believe that the continued commitment of GrainCorp to provide growers a good marketing alternative will support the growth of the faba bean market.

Figure 1. MV Sainty Vitality while under load in Portland, Victoria in March 2014.

Egyptian market

Egypt is the world’s largest importer of faba beans, its annual requirement of 480,000-520,000 tonnes accounts for over half of global imports. These imports are roughly split between UK, French and Australian origins depending on the relative quantity and quality of each of these crops. Traditionally, the Australian faba beans command a premium in the market due to their preferred colour and size but this premium varies throughout the season relative to availability.

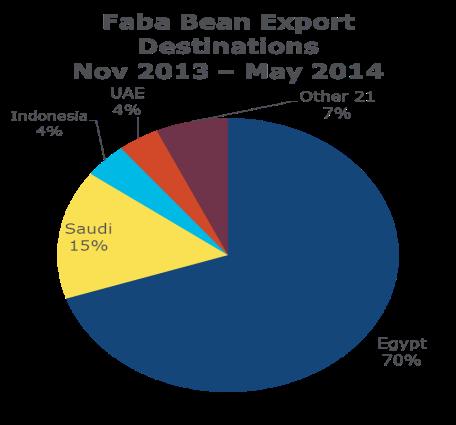

According to the ABS export statistics, over the most recent marketing season from November 2013 until May 2014, Australia exported a total of 306,021 tonnes of faba beans. Of this total export volume, Egypt represented 70% of total exports with 213,766 tonnes (Figure 2). The next largest destination was Saudi Arabia with 46,707 tonnes or 15% of exports.

Figure 2. Faba bean export destinations, November 2013 – May 2014 (Source: ABS)

Last season (2012/13) reflected a similar export profile with a total export program of 283,389 tonnes of faba beans; 187,037 tonnes or 66% exported to Egypt between November 1, 2012 and September 30, 2013. The next largest destinations were Saudi Arabia with 12% of exports from Australia, UAE with 5% and Indonesia with 4%.

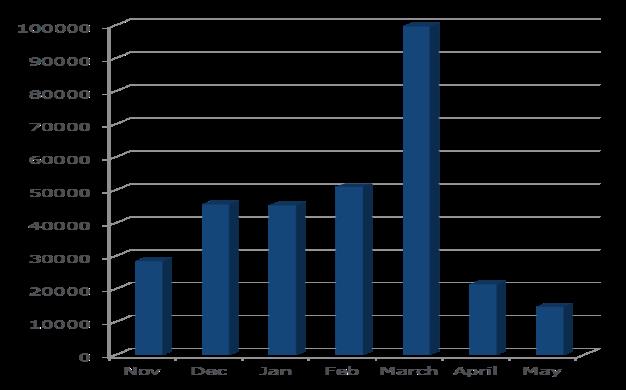

An interesting characteristic of the export program is that 80% of the faba beans are exported by the end of March. This is a function of the premium that consumers will pay for freshness which is reflected in the whiter, brighter beans that tend to deteriorate in colour over time. Importantly the premium is based on colour but also size and quality (% of damage).

Figure 3. Quantity of faba beans exported through the months of November – May.

GrainCorp has the ability to complement our existing bulk shipment programs of wheat and barley into the Middle East to provide opportunities to competitively deliver faba beans in bulk.

The greatest influence on the Australian faba bean price is the size and quality of the French and UK crops that are generally harvested in the August-November window before the Australian crop becomes available. Egyptian interest in the Australian crop usually depends on the quality profile they have been able to purchase from these northern hemisphere crop regions.

With the recent strong global value for faba beans, I anticipate an increase in acreage planted across the northern hemisphere crops, so Australians need to watch their quality profile very carefully.

The long term average value for faba beans has been close to $300/tonne delivered to Adelaide but we have achieved an average of a little over $400 delivered to Adelaide for the past two seasons. There have been significant price spikes at the tail end of these recent seasons but these sharp spikes reflect the small volume available at the season’s conclusion.

GrainCorp will continue to work closely with growers to market faba beans competitively into all key export destinations.

In Egypt, faba beans are the staple of the daily diet with most citizens eating faba beans daily as a dish called “foull” or “ful”. The visual appearance is extremely important as consumers evaluate the colour, uniformity of size and purity of the beans. There are many variations of “foull” recipes available depending on the wealth and taste preference of the consumer, as this is the main source of protein for most Egyptians.

Figure 4. Images of the dish “foull” or “ful”.

In order to market the faba beans as attractively as possible to consumers, good local traders will invest in the right people and infrastructure to process the beans. Importantly they will work with international suppliers who can provide quality and consistency.

The sorting process in Egypt has three phases:

- The first step of the process is to put the beans over a five mm oblong sieve to sift out the foreign material.

- The cleaned faba beans are then sifted over an eight mm round sieve to separate the small seeds that are too small to be split but are still useful to be sold.

- These small calibres are sold at a discount into the market – apparently they have good demand selling for pigeon feed (bred for human consumption).

- The faba beans are then sifted again over a ten mm round screen to separate out the larger faba beans that sell for a premium.

- Through steps 2 & 3 the majority of beans are segregated as a more even and consistent size of 8mm – 10mm.

To demonstrate this process, I have included images in my Powerpoint presentation that clearly show the sorting process and the consistency of the final product. The aim of the process is to separate and clean the initial product and separate out the small seeds that won’t split in the splitting machines. All of the off grades are utilised and nothing edible is wasted.

Importantly, to demonstrate the integrity of the product, the packaging in this particular brand has a transparent strip down the length of their 50kg bags that allows the consumer to see the product; the buyers are looking at colour, size and purity.

Figure 5. Image of the packaged faba beans.

The final images within the Powerpoint presentation provide an insight into the significant investments made in the storage and handling facilities; including cool store investments, to ensure the product is well maintained and kept fresh.

Finally, it’s important to understand that Australian faba beans are constantly presented to the consumer in comparison with all other origins, and therefore, quality is very important.

Conclusion

Hopefully this paper has clearly outlined the key influences on the prices of Australian faba beans, the importance of supplying clean and consistent faba beans to our customers and the strong capability of GrainCorp to connect with the international market.

Contact details

Nick Poutney

Regional Manager – Africa, Middle East & Japan, Trade Manager for the GrainCorp Pulse Business.

0418 383 336

Was this page helpful?

YOUR FEEDBACK