Export oaten hay - opportunity for grain growers

Author: Darren Keating (Australian Fodder Industry Association) | Date: 25 Feb 2015

Key messages

Australia has a well-established export hay sector however there are still opportunities for growth. Recent growth in demand for Australian oaten hay from China has created new opportunities for growers to get involved in export hay production.

While the benefits of growing cereal hay in crop rotations are well documented, many growers have overlooked the opportunity to incorporate export hay into their farming systems. Everyone involved in planning cropping rotations; growers, agronomists and advisers should look at targeting the export hay market and become part of this growth industry.

Background

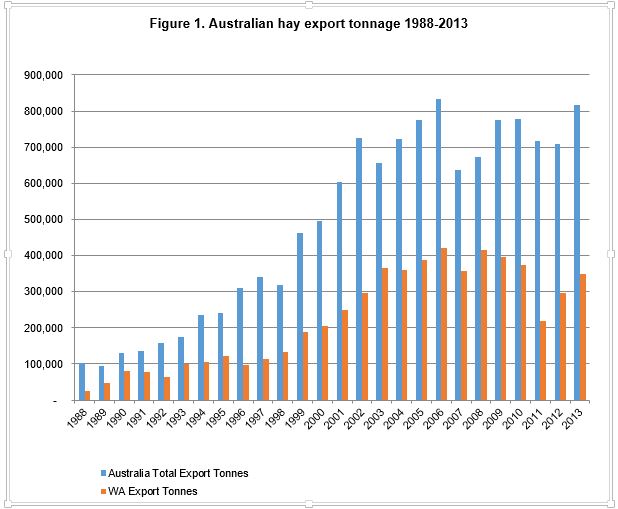

Australia has a reputation as an exporter of quality fodder products, having had a presence in the global fodder trade for over 25 years. From humble beginnings where a few containers of small bales were manually loaded by enterprising farmers, the industry successfully exported over 811 000 Mt of hay worth an estimated $295 million in 2013. The growth of Australian hay exports can be seen below (Figure 1) as can the levelling off in the growth in exports that occurred around 2002.

Oaten hay is the primary fodder product that Australian producers are exporting. Typically lucerne (or alfalfa) is the most widely exported fodder commodity worldwide, thus providing Australian export fodder an important point of differentiation. Australia does export other fodder products such as wheaten hay, barley hay, cereal straw, lucerne, vetch and rhodes grass, however in total this would usually represent less than 20% of total exports.

Australia has had a relatively steady export hay market over the past decade, with Japan the key customer. Japan continues to be a valued customer for Australian hay but China has emerged as an important and exciting new market for Australian fodder. Growth in the demand for Australian oaten hay has seen exports to China more than double each year from 2012 without any signs of slowing. This growth in Chinese demand for fodder represents the first significant opportunity for expansion of Australian hay exports in over a decade.

Opportunities in export hay for grain growers

The majority of Australia’s export hay is produced in Western Australia and Southern Australia, with Victoria being the third largest exporting state. In recent years we have seen total Australian export tonnages settle over 700 000 tonnes of hay and straw with a total 811 666 tonnes being exported 2013.

Victoria

Victoria’s share of the export hay market in recent years has been around 120,000 tonnes, however in 2013 and 2014 this figure has been in excess of 150,000 tonnes exported. Much of the growth in Victorian exports has come from existing exporters and growers, however there has been an increase in the number of hay export facilities in Victoria in recent years, and a number of additional facilities are planned in the near future.

Given the opportunities for growth of Victoria’s hay exports, there are a number of key factors that Victorian grain growers should consider. It is generally accepted that adding hay to cropping rotations can deliver substantial benefits including managing resistant weeds, reducing exposure to environmental events such as frost, and enabling growers to diversify their business without making major changes. Victoria also has a key advantage over WA and SA when it comes to hay production; and that is the close proximity of the dairy industry. Having such a large alternate market provides greater flexibility to Victorian hay producers in managing seasonal variations in both price and hay quality.

Victoria’s share of this is in recent years has been around 120,000 tonnes, however in 2013 and 2014 this figure has been in excess of 150,000 tonnes exported. Much of the growth in Victorian exports has come from existing exporters and growers, however there has been an increase in the number of hay export facilities in Victoria in recent years, and a number of additional facilities are planned in the near future.

Western Australia

Since 1998 WA has produced over 40% of Australia’s export hay, with the exception of 2011 where crop failures saw WA exports account for 31% of National hay exports. This is driven by a consistent ability to deliver high quality cereal hay to overseas markets. WA’s climate is a key factor here, providing weather that typically gives a good window for curing hay. Another key factor that has seen the WA growers focus on producing top quality export hay is the limited secondary markets for hay (i.e. domestic dairy and beef producers). This has seen growers and contractors develop skills and experience in producing high quality cereal hay. While climate is a key contributing factor to hay quality the planning and timing put in place by the grower is a defining factor in identifying consistent producers of top quality hay.

Being the largest exporting state WA also has the largest number of facilities accredited to process and export hay. The majority of these plants are within a 2 hr drive of Perth, giving not only efficient transport access to port, but also sees most farmers being within a reasonable distance of at least one export facility.

Australia’s key fodder markets

Over the past 25 years Australia has exported hay to well over 50 countries however the bulk of exports are taken by a small number of markets in Asia. There are also opportunities to expand into other markets such as the Middle East, and potentially India, however these are not yet markets of significance for the Australian export hay industry.

The following gives an outline of Australia’s key export markets.

Japan

The Australian export fodder industry was founded on trading to the Japanese market and to this day is our biggest and therefore most important customer. Typically the Japanese market takes high quality oaten hay for the beef and dairy market. This market also has historically been viewed as placing a high level of importance on subjective assessments of quality such as smell and colour, although objective analysis is also important to Japanese customers.

- 2011 – 494 903 tonnes

- 2012 – 449 117 tonnes

- 2013 – 512 600 tonnes

- 2014 – 443 619 tonnes to the end of November

Japan is generally regarded as a mature market; very consistent and stable but with limited opportunities for growth. In recent years there have been a number of challenges for Australian exporters in Japan including declining beef and dairy cow numbers and the devaluation of the Japanese Yen.

Korea

Korea has been a good market for Australian hay in recent years that has both grown in value and provided a good alternate market to Japan. This market has a strong focus on the dairy industry and typically takes lower price, mid quality hay.

- 2011 – 125 477 tonnes

- 2012 – 168 371 tonnes

- 2013 – 157 794 tonnes

- 2014 – 160 134 tonnes to the end of November

Taiwan

Taiwan is a mature and well educated market for Australian hay with preference for high quality hay, both oaten and wheaten, with high analysis results. Again the key customer is the dairy industry.

- 2011 – 40 345 tonnes

- 2012 – 37 444 tonnes

- 2013 – 46 228 tonnes

- 2014 – 46 601 tonnes to the end of November

China

Right now we are seeing the emergence of China as an important customer for the Australian export fodder industry. Small volumes of Australian fodder have been exported to China as far back as 1995, however it was not until 2009 that the current market started to evolve. This has led to the current situation where exporters have started focusing on China as a key hay market.

Demand for fodder in China is being driven by growth in the demand for dairy products. In recent years there has been a large increase in the consumption of animal protein by the growing Chinese middle class, which has triggered a growth in domestic dairy production which has more than tripled since 2000. This has seen a large investment in modern dairy farms, many in the 5000-10 000 head capacity range, and they have a strong focus on production and efficiency of scale. These new large dairies are the key customers for imported fodder.

To put the demand for fodder in China in perspective, in 2014 over 600 000 tonnes of Alfalfa was imported from the US. Imports of Australian oaten hay are much more modest but have shown consistent growth in recent years.

- 2011 – 13 836 tonnes

- 2012 – 18 000 tonnes

- 2013 – 46 000 tonnes

- 2014 – 114 000 tonnes to the end of November

Early indications of the 2015 demand for fodder in China point towards continued growth in demand for Australian fodder.

Was this page helpful?

YOUR FEEDBACK