Risk management options

Author: David Smith (ORM Pty Ltd) | Date: 16 Feb 2018

Take home messages

- Peril insurance should be seen as one of a number of ways to manage financial risk in farm businesses.

- Peril insurance has a benefit to management of financial risk in some situations but not all.

- Farm businesses should conduct a thorough assessment of the merits of peril insurance before purchasing policies.

The information in this paper is general in nature and should not be taken as personal professional advice. Readers should seek their own independent advice from a qualified adviser and not rely solely on the general nature of information in this paper.

Introduction

Australia has one of the riskiest environments in the world for farming and hence growers have to manage large crop yield and income fluctuations. Peril insurance is one of a number of tools that growers can use to minimise income and profit fluctuations.

Insurance has been available to grain growers for many years. Traditionally fire and hail insurance are the major perils that have been insured.

In the 1970s peril insurance other than fire and hail was offered to Australian grain growers. This was withdrawn after two years due to lack of uptake by growers.

In the 2000s it was once again reintroduced, and similarly it lasted for only two years before folding.

Within the past few years multi-peril crop insurance (MPCI) products have re-emerged for the Australian grain grower. Time will tell how long they will stay on the scene this time?

Types of peril insurance

Multi peril

Multi peril insurance policies cover:

- Revenue insurance. Where a business insures an agreed amount, usually up to a maximum of 70% of past five year’s average income per hectare. Payouts are triggered by the occurrence of a specified peril and claims are paid on the difference between the farm’s actual income and the insured income level.

- Minimum yield insurance. These policies insure a yield, usually up to a maximum of 70% of your past five year’s average production.

MPCI insures and offers cover against perils that historically have been borne by the grower. These can include, but are not limited to; rainfall (both too much and too little), frost, heat shock, wind damage, insect or pest damage or plant disease.

Peril insurance covers the agreed sum nominated prior to the commencement of the policy. Some policies cover yield at a nominated price whereas others cover a nominated dollar figure per hectare.

Some companies offer policies with premiums in bands, the higher the amount insured the higher the premium. Policies can be offered for decile 1 income (lowest percentile) or up to decile 7, which is 70% of your average production over the past five years. Some policies also allow businesses to self-insure a portion of their risk. For example, a business may feel that they do not need to insure the first 20 or 30% of their five year’s average production and will self-insure this portion. This will lower premiums as the insurance company does not have as much exposure to claims. The self-insured section is usually the lower risk portion of the policy.

If you were seeking an insurance to guarantee an average production year (decile 5), the premium would be far more expensive than a decile 1 production year. Businesses generally seek to cover their direct costs, which are typically around 60% to 80% of income and would be a decile 3 to 4 year. Multi peril policies that cover 70% of income cost around 5% to 15% of the sum insured. These premiums vary on each application and reasons for the variances include geographical location, historical performance, seasonal outlook, variability of past performance and level of cover being sought. Companies are reluctant to provide general information regarding their policies as premiums are struck on an individual request and depend on the information provided within the application.

One of the difficulties for companies offering multi peril insurance is that growers are insuring a product that can be influenced by ‘best practice’. This is subjective and not a straight ‘act of god’ such as fire or hail. Establishing the policy criteria is more difficult for the insurer and in some instances open to interpretation by the grower.

Single peril

Single peril insurance typically covers temperature (either frost or heat), rain, fire and/or hail.

Single peril insurance is also called Index Insurance, Weather Certificates or Parametric Insurance. Single peril insurance typically only covers an amount in total dollars. Parameters can be straight rainfall — gamble on xx millimetres of rainfall in xxx month, or they can be insuring against the event of high or low temperatures. Single peril insurance products are relatively simple and claims do not need an on-farm assessment. There is less paper work to fill out and policies can be written up until 20 days prior to the commencement of the insured period. Policies generally use Bureau of Meteorology (BoM) records and insurance can be obtained for a nominated grid reference and do not need to be tied to a BOM weather site. Bureau of Meteorology (BOM) records then indicate that the criteria are achieved/not achieved then the payment is usually made within 20 days after the insured event occurs.

Some insurance companies offer policies that insure against the ‘odds’ of greater than xxx millimetres of rainfall in August, September, October, etc. but this option is not offered by all companies.

Examples of the role insurance can play

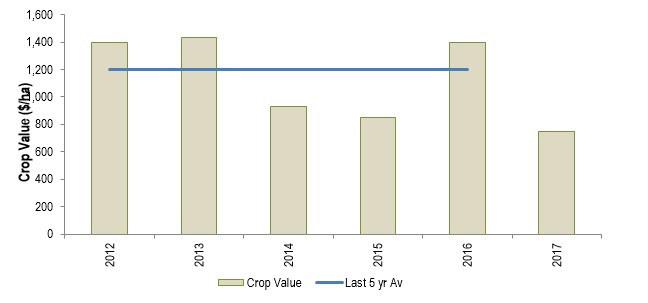

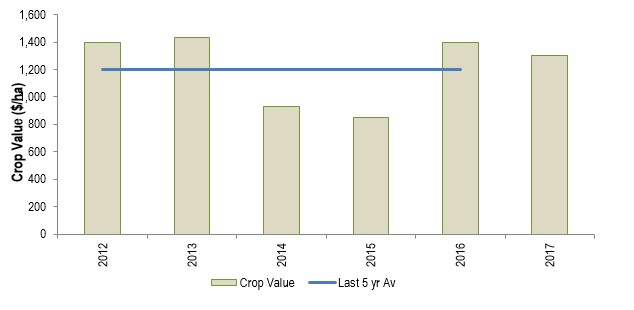

Figure 1 indicates the $/crop ha income for a model local south west (SW) Victorian farm (‘model farm’). A farm with approximately 45% canola and 45% wheat and 10% other (hay, barley, oats) has been modelled by ORM. In 2017 frost severely affected many wheat crops in the region. Figure 1. shows the past five year’s crop returns and 2017 with frost effect. Figure 2 is the same farm without the impact of frost reducing wheat yields. Income per hectare changed from $1,300/ha to $750/ha as a result of the frost and its effect on wheat yields (down from 6t/ha to 1t/ha). Canola was not affected by the 2017 frost.

Figure 1. Crop value ($/ha) for SW Victorian farm from 2012 – 2017 (with 2017 severely affected by a frost event).

Figure 2: Crop value ($/ha) for SW Victorian ‘model’ farm from 2012 – 2017 (without 2017 affected by frost).

What would be the impact of taking insurance to alleviate the frost effect on income?

The model farm has a previous five year average income of $1,200/ha.

ORM Pty Ltd and AgProfit benchmark data indicates the following crop costs for SW Victorian farms (Table 1).

Table 1. Costs associated with growing crops for SW Victorian farms.

Cost | $/crop ha |

|---|---|

Overheads | 100 |

Farm input costs | 330 |

Machinery operating costs | 240 |

Labour | 170 |

Total | 840 |

In order to cover the costs associated with growing the crops in the model farm, the business would need to insure to receive $840/ha. Note some labour cost listed within Table 1 is family labour which does not impact on cash flow.

If the business had taken multi-peril revenue insurance they could have insured to receive 70% of their five year’s average income of $1200/ha which equates to $840/ha. Assuming they insured for the $840/ha, during 2017 with the frost, they would have received a payment of $90/ha (sum insured of $840/ha minus 2017 crop income of $750/ha) using MPCI revenue insurance.

Assuming a crop area of 2,000 ha annually, and premiums are between 5% and 15% of the insured value ($840/ha) or $42/ha to $126/ha, respectively.

Over the five years of data collected the model farm would have paid premiums of between $420,000 (@5%) and $1,260,000 (@15%) and would have received payout of $180,000 for the 2017 frost event.

If the business had taken out single peril frost insurance to protect against a frost event of the temperature falling below zero degrees the policy would have been triggered in 2017. If it is assumed that the business had taken out sufficient insurance to cover the input costs listed in Table 1 we would need cover of $840 per hectare for 2,000 hectares or $1,680,000 to cover costs which equates to a premium of $84,000 (@5%) and $336,000 (@15%).

Frost insurance is not tied to production and hence a business can take as much cover as they wish. Indicative premiums to payout if the temperature falls below zero degrees between October 15 and November 5 in Lake Bolac are approximately 10% of the sum insured.

The role of peril insurance — where it fits

Multi peril insurance is one of the many tools a farm business can utilise to help manage financial risk.

If a business is consistently struggling to generate profits due to high cost structures or poor production compared to district averages, adding an additional cost of MPCI premiums may not help increase profitability. In comparison, if profits are made in some years, but are highly variable due to climatic or disease occurrences, MPCI could assist to reduce income and profit variability.

Other ways to spread risk are as follows:

- Livestock

- Livestock typically make up a smaller percentage of total farm income but a larger part of profits due to lower associated costs. Stock can be locked up and fattened if paddock feed and conditions are not available.

- Time of sowing and crop type mix

- Growers who spread their risk, sow a variety of crops at a variety of times.

- Hay

- By growing hay, growers are reducing their reliance on spring rainfall.

- Hay is a safer option if concerned about the impact of frost.

- Financial buffers, such as off farm investments are an example of spreading risk. These can include:

- Equity in land.

- Farm management deposits (FMDs).

- Cash reserves.

- Shares.

Briefly, FMDs have taxation advantages. An individual pays a marginal rate of tax as determined by the taxable profit in the financial year when the FMD is withdrawn. No tax is paid in the year of the deposit, businesses may be able to offset FMDs against loans.

Shares are liquid and can be converted to cash very quickly.

All of the financial buffers listed can be utilised to supplement income in poorer years.

In order to have a financial buffer a business needs to be able to generate profits that can be put away for a ‘rainy day’. The funds are not utilised until a poor season, during which they are used to fund annual inputs.

Financial buffers should ideally be large enough so that they can pay a farm’s operating costs for one season. The down side of a large financial buffer is that businesses need to also have that side of their business making a good return when it is not being used for farm costs.

Conclusion

Peril insurance should not be seen as the only way to manage financial risk in farm businesses. It is one of the many tools available to growers along with general good financial and production management practices. Peril insurance has a benefit in some situations but not all and farm businesses should conduct a thorough assessment of the merits of multi peril insurance for their own personal and business circumstances before purchasing policies.

Useful resources:

Multi peril insurance can take the stress from risk

Contact details

David Smith

david.smith@orm.com.au

Was this page helpful?

YOUR FEEDBACK