The future of the grains industry — a shared responsibility

Author: Rohan Rainbow (Crop Protection Australia). | Date: 13 Feb 2018

Take home messages

- The global landscape for acceptable chemical use and residues is an increasing challenge which requires planning by industry, government and the commercial sector to meet future industry needs.

- The Australian grains industry will need to consider adoption of more sophisticated chemical stewardship programs to increase access to crop protection technologies and meet market demands.

- Increased investment in crop protection technologies and foundations to drive this investment are required to ensure Australian producers have access to the best available technologies to remain internationally competitive.

Background

Plant and animal industries are facing substantial emerging biosecurity threats and impact from pesticide resistance. Australia is no longer on the global priority for pesticide and veterinary medicine commercialisation as it was 20 years ago. To address Australian needs, increased incentive for investment has been required, such as the joint herbicide discovery investment collaboration between Grains Research & Development Corporation (GRDC) and with Bayer.

Agricultural industries in Australia, including grains, are currently missing out on more than 50% of the potential new crop protection product registrations which key competitors in Europe and the USA have access to. This increases to more than 80% when considering the number of grain crops with registered use. Australia strategically requires access to new and safer pesticides, but is experiencing increasing market failure of investment. It is missing out from productivity improvements through commercial investment in a large number of potential emerging biological, biochemical and biotechnology based AgVet technologies. Australia is also experiencing the consequence of the ‘double whammy’ of a smaller pesticide pool and consequential selection pressure leading to accelerated pesticide resistance. A small pool of crop protection products is one of the reasons Australia is a ‘world leader in pesticide resistance development’.

Major factors resulting in declining investment in Australia include:

- Australia is a small AgVet market in a global context, representing less than 1.5% of the world market.

- Australia is experiencing difficulties with complex AgVet regulations, timeliness and costs relative to commercial return on investment.

- Global multinational companies face a poor rate of return on commercialisation investments in Australia compared with major developing markets including Brazil and China.

There is clearly increasing market failure for investment in AgVet technologies in Australia. Market failure in crop protection solutions in Australian agriculture, including grains, is now expanding well beyond the previously well-defined market failure areas of minor use and specialty crop programs.

Based on the experience of minor use programs in North America where there have been similar issues, there is clearly an opportunity to deliver on these outcomes through a collaborative approach. Market failure in AgVet investment in minor use, which is often described as speciality crop programs, is not unique to Australia. There has been declining global investment in minor use, particularly since the global financial crisis began in 2002. Government supported minor use investment programs in North America have been expanded, such as the United States (US) Interregional Research Project #4 (IR-4 Project) and the Canadian Agriculture and Agri-Food Canada Minor Use Program (CAN-MUP). The IR-4 Project has been substantially expanded with formal collaboration with Canada and Mexico under the North American Free Trade Agreement (NAFTA).

More recently, collaborations with the IR-4 Project have been established with Brazil and Costa Rica. The IR-4 Project has provided the necessary field and residue data to account for approximately 20% to 25% of all submissions made to the US Energy Protection Authority (EPA) for new uses and account for approximately 50% of all new tolerances that are established. More than 80% of the IR-4 Project is focused on new chemical actives or biological. Investment in commercialisation of biological crop protection technologies in Australia has been very low. Regulatory restriction for importation of successful commercialised biological products from overseas into Australia has also resulted in a very expensive commercialisation pathway, most of which will not come to Australia unless there is additional investment incentive.

Improved prioritisation of needs, identification of benefits of co-investment by industry, government and commercial registrants and establishment of investment incentive frameworks to support these programs have had a substantial impact in delivering benefits to industry and the community. The establishment of the AgVet Collaborative Forum has been a great start in delivering these benefits in Australia, however investment in this program is not ongoing and no future plans have been announced. There is much more to be done to ensure Australian grain growers have access to the technologies that international competitors have access to.

Current global regulatory situation

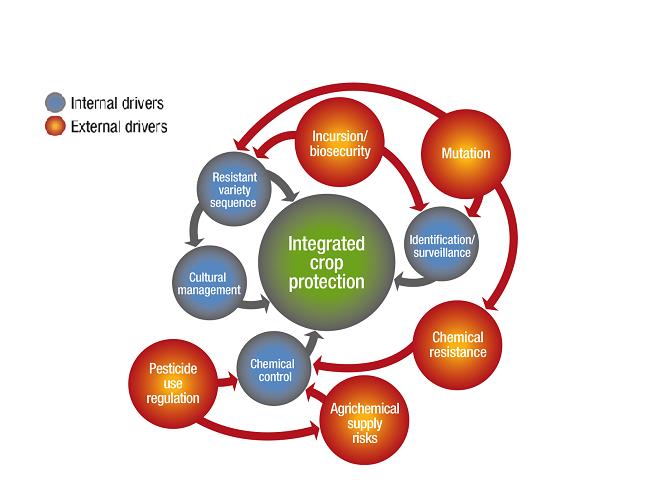

The substantial cost of commercial development of new crop protection products has resulted in a tightening of investment by companies. Australian weed, pest and disease issues are rarely specifically on the radar for global pesticide development. Combined with the constant threat of biosecurity incursions and pest mutation, this ‘global crop protection storm’ and management options are demonstrated in Figure 1.

Figure 1. Key external and internal crop protection drivers.

The impact of chemical regulation changes by some countries, global reviews and new scientific knowledge on toxicology have led to a substantial increase in regulatory cost to maintain the use of many current agricultural chemicals. The cost of companies responding to these reviews is often commercially prohibitive and has in many cases resulted in the loss of a number of chemical registrations across the globe due to the regulatory review cost burden and generation of new data for older out of patent chemistry, not necessarily due to any specific safety issues.

Grain growers, through their GRDC levies, are not in a position to fund the substantial future avalanche of cost of data generation required to support the retention of a diminishing number of older chemistries. This cost must be met at both a national and international level. Judicious discussion is required within industry to determine each situation on a case-by-case basis, particularly so as not to create market failure where commercial support may still exist to meet these costs.

While there is a major focus on international harmonisation of regulatory standards for food and feed safety requirements and trade through consistent maximum residue limits (MRLs), there appears to be an increasing divergence by some countries in their approach to regulatory assessment, particularly the European Union (EU), and a number of Asian countries including South Korea.

Issues for Australian agricultural industry include:

- Community sentiment from pesticide withdrawal overseas.

- Continued occurrence of adverse pesticide events.

- Continued occurrence of National Residue Survey (NRS) residue breaches.

- Pesticide reviews now have defined timeframes and cut-offs for response.

- Long term trade and MRL concerns — Codex Alimentarius Commission (CODEX) support.

- Potential market failure of generic pesticide regulation support.

- Australia’s pesticide priorities rank low on a global scale.

- Demonstration of pesticide best practice and stewardship.

European Union

- Shifted from risk-based to hazard-based assessment.

- Directive 91/414/EEC had a big impact on the number of pesticides available in the EU. This directive set out to review all registered chemicals over 10 years with harmonisation of EU technical evaluation standards, however only 30 evaluations were completed in that period.

- Resulted in a reduction from 945 active substances in 1999 to 336 in 2009 (including new pesticides) — a 64% reduction.

- The majority were mainly eliminated because data packages were either not submitted, some were withdrawn or the pesticide failed the review on issues relating to human health or the environment.

- In January 2009, the European Parliament voted for a regulation to replace Directive 91/414/EEC with 1107/2009. Among the changes, new hazard based ‘cut-off’ criteria will be introduced and active ingredients (AIs) will lose approval if they:

- Cause DNA mutations (mutagenic).

- Cause cancers (carcinogenic).

- Disrupt endocrines or are toxic for reproduction.

- Are a persistent organic pollutant.

- Are persistent, bioaccumulating and toxic or are ‘very persistent and very bioaccumulating’.

- Further reduction in EU Annex 1 registrations — a further 70-plus pesticides are expected to be withdrawn based on EU Hazard assessments.

- Further issues with product imports into the EU expected with MRLs for all products withdrawn from Annex 1 reduced to ‘below detectable limits’ or 0.01mg/kg.

- There will be substantial issues for stewardship and pesticide use on vendor declaration for products to the EU.

- A number of currently approved EU Annex 1 DMI triazole fungicides are now due for de-registration. The new EU regulations include a provision that an AI shall only be approved if ‘it is not considered to have endocrine disrupting properties that may cause adverse effects in humans [or] on non-target organisms’.

- There have been notable flow-on effects from EU regulation decisions to other markets including a number of Asian countries, particularly assessments for sensitivity to bee health.

- Two new legislative packages for endocrine disrupting chemicals have been adopted by the EU Commission presented on 15 June 2016; the Biocidal Products Legislation, the other under the Plant Protection Products Legislation which sets the criteria to identify endocrine disruptors. This includes a new approach to MRL compliance and will result in a key period of change to EU chemical regulation. New criteria for assessments became effective from November 2017. These will likely impact on Australian exports to the EU that has residues of many chemicals including simazine, tebuconazole and particularly organophosphate (OP) insecticides.

- Import tolerances and MRLs may be an issue for Australian imports. There will be no differentiation on domestic and import MRLs, based on the limit of detection (0.01mg/kg). Should an MRL not be available, importers can apply for a determination, however chemicals that have been determined an endocrine disruptor will not be allowed an assessment.

- Glyphosate regulation in the EU has unfortunately become politicised and not necessarily just based on science based assessment. In early 2016, the EU Commission proposed to the Member States to renew the approval of glyphosate, but there was insufficient support either in favour or against the proposal. Given the diverging opinions between the International Agency for Research on Cancer (IARC, an agency of the World Health Organization) and EFSA on the potential carcinogenicity of glyphosate, it was considered appropriate to ask the European Chemicals Agency (ECHA) to assess the hazard properties of the substance before taking a decision on its potential renewal at EU level. On 29 June 2016, the EU Commission called for a vote on the renewal proposal, but no majority of Member States either supported or opposed the renewal. The Commission then adopted an extension of the approval of glyphosate for a limited period to allow the ECHA to conduct its assessment of the potential carcinogenicity of glyphosate. This extension was limited to six months, expiring on 15 December 2017. A decision by the appeals committee of EU government based on an EU Commission proposal to extend the glyphosate registration for a further five years is still outstanding. Only 18 member states voted in favour with a majority of 65.71%, just over the 65% threshold required for approval. Germany swung the decision having abstained from previous votes; however since then it has indicated that this decision may be retracted with a national ban on use.

- It should also be noted that Member States also voted in favour of amending the conditions of the existing approval of glyphosate in July 2016, adding further restrictions to ensure the highest safety standards for humans and the environment. The Commission's decision established three conditions for further use of glyphosate in the Member States, as the actual decisions concerning the authorisation of plant protection products containing approved substances for use in their territories are the responsibility of Member States:

- Ban a co-formulant called POE-tallowamine from glyphosate-based products.

- Minimise the use in public spaces, such as parks, public playgrounds and gardens.

- Scrutinise the pre-harvest use of glyphosate.

South Korea

- Codex MRLs will no longer be accepted upon full implementation of the South Korea positive list pesticide labeling system.

- Codex and provisional canola MRLs to be deleted 31/12/2016. It was previously indicated that 23 MRLs would be deleted.

- New pesticide MRLs, approximately AUD$35,000 for a toxicology assessment and approximately AUD$6,000 for a residue assessment — assessment period of 12 months.

- The use of late season fungicides and insecticides is likely to be an issue for this market. Dimethoate and omethoate MRLs have been reduced to trace levels as per the expectation. A key concern has been the impact on the main fungicide used in canola — ProsaroTM (prothioconazole and tebuconazole). There are also likely to be concerns with haloxyfop based on NRS results.

- Suitable glyphosate import tolerance MRLs are in place for canola and barley.

USA

- The US EPA has issued orders for an Endocrine Disruptor Screening Program (EDSP).

- Includes fungicides propiconazole, tebuconazole and triadimefon for Tier-1 screening in the EDSP.

- The US EPA states that a variety of chemicals were found to disrupt the endocrine systems of animals in laboratory studies and compelling evidence shows that endocrine systems of certain fish and wildlife have been affected by chemical contaminants, resulting in developmental and reproductive problems.

- EPA has now expanded the EDSP to include male hormones (androgens) and the thyroid system, and to include effects on fish and wildlife.

- Spray drift regulation is increasing in the USA. Arkansas and Minnesota have prohibited summertime sprayings of dicamba-based herbicides to prevent a repeat of damage seen across the US farm belt. Missouri and North Dakota are also likely to follow suit.

Agricultural chemical reviews impacting grains

- CODEX Phosphine review 2021 – There are major gaps in current data packages to support the ongoing use of this chemical group, including aluminium phosphide.

- Detailed scoping of reviews for dithiocarbamates, cyanazine, simazine and metal phosphides for use in grain treatment including aluminium phosphide to commence in 2017.

- Review priority for chlorothalonil, triazole fungicides and amitrole to be revaluated by December 2017.

- Paraquat review is ongoing. While this review was to be finalised in January 2018, a revised finalisation date is currently under review.

- Australian Pesticides and Veterinary Medicines Authority (APVMA) 2,4-D review will be finalised in 2018.

- APVMA spray drift review, which has been significantly delayed, will be finalised in 2018. The outcomes of this review need to be finalised before the 2,4-D review.

- Detailed scoping.

Case studies

Late season glyphosate use in barley

- Herbicide resistance is driving practice change at an unprecedented level — weeds cost more than $3.27 billion to the Australian grains industry (Llewellyn et al., 2016).

- Pre-harvest glyphosate registered for crop topping in Australia and overseas on various pulses, canola, wheat and sorghum has proved very effective in improving in-crop weed control for industry.

- Pre-harvest glyphosate use in barley is registered in EU and North America (this includes malt and feed barley in the UK and feed barley in Canada).

- A key issue for Australian growers is having access to the same tools as overseas competitors.

- APVMA approved a permit application submitted by Grain Producers Australia (GPA) in November 2016 for late season glyphosate use in feed barley APVMA permit application.

- Chemical residue data from trials and label registration from Australia and overseas demonstrates food safety and market MRL compliance with CODEX/Food Standards Australia New Zealand (FSANZ).

- NRS data indicates to-date all exports have a detectable glyphosate residue of zero or well below the Australian MRL of 10mg/kg.

- A loss of a glyphosate permit/registration and associated MRL in barley would have devastating effects on saleability of barley grain and malt with immediate ramifications on stocks held by industry and grain traders.

- This issue highlighted the value of the NRS and the importance of whole of industry discussion on finding a resolution.

- There is an industry responsibility to demonstrate stewardship and meeting specific market requirement compliance through vendor declarations and segregation.

- There is ongoing work to secure a registration for glyphosate use in barley.

Managing fungicide amended fertiliser transport risk

- There is a need to improve management of back loading of grain trucks with fungicide amended fertiliser, particularly product treated with flutriafol.

- Grain Trade Australia (GTA) conducted a truck cleaning project for industry.

- It should be noted that concern with current NRS detection of flutriafol in canola has been attributed to grain carried in trucks where prior cargoes were fungicide treated fertiliser.

- The grains industry has been proactive in highlighting this issue to growers and to the transport industry operators through a project led through GTA supported by funding from the Australian Government Department of Agriculture and Water Resources under the Package Assisting Small Exporters.

- Trial work is completed and a report has been finalised.

- Findings and outcomes of this report including draft procedures developed for cleaning trucks that have previously carried fertiliser (specifically focused on addressing the flutriafol fertiliser residue issue).

- These procedures are currently being developed into a revised Australian Grains Industry – Grain Transport Code of Practice.

Omethoate and dimethoate review impacts

- Omethoate is registered in very few other major exporting countries except Australia.

- Omethoate is a metabolite of the chemical dimethoate, which has also been an effective and cheap pest control tool for producers for many years.

- Key issue is that the global science has moved further on the OP chemistry group and the toxicology reviews.

- An international science and chemical review, however, has resulted in substantial regulatory challenges for continued use and future market access of food products where these OP products are used.

- There are industry concerns about the market access consequences of international reviews currently close to finalisation.

- Even if there is still a registered use in Australia, international market acceptance of product will be an issue for many grains, horticulture and meat industries.

- While there have been no detections of omethoate and dimethoate in the grains industry funded NRS, capacity for residue detection due to improving analysis technologies remains a challenge for the industry.

- GPA submissions to the APVMA dimethoate review sought consideration of industry stewardship facilitated by GPA and take into consideration that there have been no detections above the level of detection of omethoate (0.01mg/kg) in the grains industry funded NRS.

- The APVMA review recommended a phase out period of two years for late season uses and for seed treatments could be implemented as an extension to the existing permit 13155.

- Industry stewardship and the NRS results have led to support of a two year phase out period - not permanent retention on labels. The lack of late season control options still remains.

- Dimethoate registration for red-legged earth mite and lucerne flea has been retained in oilseeds and pastures, only for crop emergence and pre-emergence stages.

- The APVMA noted that new data was submitted in support of a registration application and is not available to this reconsideration. There is no objection to it being used in a new registration application.

- Red-legged earth mite and bryobia mite are a pest mainly to Australia, resulting in a limited number of chemical registrations.

- Limited commercial interest in new products is due to the dominance and competitive price of these older OP products in the market place.

- Australia only has access to a fraction of the miticide chemicals currently available to competitor producers in North America, such as cyflumetofen, fenproximate, acequinocyl, spiromesifen, plus new miticide products registered in limited crops including milbemectin (strawberries only) and etoxazole (cotton only).

Value of the NRS

In addition to providing confidence in food and feed safety and the integrity of Australian grain products to international markets, the NRS has provided useful insight for industry management of residue issues where they arise and also to give support and confidence to regulatory decisions. The decision by the APVMA for a 12 month phase out of omethoate use in crops and pasture has been determined using the supporting NRS data. The NRS data has also been important in supporting the application for permitted late season glyphosate use in feed barley.

Discussion

The key challenge is to increase global AgVet chemical investment to address Australian agricultural industry needs. Clearly, international minor use investment incentive programs have competed with Australian needs, but in addition to this, incentive reforms such as reduced data requirements, increased data protection, conditional registration programs and direct investment in minor use have successfully increased investment in North American crop protection technologies. If Australia is to remain globally competitive, Australian industries, government and the commercial sector will have to determine if they want to press the button to hook into these international collaborative investment programs.

This situation is further highlighted when new chemical registrations are compared between Australia and other international jurisdictions (Table 1). While the number of new AgVet chemicals being registered in Australia is comparable with other markets, the actual number of crops being placed on those labels is not. This is a direct consequence of the relatively small size of the Australian market.

Table 1. Comparison of recent agricultural chemical registrations in Australia, Canada and the USA (2008 to 2012).

Australia | United States | Canada | ||||

|---|---|---|---|---|---|---|

Chemical Type | No. of new chemicals | Av. No. of crops per label | No. of new chemicals | Av. No. of crops per label | No. of new chemicals | Av. No. of crops per label |

Fungicides | 10 | 7 | 9 | 32 | 7 | 21 |

Herbicides | 8 | 2 | 7 | 11 | 5 | 11 |

Insecticides | 7 | 9 | 6 | 25 | 4 | 30 |

Plant Growth Regulators | 1 | 1 | 0 | 0 | 0 | 0 |

Total | 26 | 19 | 25 | 68 | 17 | 62 |

Source: Table prepared by Kevin Bodnaruk GPA response to DAFF first principles of cost recovery.

Compounding this problem is that there are rapidly emerging pesticide resistance issues in the grains industry for which there are few alternatives except for a number of new products that have been registered in horticulture. This has resulted in the need for a number of minor use and emergency use permits. It is from these types of situations that a substantial portion of permit needs arise as successful pest management is an integral part of improving industry productivity to meet consumer demands.

The omethoate and dimethoate case study highlights the need for new chemical actives and investment in Australia. Late season control of mites and other pests in crops and pastures is a gap where industry access to new chemical products will be very important going forward. The key issue for Australia is the lack of new miticide modes of action (MOA) and the lack of investment in new, safer actives with different MOAs for resistance management.

The key issue for Australian producers is commercial investment in new technologies. For example, USA and Canada have additional miticide MOA Australia does not yet have registered. Due to the broader trade risk issue, the only viable industry solution is to fast track registrations of new chemical actives as direct replacements for late season application and demonstrate industry stewardship to maintain omethoate for border and bare earth applications.

There is a need to increase multinational confidence for investment into Australia and also increase Australia’s ranking on investment priority compared with competing investment opportunity in Asia and South America. To address investment in the longer term, there is a need for cross-agricultural industry discussion with government and commercial chemical companies on options to increase this confidence. Through industry consultation to date, the identified outcomes for community and industry that need to be achieved include:

- Increased national and foreign investment in Australia.

- Increased agricultural profitability and sustainability.

- Increased delivery of a diverse range of foods to a multicultural community.

- Increase productivity and scale of industries contributing to Gross Domestic Product (GDP) and balance of trade.

- Improving safety to community, environment and trade.

It will be important for the Australian grains industry to manage and demonstrate the stewardship of omethoate and dimethoate in grain production, glyphosate in feed barley and decontamination of flutriafol in grain transport and ensure only registered chemical products are used to make certain market access can be maintained. Use of unregistered chemical products, particularly late season will make grain unfit for consumption and trade, putting Australian markets and brand reputation at risk. It will be an industry responsibility to manage the sustainable use of these chemical tools to manage both market and resistance risks going forward to ensure the industry still has access to these chemical products. Producers should have a farm business stewardship plan. The GPA Grains Guide and CropLife Australia’s MyAgCHEMuse are useful.

Conclusion

The global landscape indicates that it will be difficult to maintain market access with the use of a number of currently registered chemical products. While sovereignty in each country allows for unique chemical regulations, it will be important for Australia as a food-exporting nation to be pro-active in responding to international trade reviews and continued support for recognition of CODEX MRLs. Industry discussion is required on how to best demonstrate chemical stewardship to meet market requirements, including the use of more sophisticated stewardship and quality assurance programs for specific markets. The Accelerating Precision to Decision Agriculture – P2D project has highlighted that improved data management for crop protection and biosecurity is potentially worth $1 billion to Australian agriculture. This does not include the flow on value from trade and market access. Implementation of data systems to efficiently capture chemical use, provenance and other information will increase in market demand. How this is approached, including integration with block chain systems, is a shared responsibility for the grains industry. The long-term solution is to ensure Australian producers have access to all the crop protection tools that our international competitors have access to. Incentives to drive commercial investment in these new crop protection products will be critical for the small Australian market.

References

Llewellyn RS, Ronning D, Ouzman J, Walker S, Mayfield A and Clarke M (2016) Impact of Weeds on Australian Grain Production: the cost of weeds to Australian grain growers and the adoption of weed management and tillage practices. Report for GRDC. CSIRO, Australia.

Useful resources

CropLife Australia MyAgCHEMuse

Grain Producers Australia - Growing Australian Grain - Grains Guide

GRDC Pre-harvest Herbicide Use fact sheet

GRDC Grain marketing and pesticide residues fact sheet

Contact details

Rohan Rainbow

Crop Protection Australia

PO Box 325 Deakin West ACT 2600

02 6282 2226; 0418 422 482

r.rainbow@cropprotectionaustralia.com

www.cropprotectionaustralia.com

@cropprotectaus

Was this page helpful?

YOUR FEEDBACK