Decisions in a tough year

Author: Eric Nankivell (Farmanco) | Date: 20 Mar 2018

Take home messages

- Not everyone is in the same position.

- Processes: four step tight budget process.

- Strategies: rotation, fertiliser, machinery.

- Land values: opportunity or threat?

Overview

Thankyou to GRDC for providing the opportunity to present at the Condobolin GRDC Farm Business Update. Hopefully we can generate some challenges and discussion that will help clarify and inform some of the decisions you are making moving into seeding 2018.

We all think that we received 20mm of rainfall. Make no mistake, there was only 15mm in ‘Windmill’ paddock and more than 30mm at ‘Grandads’! It is important to recognise that it is the same with all farming businesses. While from the outside, they all appear the same, there are always significant differences.

This is no more evident than in this community. Many of you had your best ever year in 2016 with record yields, followed by one of your worst in 2017. But spare a thought for those on the river who had their worst year in 2016 because it was too wet and a consecutive poor year this year.

Mix with this, the differences in stage of life, attitudes to risk, opportunities taken to expand, etc and you have a wide range of business strengths, concerns and attitudes. Hence today, my focus is on the key things that most people are trying to make decisions on – some of this might be directly relevant to you in your business, but some of it might just not be a big priority.

Just how bad was it?

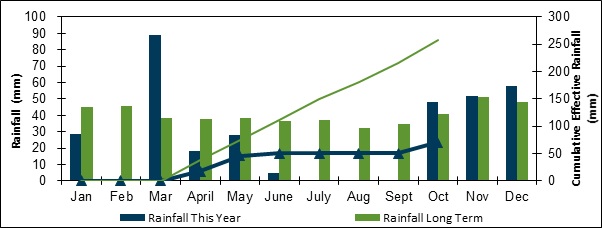

Figure 1 illustrates the rainfall during 2017 for an example farm in this area and that of the long term average.

Figure 1. Rainfall during 2017 for an example farm in this area and the farm’s long term average.

Yes, this is correct. For this farming business, there was no rainfall recorded in July, August or September.

The great start to the season enabled most businesses to commit fully to their cropping programmes with a good measure of confidence. This confidence was still looking rewarded, despite dry winter conditions – up until the frosts (1 July (-6.8°C), 2 July (-5.5°C), 12 July (-4.0°C), 22 July (-5.1°C), 29 July (-4.1°C), 20 August (-4.5°C), 29 August (-5.3°C) and 1 September (-3.9°C).

Despite this, no matter how bad things are there are always ways you can have a positive impact on your business. Undertake a formal review, know where you stand and decide your course of action. The greatest risk you have is in shutting down and not being able to move forward. If you feel like you are in this position seek some counselling advice to help you focus on the task at hand.

Strategies for tight budgets

I often use this simple process to help clarify the possibilities when it comes to tight budgets. The key things you can do are:

- Increase income

- Reduce expenses

- Bring forward income

- Delay payment of expenses.

Sounds obvious? If you start with a brain-storming session around each of these items, you can manipulate cashflow overdraft expectations by as much as 50%. I have one very focussed client in a difficult position, who reduced the business’s overdraft requirement by 100% starting with this process.

You discover that you can do things like defer payment of chemicals and fertiliser on terms. You can get an advance on grain sales if you are prepared to commit to a particular buyer. You can get a wool-advance six months before you require it. You can bring forward sheep or even wool sales. The important thing to realise is that there are many opportunities here.

It is however, important to recognise that there are nearly always costs associated with making these decisions. Taking an earlier wool advance comes at a higher cost than bank interest. However, sometimes the penalty is minimal or there is no penalty at all so it is worth investigating.

Once you have a list of the possibilities, you can rank them according to which ones are the last ones you might consider. For example, selling an item of machinery or selling the breeding ewes.

Operating cost caution

Don’t cut costs aggressively without looking at the big picture. The aim is not to reduce income. We have all seen people go extreme and cut right back in the wrong areas and this often starts a spiral of continued poor performance.

Operating costs: wages, fuel, repairs, fertiliser, chemicals, any direct enterprise costs including levies and royalties, seed, shearing, selling costs, etc.

The operating cost : income ratio is the measure of the skill of farming. It is about getting the most income for the least expense.

Be sure when you are reviewing expenditure that you assess the likely impact on yield and price of each option.

The benchmark average for the operating cost : income ratio is 58% for our medium rainfall clients. The Top 25% is 53%.

Rotational choices

I suspect that rotational choices is the area that most of you have spent your time on.

Rotational choices are often choices between short-term and long-term profit.

If you are in a very tight cashflow position you will need to sacrifice some enterprises that have the risk of sending your business over the edge in the short-term through poor performance.

You may have to cut back on legumes in favour of cereals. This might not be an easy choice but it may be a necessary one. Work out what the differences might be in profitability and make a rational short-term choice if you need to.

Some of the choices will be based on emotion and fear. The pain of such poor performance on canola last year has seen the canola area significantly reduced in favour of barley which had a reasonably good year given its slightly better frost tolerance over wheat. Look at your five-year average and be sure that you are not making a poor decision by reducing canola in the rotation too much. You still have to make a judgement on the risk – 2018 might be as bad as 2017.

Likely the strength of your overall business will be a factor in going against the trend for canola and barley. You might just not have the choice.

Be careful about swapping crop for increased pasture. There might be some good opportunities to reduce the area of crop on riskier soil types but if you are going to reduce crop and increase pasture, ensure that you have targeted your stocking rate on that pasture appropriately. Otherwise, you will not produce much more sheep income but this enterprise will be carrying more of the fixed overhead costs of the business. The end result could be worse, so just follow through and make sure it makes sense.

Consider the rotational weed aspects of your decisions with your agronomist. Make sure that you are making a sound rotational choice with the least compromises and then executing the choice appropriately to manage the rotational options for the following year– bearing in mind you might have to be pragmatic.

Fertiliser

Fertiliser is the largest variable cost for most farm businesses. Thinking through your fertiliser strategy can provide you with opportunities to improve yield with lower inputs.

The most obvious example of this is on farms with soil types where:

- Colwell P is > 30

- Phosphorus buffering index (PBI) <100

- pH > 4.7 and

- not a Red Ferrosol Soil.

On this type of soil (i.e. Colwell P > 30, PBI <100 and pH >4.7) which is quite typical through NSW, you can target replacement-only rates of phosphorus (P) on cereals, i.e. one tonne of wheat removes three units of P. If your average yield is for example; 2.3t/ha, then 2.3 * 3 = 6.9 units of P. To achieve this you only need apply 6.9/22 (units of P in monoammonium phosphate (MAP)), which is equivalent to 31kg of MAP. Sounds low if you are using 60kg but it is adequate to maintain P levels.

Radio isotope work shows that only 20% of the MAP you apply ends up in the plant. Eighty per cent comes from the soil reserve, so even if you don’t get it quite right, the actual impact of what you are applying is minimal. So, have confidence in going down this track. Speak to your agronomist and put in some test strips of double rate/half rate alongside and see if the difference shows up on a yield monitor, just to prove to yourself that this strategy is working for you.

Be aware that this is not a strategy for Red Ferrosol soils. These may have very high rates of P in soil tests, but this may still be unavailable to the plant. Most of you will be aware if you have any of these types of soils as they are generally well identified.

Improving pH also improves the availability of P. If you are cutting back P rates, this may free up some money for lime that will have a longer term positive impact on overall productivity. In some cases, this saving on P could give you the freedom to chase the season with nitrogen (N) if it looks like it is going to be a good year.

Machinery replacement

You need to develop some of your own rules of thumb with machinery replacement to help keep you focussed on a realistic replacement strategy.

My rules of thumb:

- 10% of your total plant value is the maximum level of repayments or expense per year.

- 8.5% client benchmark average to gross income ($2M income = $170k per annum).

- Maximum 30% of profit in a good year to play ‘catch-up’.

- Prioritise according to productivity gain:

- Better establishment

- Spraying timeliness

- Harvest efficiency.

The cheapest depreciation on a machine is often the period after it has been paid off!

However, reliability and productivity are the biggest drivers of your business so if you can make a significant improvement to either of these, further investment is necessary. Maybe you can’t do it all this year or maybe you can’t do any of it this year? If you can’t do any upgrading, then use your best asset – your timeliness to be right on the money, even if it requires additional seasonal labour.

You don’t want to be the grower with the oldest machinery who is last to finish everything. But you don’t need to be the grower with the newest machinery finishing first and not being profitable. As with most things in life, somewhere down the middle is likely the most rewarding.

Land values

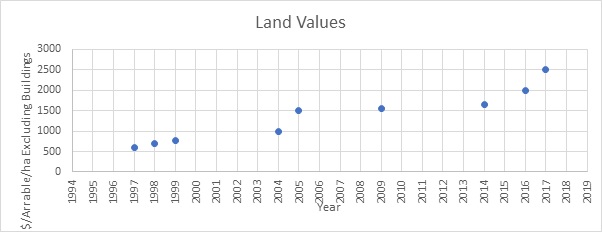

Figure 2. An example set of land values for the last 20 years.

We did this exercise the other day with clients. Very simply, we looked at all the sales within a 20km radius over the past 20 years to see if it could help give us perspective.

Similar amalgamated data comes from Rural Bank each year, but often it is better just to sit down and record your own info in your own area.

Figure 2 shows that land values in this locality jumped 50% in 2004/2005 which is very similar to the jump in other areas at the current time. However, be aware that there is a whole decade here where the land growth component was virtually zero.

The current rise in land values might bring on good properties that would not normally come onto the market, and this might present an opportunity for your business.

If you are not able to expand, then sit back and relax. You get all the benefits of rising land value without having to do anything!

Beware: expansion at the current time needs to be considered cautiously. Has the profitability of agriculture fundamentally improved in the cropping region? Was your bank asking you to reduce debt two years ago, but now seem keen to lend you more money to expand? Really sit down and pull apart the profitability of a potential expansion as historically businesses have got into trouble buying during a rural property bubble.

If you are expanding in the medium rainfall zone. Set your target equity after expansion at 75%. Be prepared to see no growth in land values for a decade (seems unlikely?) and test your assumptions to make sure that consecutive poor seasons don’t start you on the way to be a statistic of the latest rural property bubble.

The land value does have other ‘off-site’ impacts. In succession planning, the expectations of off-farm members can be enhanced and many succession planners are focussed on the value of assets rather than what level of income these assets can support. With rising asset values, there is a greater risk that succession planning outcomes will lead to higher risks for on-farm families. Make sure you work through how it will work on paper. Don’t just go with emotion.

Conclusion

Despite the risks, there are many opportunities for business. Work out whether they are good opportunities for you. Let’s hope for the best for 2018.

Contact details

Eric Nankivell

0428 914 263

enankivell@farmanco.com.au

www.farmanco.com.au

@Eric_Nankivell

Was this page helpful?

YOUR FEEDBACK