Super high oleic oil - a game changer for the oleochemical industry

Author: Rosemary Richards (GO Resources) | Date: 19 Feb 2019

Take home messages

- Safflower varieties have been bred to produce super high oleic oil which provides superior thermal properties and functionality, and therefore, many applications are available for its use including bio-lubricants, bioplastics, cosmetics and pharmaceuticals.

About safflower

Safflower is a winter/spring growing crop. It is:

- Heat and drought tolerant,

- suited to both dryland and irrigation farming systems,

- low input, low maintenance and easy to grow, and;

- crop inputs and machinery requirements similar to cereal /canola production

Rotation benefits include:

- Late autumn/early winter or early spring crop option.

- Potential to double crop out of sorghum.

- Heat and drought tolerant suited to lower rainfall areas.

- Broadleaf crop option – break crop for cereal diseases (e.g. Crown rot, Common root rot, Yellow leaf spot).

- Improve soil structure when used strategically in crop rotations.

- Utilises soil water deep in the soil profile/lowers the water table.

- Sodic soils/salt tolerance

Table 1. Summary of key safflower characteristics.

Sowing time | June to September |

Flowering | End October /November - December |

Harvest | Matures in 110 – 170 days Mid December – January northern NSW |

Yield - dryland | 1.0 – 1.5 t/ha |

Yield - irrigated | 2.0 – 3.0 t/ha |

Disease | Alternaria (resistant varieties developed) Phytophthora |

Pests | Heliothis /Thrips /Birds |

Weeds | Sowing window offers opportunity to control late germinating weeds and/or herbicide resistant winter weeds and to incorporate additional IWM strategies |

Table 2. Wide adaptation of safflower as reflected by its diverse production localities.

| Jan | Feb | March | April | May | June | July | August | Sept | Oct | Nov | Dec | |

| Ord River | Plant | Harvest | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gilbert River | Plant | Harvest | ||||||||||

| Burdekin | Plant | Harvest | ||||||||||

| Nth NSW | Plant | Harvest | ||||||||||

| Sth NSW | Plant | Plant | Harvest | |||||||||

| Vic - Wimmera | Harvest | Plant | ||||||||||

| Vic - High R/F | Harvest | Plant | Plant | Plant | Plant | |||||||

| Sth. East S.A. | Harvest | Plant |

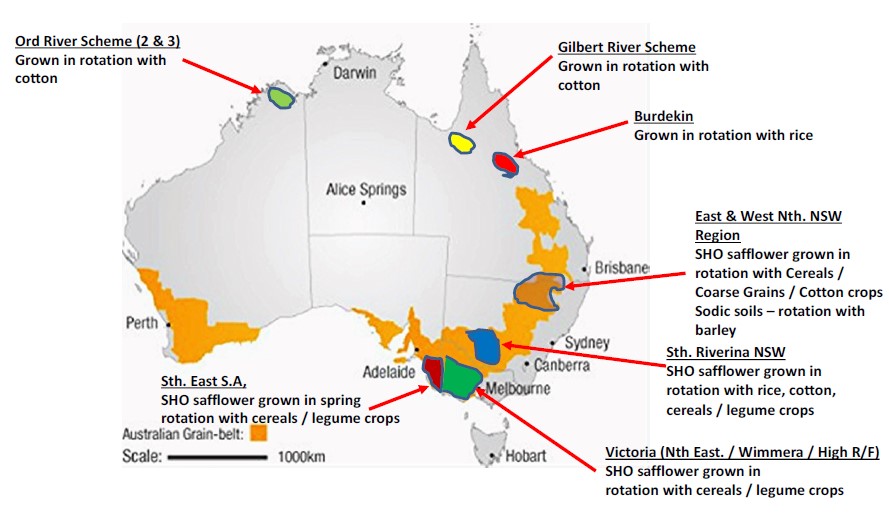

Figure 1. Diagram of safflower production locations demonstrating its adaption to varied environmental conditions.

About GO Resources Pty Ltd

Australian clean technology business whose focus is the sustainable production and supply of renewable and biodegradable bio-based raw materials targeted to the industrial and oleochemical markets

The game changer – super high oleic oil

Expectations for super high oleic oil:

- To replace fossil fuels for use in industrial and oleochemical markets.

- To replace palm oil.

- A new ‘cash’ crop for the agricultural industry.

- Crop Biofactories Initiative - A strategic alliance between CSIRO and GRDC to develop high-value industrial crops for Australian growers.

- The oil contains >92% oleic acid (a monounsaturated fatty acid) with very low levels of saturated and polyunsaturated fatty acids.

- No existing commercially available bio-based oil can reach this super high purity directly from the seed oil.

- The super high oleic oil is a new and unique raw material for the production of bio-lubricants, bioplastics, cosmetics and pharmaceuticals.

‘Best in class’ of vegetable oils

Table 3. Comparison of super high oleic (SHO) oil with other vegetable oils.

| Average Content | Stearic acid (C18:0) | Oleic acid (C18:1) | Linoleic acid (C18:2) | Linolenic acid (C18:3) | Palmitic acid (C16:0) |

|---|---|---|---|---|---|

| GO Resources SHO Safflower | 2% | 93% | 2% | 0% | 3% |

| HO Sunflower | 3-7% | Min. 75% | 5-15% | Max 0.2% | 3.5-8% |

| HO Soybean | 4% | >75% | <10% | <3% | |

| HO Canola | 7% | 70% | 20% | 3% | |

| Canola | 2% | 62% | 20% | 8% | 4% |

| Palm | 5% | 39% | 11% | 0.2% | 43% |

| Soybean | 4% | 21% | 56% | 7% | 10% |

| Sunflower | 5% | 15% | 71% | 0.5% | 6% |

| Safflower | 3% | 15% | 73% | 0% | 6% |

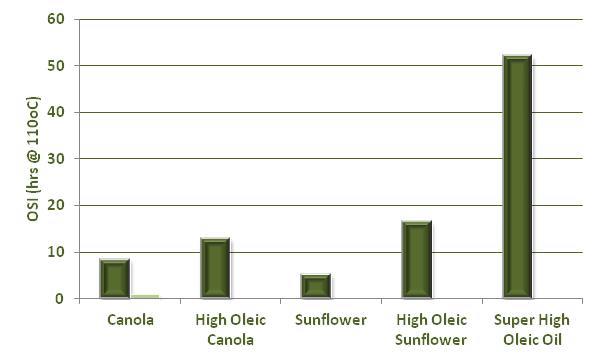

Not all bio-based oils are equal. Compared to palm oil, high oleic (HO) sunflower oil, HO soybean oil and HO canola oil, SHO safflower oil provides superior thermal properties and functionality which make it ideal for use in industrial applications.

Figure 2. Performance as measured by thermal stability.

Demand for bio-based oils is increasing

Global lubricants market expected to reach US$166.9 billion by 2021.

‘The adoption of bio-based lubricants to reduce harmful environmental effects is the current trend in the lubricants market and is boosting the overall growth of the market (Lubricants Market. MarketsandMarkets Report 2016)’.

Some of the factors that are driving increased demand include global warming, climate change, population growth, dwindling fossil resources and biodiversity (Figure 4).

Figure 3. Factors driving increased demand of bio-based oils.

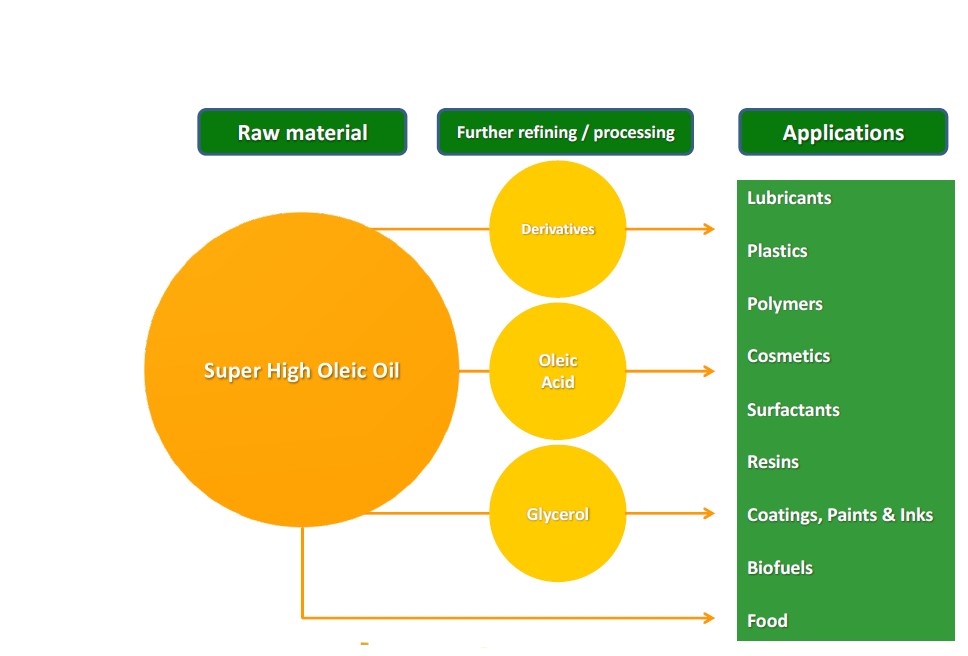

There are many applications/many markets for super high oleic oil. Some examples are provided in Figure 5.

Figure 4. Example of applications for super high oleic oil.

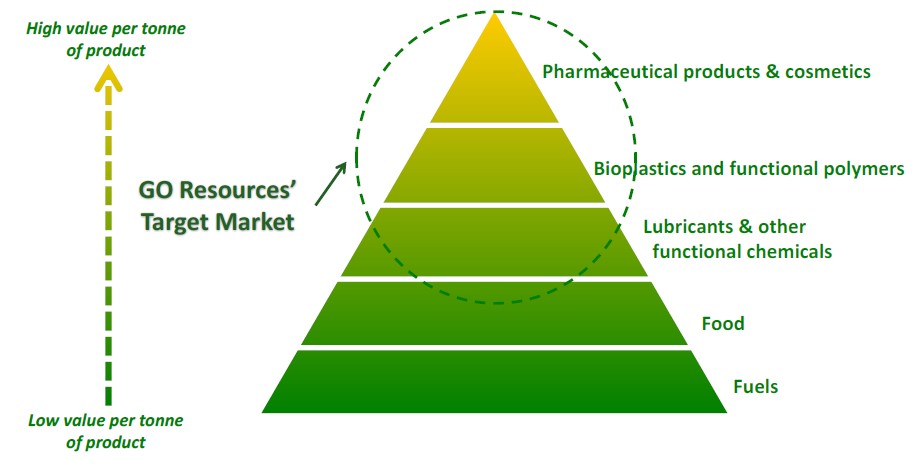

GO Resources’ focus is on the industrial market

GO Resources will target the higher value/higher margin industrials markets where the superior functionality and quality of its super high oleic oil are valued and in demand by customers. GO Resources will bypass the low value end markets where price is a key driver of demand.

Figure 5. GO Resources market target plan.

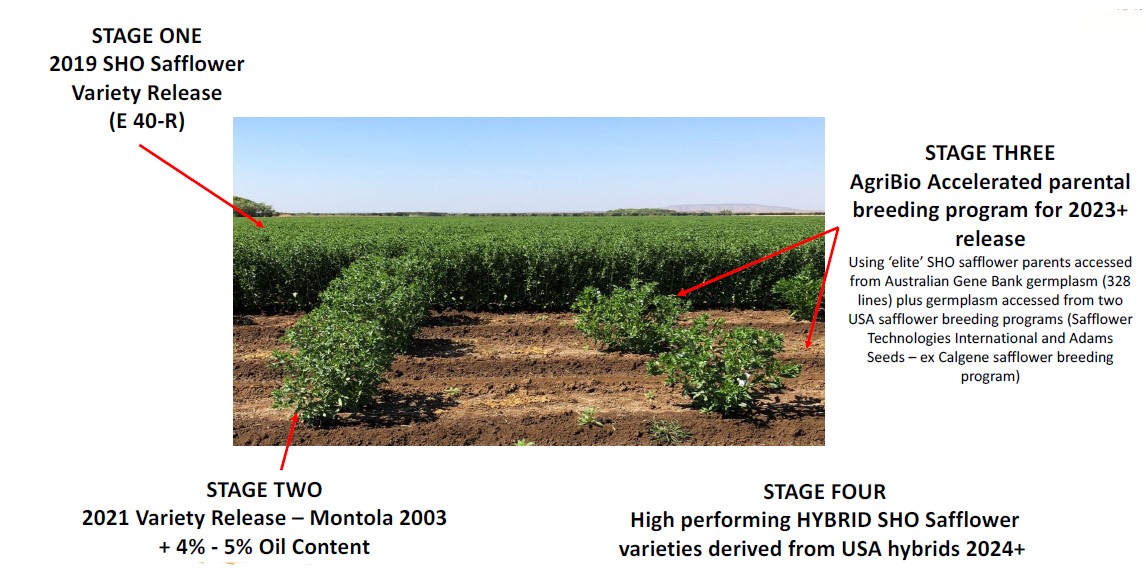

SHO safflower plant breeding strategy

Figure 6. Diagrammatic representation of SHO safflower plant breeding strategy.

Accessing diversity– 300+ safflower lines

Focused on four-value adding targets:

- Increase grain yield reliability and oil content through the development of regionally adapted SHO safflower varieties:

- Innovative use of diverse germplasm (accelerated breeding).

- Reduced time to flowering on-set (i.e. short seasoned cultivars compared to canola).

- Development of hybrid SHO safflower varieties.

- Faming system optimisation.

- Increase the harvest index (HI) and water use efficiency (WUE).

- Increase the level of resistance to Alternaria (Alternaria carthamii), which may become more prevalent if safflower production increases due to additional sources of inoculum.

- Add value to seed meal and trash.

Agronomy and farming systems strategy (2016 – 2019)

Objective:Develop SHO Safflower Crop Management Package (CMP)

Agronomy research:

- Herbicide screen: Establish and manage a large plot non-replicated herbicide screen of previously registered herbicides (pre-emergent, post-plant pre-emergent and post-emergent) for the purpose of assessing weed control efficacy and variety tolerance (2017 - 2018).

- Seeding rate: Assess impact of seeding rate on crop emergence and yield (Completed 2016 - 2017).

- Time to seeding: Assess impact of time of sowing on crop emergence and yield (2016 – 2019).

- Seed treatment: Assess crop safety, disease control and impact on yield (Completed 2016).

- Plant nutrition: Assess impact of various fertilizer programs on crop mergence and yield.(2018/19).

- Farming systems: Identify fit in farming systems and quantify rotation benefits

Time to seeding and seeding rate

Table 4. Recommended optimum (RO) and extended ( > or < ) sowing window for safflower.

| May | June | July | August | September | October | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Week | 1 | 2 | 3 | 4 | 1 | 2 | 3 | 4 | 1 | 2 | 3 | 4 | 1 | 2 | 3 | 4 | 1 | 2 | 3 | 4 | 1 | 2 | 3 | 4 |

| Northern NSW | < | < | RO | RO | RO | RO | RO | RO | RO | > | > | |||||||||||||

| Central NSW | < | < | RO | RO | RO | RO | RO | > | > | |||||||||||||||

| Southern NSW | < | < | RO | RO | RO | RO | RO | > | > | |||||||||||||||

| Victoria | < | < | RO | RO | RO | RO | RO | > | > | > | > | > | > | |||||||||||

| South Australia | < | < | RO | RO | RO | RO | RO | > | > | > | > | > | > | > | > | |||||||||

Table 5. Seeding rates of safflower for different regions and different climatic conditions.

| Favourable conditions | Drier conditions | Irrigated crops | |

|---|---|---|---|

| Northern & central NSW | 20 - 25 plants/m2 | 15 plants/m2 | 40 - 50 plants/m2 (25 - 31kg/ha) |

| (12 - 15kg) | (9kg/ha) | ||

| Southern NSW | 30 - 35 plants/m2 | 25 plants/m2 | |

| (18 - 22kg/ha) | (15kg/ha) | ||

| Victoria & SA | 30 - 40 plants/m2 | 20 - 30 plants/m2 | |

| (18 - 24kg/ha) | (12 - 18kg/ha) |

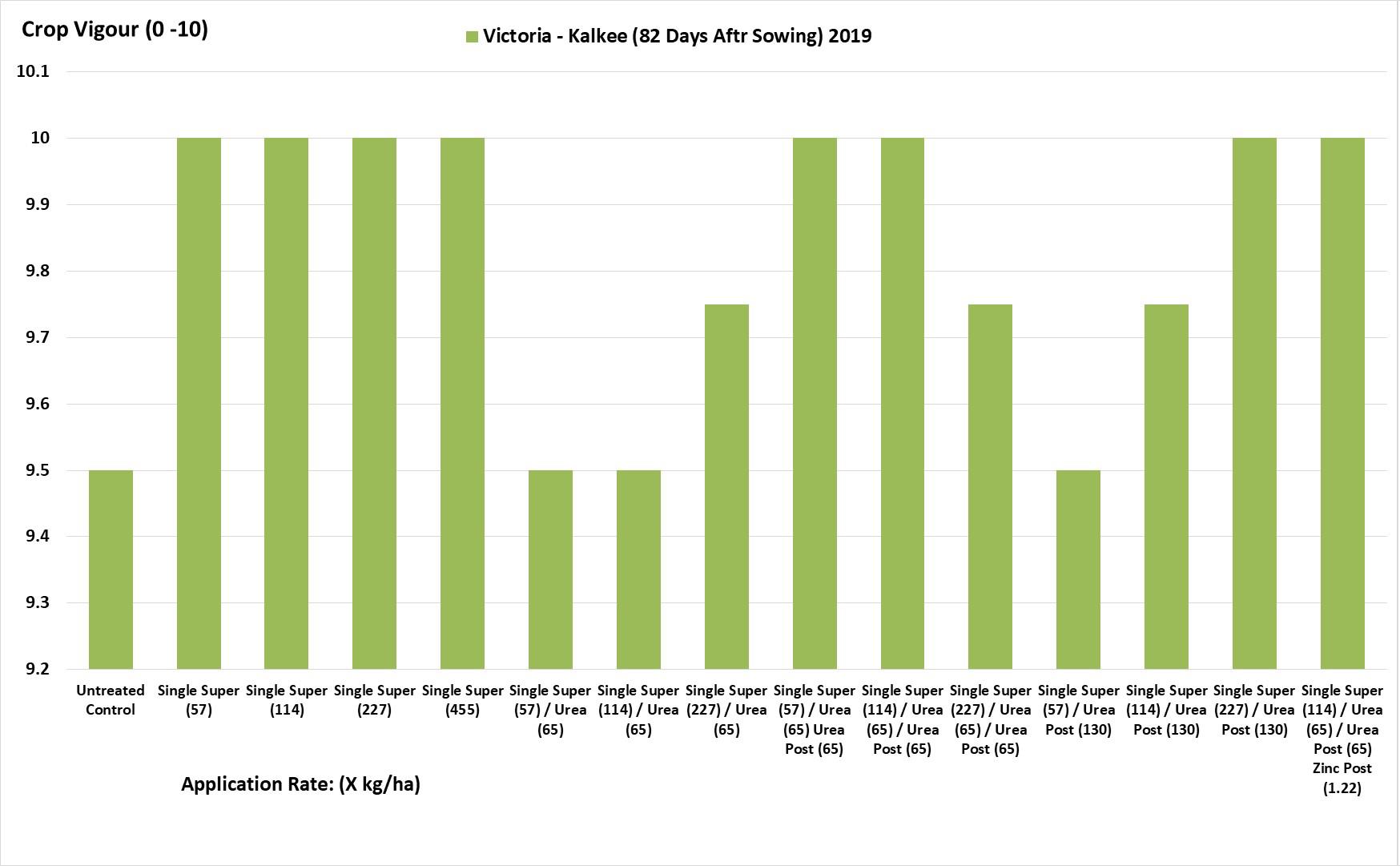

Plant nutrition

Safflower response to different plant nutrition treatments (Figure 9).

Figure 7. Safflower response to different plant nutrition treatments trialled at Kalkee, Victoria 2019.

Table 6. Nutrient removal by safflower (kg/t seed) compared with wheat.

| Nutrient | Safflower | Wheat |

|---|---|---|

| Nitrogen | 25 | 23 |

| Phosphorus | 4.3 | 3 |

| Sulphur | 4 | 2 |

Herbicides for use in safflower

Herbicide tolerance screens 2017 and 2018 - Horsham/Narrabri/Streatham. Details of trial are listed in Table 7.

Table 7. List of herbicides tested for use in safflower.

Registered | Minor Use Permit in Safflower - Status | ||

|---|---|---|---|

Granted | Applied For in 2018 | Applied For in 2019 | |

Trifluralin | Ally | Sertin | Propyzamide |

Avadex Extra | Dual Gold | Sakura | |

Diclofopmethyl | Boxer Gold | ||

Propaquizafop | |||

Pendimethalin | |||

First commercial planting – 2019

Small scale commercial development which aims to:

- Evaluation of varieties.

- Continue to build knowledge of crop agronomy and role in farming systems.

- Generate commercial quantities of oil for customers.

Production areas:

- South – dryland / irrigated.

- North - irrigation (cotton)/dryland/sodic soils.

Grower requirements/logistics

- No Technology User Agreement including:

- Crop management plan.

- Good agricultural/management practices.

- Records.

- No farmer saved seed.

- Logistics.

Pricing

- Deliver competitive return per hectare

Crop management plan - key requirements

- Advise GO Resources if have or intend to plant conventional safflower.

- Notify neighbours of their intention to grow the genetically modified (GM) crop.

- Ensure good crop agronomy in a sustainable manner.

- Implement on-farm management practices to:

- Minimise the risk of outcrossing.

- Control GM high oleic safflower volunteers.

- Prevent the inadvertent mixing of plant material during planting, flowering, harvest, and storage.

- Manage machinery and equipment hygiene pre- and post-use in SHO safflower.

- Maintain a complete set of paddock management records = good agricultural practice

Grower case study

- Sow the crop early rather than later in spring as this is ideal if growing it as a cash crop.:

- ‘Sowing it early gives it a chance to establish well and you can provide the right nutrition in order to make good yields.’

- ‘It can also be grown as a strategic crop to soak up moisture or help tidy up a weed problem, or as an opportunity crop where things might go wrong with your normal winter program, such as an establishment failure with cereals.’

- There is tremendous opportunity for the crop, with CSIRO issuing a licence to GO Resources to commercialise genetically modified safflower technology to produce super-high oleic safflower oil for the high-value industrial oil market:

- ‘For me, that could be the future of safflower – specialised oil production with varieties designed for a slightly drier climate.’

- ‘I would only be prepared to grow safflower on a yearly basis if there was a stable market for it’ - The industry is starting to look that way but we have seen plenty of players come and go over the years. ‘We need a stable player in the market to ensure growers get a good price and are paid for what they produce.’

Contact details

Rosemary Richards

rosemary@bowmanrichards.com

Was this page helpful?

YOUR FEEDBACK