Buy, lease or invest off-farm

Author: Mike Krause (P2P Agri) | Date: 20 Jun 2019

Take home message

- There is no substitute for undertaking a professional approach to farm business analysis.

- There are positive options for farm business expansion through land purchase, land leasing and share farming. The key is however, to undertake the correct analysis so the whole farm performance of liquidity, efficiency and wealth is understood. This will ensure improved risk management.

- Good, sound farm business analysis isn’t always easy, but it can be done using improved analytic technology, and it is worth doing. Do this for yourself or use a professional farm business management consultant.

Introduction

Farming has become more challenging with significant variation in seasonal outcomes, market volatility, increasing land values and tightening financial requirements from banks. So, the risks of farming are high. These conditions have made it challenging to decide whether all our financial resources should be placed back into the farming business or diversified into other investments. It is inevitable that the answer to these questions will be subjective, as to make the perfect decision we need to know what the future will be, and we don’t. However, there are some fundamental principles that can be used in helping to make the best decisions. This paper outlines these principles and provides a farm case study to provide some insight into how to go about making these decisions.

Check list for the big decisions

Making decisions with uncertainty can be challenging but the following steps will help improve your decision-making to make the most of your opportunities:

- Know the vision for your business

Knowing what business goals you wish to achieve in 10 years will greatly inform the decision to diversify your investment. For example:- Family succession - Do you wish to build the business to assist with the family succession? If this is the case, your goal should consider farm size to maintain its viability into the future.

- Retirement - Do you wish to grow the asset base to fund your retirement as there will be no next generation on the farm? In this case, you will be more concerned with the potential returns you can achieve from a wide range of investments.

- Risk - Are you concerned about the risks in agriculture and are looking for diversification to help manage that risk? In this case, diversifying your investments may be important to you.

- Know your passion

There is a great saying, ‘Do what you do best’! In other words, you will be willing to put in the extra effort needed for success if you love what you do.

If you love farming, you will manage your business well, which will likely mean your best return will be gained from investing into your business.

If you are considering diversifying your investments off-farm, then consider if this is part of your passion. If you are not willing to learn about managing your investment off-farm and putting time and effort into this, then any gains you make could be absorbed by the investment costs you may incur. Be careful when deciding where to place your off-farm investment as it will need management.

- Understand the three levels for good farm business management

When managing your business, it is very helpful to plan and monitor the following three aspects of your farming business:

- Liquidity – This is the cash flow of the business. A monthly planned and monitored cash flow budget greatly improves the business cash performance. If you are considering off-farm investment, also consider the cash flow implications to your whole business if you were to take cash out for an off-farm investment.

- Efficiency – One of the key measures of financial performance is how well you have used the resources in your business, as measured by:

- Return on assets managed – This is the measure of how efficient the total business assets are being managed. Total business assets include the value of owned, leased and share farmed land, machinery, water rights and livestock. When you are considering investment back into your farming business, this measure assesses if it is a good use of your money. If your business doesn’t improve in efficiency even with further investment, then you should perhaps put your money elsewhere. Knowing your efficiency is a key analytic to help you decide where your surplus money should be going.

- Return on equity – This is the return you are getting from the assets you own, otherwise known as your equity. This is another key measure when deciding whether to invest off-farm. If your business is generating a 4% return on equity and a risk-free bank deposit is giving you 1%, then you would get better returns investing in your business. Do you know your business’s return on equity?

If you wish to know more about these measures, refer to Section 5.5 of ‘Farming the Business’ manual (Farming the business manual). - Wealth – This is measured by the business’s balance sheet and is known as Net Worth. Net Worth is the difference between the Total Assets owned and the Total Liability owed. This is the key performance indicator we wish to see grow over time. Further discussion of Net Worth is given in Section 5.3 of ‘Farming the Business’ manual. Any investment consideration, whether on-farm or off-farm should be assessed for its likely impact on the Net Worth.

Farmers often ask, ‘Why do I need to know my balance sheet, as I’m not going to sell the farm?’ It’s not just about selling the farm – knowing your Net Worth is part of a risk management strategy as the higher the wealth in your business, generally the better risk is being managed. Also, banks place significant value in knowing your business balance sheet and the equity.

- Do your analysis

Once you understand how to measure the three important measures of business liquidity, efficiency and wealth, you can apply them to any investment opportunity, both on-farm and off-farm.

You can do this yourself by studying the GRDC manual ‘Farming the Business’ or by building a series of Excel spreadsheets, or by using the new, easy to use farm management modelling platform called ‘P2PAgri’ (more information can be found at P2P Website). Alternatively, you can use an experienced farm business management consultant

- Make your decision

Despite having done significant business analysis, some people may find it difficult to decide. The biggest risk is not making a decision. Do the analysis, weigh up all the benefits and costs, decide on the best action, then follow through and act on that decision.

- Communicate your decision to your partners

Once the decision is made, you will need to communicate this clearly with your business partners if they haven’t already been included in the decision-making process. This may also include your bank if you require additional finance.

For example, communicating clearly with your bank means they will be better informed of your business direction, and will gain the understanding and confidence they need to further invest in your business. Putting a professional document together supporting your decision and providing the bank with the clear information they need could significantly decrease your risk grading, and therefore, decrease the interest rate you are offered.

While it’s good to get the bank approval on any new funding proposal you put to them, do not rely on their approval to gain confidence in your decision. Banks have a different goal in lending to you than you have for running your business. They will be making decisions on your business based clearly on their goals, not yours.

Some observations of the economy that affect business expansion

Two significant issues have helped shaped the rural economy in recent times:

- The increase in land values.

- The cheapness and availability of finance.

Land values

Land values have been significantly increasing across the Australian agricultural landscape. This increase has been steady since 2000 and has been occurring despite significant variability in the annual financial performance of different farming regions. Figure 1 indicates the average annual increase in land value in Victoria from 2012 to 2017. In the Wimmera, it appears to have been a 6% annual increase in value (Source: Australian Farmland Values 2017, Rural Bank).

Figure 1. Land value increases from 2012 – 2017 (Source: Australian Farmland Values 2017, Rural Bank).

Figure 1. Land value increases from 2012 – 2017 (Source: Australian Farmland Values 2017, Rural Bank).

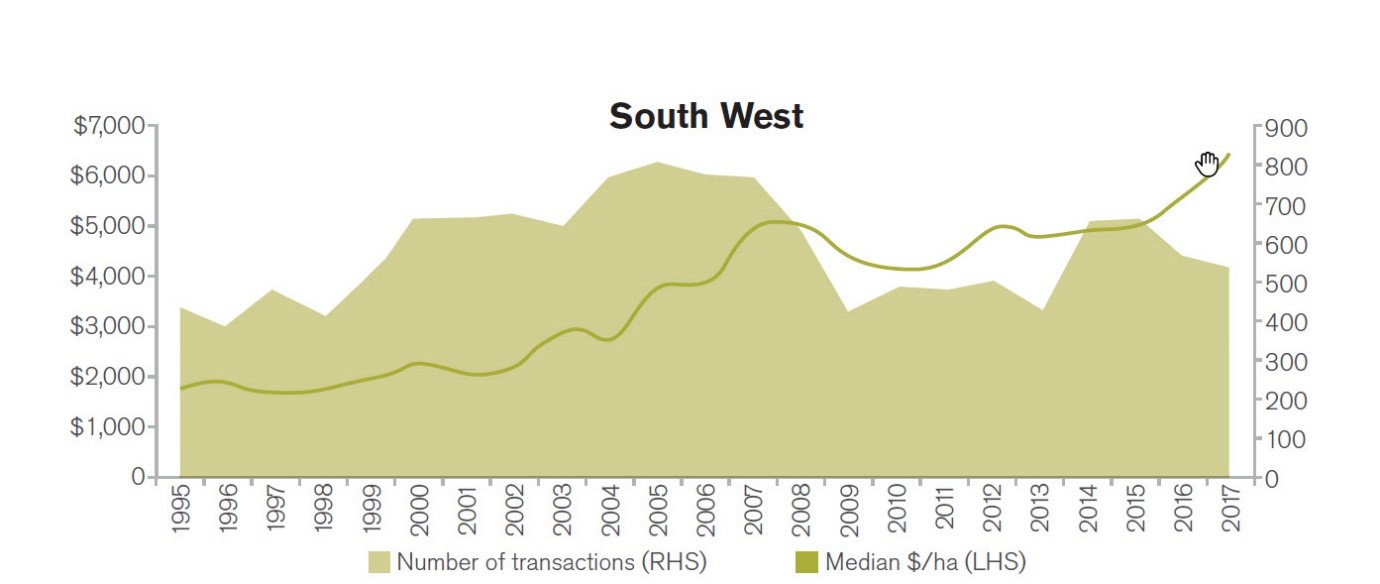

The trend in land values from 1995 in Victoria’s South West is shown in Figure 2 and indicates a steady increase. This analysis comes from Australian Farmland Values 2017, Rural Bank.

Figure 2. Land Value trends in Victoria’s South West.

Figure 2. Land Value trends in Victoria’s South West.

This land value increase has provided both benefits and costs:

Benefits:

- The value of land in the farmer’s balance sheet has significantly increased, adding directly to improved farm business net worth. Another way to look at this is that the wealth of the business has increased despite the financial performance of the business.

- As banks take security of their lending against the land value, they have felt financially secure with their rural lending, even through poor financial years. This has provided significant security for farming businesses through this period.

- Farmers have found it relatively easy to secure added finance when they have needed it.

Costs:

- When farmers look to expand their business through additional land purchase, they will have to pay these high land values. So, they must carefully consider the financial benefit of paying high prices for land.

- New entrants into farming have been greatly restricted as significant capital is needed to purchase land to start a farming business.

- It is challenging to achieve high Return to Assets Managed because the asset values are so high. This is why we have seen Australian farm businesses remain in family business hands rather than corporate farming.

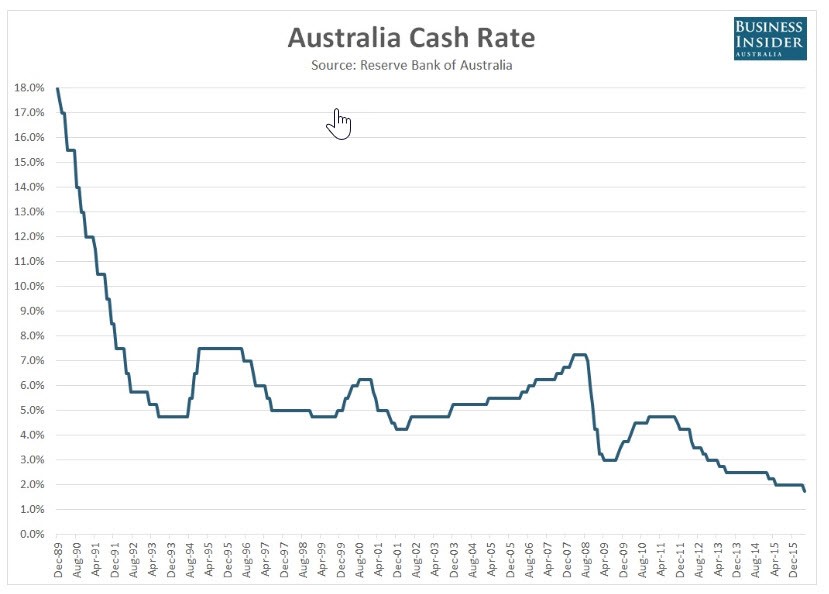

The interest rates

Historically, interest rates are at an all-time low. The Reserve Bank of Australia (RBA) recently decreased the official rate to 1.25%. Figure 3 indicates the RBA’s official cash rates since 1989 and the trend has been significantly down.

Figure 3. Cash Interest Rate (Source: Reserve Bank of Australia).

Figure 3. Cash Interest Rate (Source: Reserve Bank of Australia).

This has meant that the price of borrowing money is at very low levels. However, it must be noted that since the conclusion of the Royal Commission into Banking, the access to new lending has become more difficult with significantly higher checking and data requirements. The approval time for new lending has significantly slowed. This means that farmers will need to become increasingly more professional in managing their relationship with their banks and in seeking more funding.

It is observed that the recent experience of relatively cheaper lending could have been a major catalyst for the increase in farm land value, as farmers have been able to service more debt in their cash flow. Also, during this time, banks were happy to lend interest only loans. However, recent bank lending is now swinging back towards principal and interest lending (Amortised loans), where principal must also be repaid over time.

Buying versus lease versus share farm

This is the perennial question when it comes to business expansion. In the environment of increasing land values and low interest rates, should all expansion be land purchase?

Farmers rarely get the opportunity to assess all three options simultaneously when wishing to increase land area for their business. A Farm Case Study has been used to consider which option gives the best financial outcome, and demonstrates the process mentioned in points ‘Understand the three levels for good farm business management’ and ‘Do your analysis’. While a typical mixed farm from the Lower North of SA with 2,000ha has been used in this analysis, the principles illustrated are applicable to all farm businesses. However, the results could be different when considering your business expansion, so there is no substitute in undertaking you own proper analysis should you be considering these options.

The Farm Case Study

One way to assess the impact of an on-farm investment is to consider the following situation: you have just finished a great season and have $1m to invest and you wish to invest on-farm. You could:

- Purchase additional land

- Take on more land though leasing

- Take on more land through share-farming

The key characteristics of the Case Study farm are shown in Table 1.

Table 1. Key characteristics of the Case Study farm.

Land area: 2,000ha | Equity 87% | Av annual rainfall 620mm |

Total Asset Value $25.5m | 3 Labour units | |

Total Liability Value $3.3m | ||

Enterprises | Yields (t/ha) | Decile 3 Decile 5 Decile 7 |

|---|---|---|

Barley | 175 ha | 3.5 5.0 6.0 |

Wheat | 525 ha | 3.2 5.0 6.0 |

Cereal hay | 300 ha | 5.0 7.0 10.0 |

Canola | 280 ha | 1.2 1.8 2.2 |

Faba Beans | 420 ha | 1.5 3.0 4.0 |

Pasture (Self replacing Merino) | 300 ha (3,200 dse) |

The opportunity assessed is to add 300ha to the operation with the key details of the new land shown in Table 2.

Table 2. Characteristics of the new land.

New land value $5,000/ha | Same productivity as home farm | |

Stamp duty of 5% | Assume current labour and machinery will service the additional land | |

Land use: Enterprises | Wheat 75ha | |

Hay 75ha | ||

Faba Beans 75ha | ||

Canola 75ha | ||

Land purchase | ||

Put $1m into land purchase | Borrow $2.89m @ 5% | Repay over 15 years |

Assume a 5% annual growth in Land values | ||

Land Lease | ||

$1m remains in the bank | 300ha lease @ 5% of land value | |

Land Share Farmed | ||

$1m remains in the bank | 300ha agreement @ 75% income to the share farmer | @ 100% variable cost to the share farmer |

The modelling was done using the new, cloud-based P2PAgri farm modelling software. As there are differences in risk between the land management options, an average season (Decile 5) was modelled in 2019, poor season (Decile 3) in 2020 and a good season (Decile 7) in 2021. The remaining three seasons of the 6-year planning period were left as average (Decile 5) seasons. This allows the risk profile of seasonal variation to be assessed between land purchase, land lease and land share farmed.

The Farm Case Study results

Liquidity

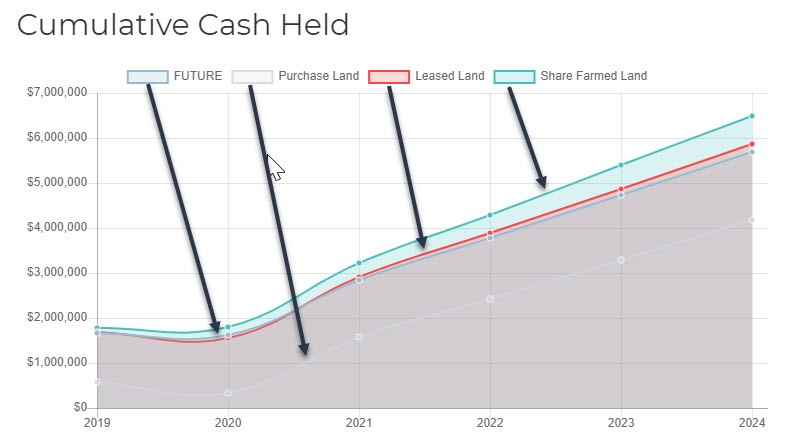

The cash surplus implications for the three options are shown in Figure 4. This modelling assumes that surplus cash is accumulated over the planning period. While this may not be the case as farmers have other uses for their surplus cash, it does illustrate which option generates the most cash.

Figure 4 shows that the share farming option provides the best opportunity to generate cash. This is related to the share farming agreement modelled of 75% of the income going to the farmer and the farmer paying 100% of the variable costs. The purchase of the 300ha of land showed the lowest cumulated cash as the $1m was used in the land purchase, and this loss of cash could not be caught up over this time period.

Figure 4. The modelled Cash projections (Source: P2P Agri)

Figure 4. The modelled Cash projections (Source: P2P Agri)

Efficiency

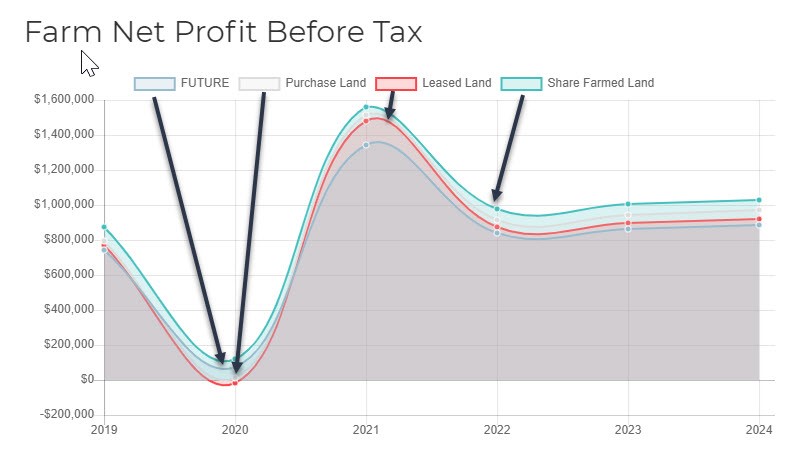

The addition of the 300ha does alter the risk profile of the business as shown in Figure 5. As expected, the financial performance is affected in the poor year of 2020, but great profits were generated in the better season projected in 2021.

This business is quite viable before the added land. Only the share farming option provided better profits in all seasons. Leasing and land purchase both produced less profit than the ‘do nothing’ scenario in the poor season of 2020, but both options generated improved profits compared to the ‘do-nothing’ scenario in the projected 2021 season.

Given average seasons, all options for taking on the added 300ha generated better profits than the ‘do nothing’ scenario.

Figure 5. The modelled Farm Net Profit before Tax (Source: P2P Agri)

Figure 5. The modelled Farm Net Profit before Tax (Source: P2P Agri)

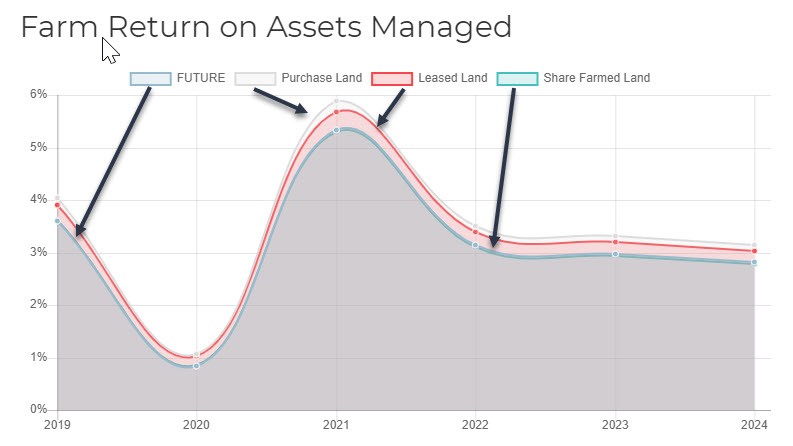

Return on Managed Assets is a sound measure for business efficiency and the results of the farm case study modelling are shown in Figure 6. The best results were the land purchase and land leasing. The ‘do-nothing’ and share farming option performed nearly identically but were not as good as the land purchase and land leasing options.

Figure 6. The modelled Farm Return on Assets Managed (Source: P2P Agri).

Figure 6. The modelled Farm Return on Assets Managed (Source: P2P Agri).

Return to Equity is the best measure when comparing land expansion to off-farm investment. Table 3 shows the average estimated Return on Equity of the four farm options assessed. The results indicate the best Return on Equity was the share farming option.

The results compare favourably with the current bank deposit rate of 1% but are slightly lower than the average yield from the All Ordinary Equity of the last 5 years of 4%.

Table 3. The modelled Return on Equity

Land Ownership Options | Average Return on Equity |

|---|---|

Maintain the same land holding | 2.99% |

Purchase the added land | 3.15% |

Lease the added land | 3.06% |

Share farm the added land | 3.43% |

Wealth

Wealth in measured by the growth in Net Worth of the business and the projected Net Worth for all the options by 2024 is shown in Table 4. This indicates the best option is the land purchase. A land value growth of 5% has been assumed and the growth experienced on the value of land purchased was greater than the higher profits generated by the other options of leasing and share farming. So, in this example, the best option to generate wealth is the land purchase option.

Table 4. The modelled final Net Worth

Land Ownership Options | End of 6 years Net Worth |

|---|---|

Maintain the same land holding | $31.9m |

Purchase the added land | $33.0m |

Lease the added land | $32.0m |

Share farm the added land | $32.5m |

Conclusion

The analysis of farm performance and assessing the options of land purchase versus leasing versus share farming is complex. However, if done correctly, it greatly informs the farm business decision-making. Doing this analysis may improve your credit risk rating with your bank and may result in obtaining a more favourable lending rate.

The Farm Case study analysis is provided to illustrate the detailed analysis needed to assess the various land managed expansion options. If you are considering this option for your farming business, an analysis specific to your business, opportunity and business environment is highly recommended. You can also utilise a qualified farm adviser to undertake this work for you.

This analysis does illustrate that in this lending environment of low interest rates and constant increasing land values, the land purchase option is viable and can improve efficiencies. However, this may not be the case for all land purchase opportunities and the business equity levels will have a significant effect on the analysis.

There is no substitute for undertaking your own analysis of your own opportunities.Considerable help can be provided from the resources listed in the Reference section and from appropriately trained professional farm business management advisers.

References

Australian Farmland Values 2017 Report, Ag Answers, Rural Bank Australian Farmland Values 2017 Report

Plan2Profit Agri (P2PAgri) Farm Business Management Platform Website P2P Website

Farming the Business (2015), M. Krause, GRDC Publication, Farming the business manual

Contact details

Mike Krause

P2PAgri P/L

0408 967 122

Mike@P2PAgri.com.au

Was this page helpful?

YOUR FEEDBACK