Practicalities and economics of integrating dual purpose crops into the whole of farming operation in the medium rainfall zone

Author: John Francis (Agrista) | Date: 25 Feb 2022

Take home message

- There is no one size fits all approach to the integration of dual-purpose crops into a farming system. The value of the integration will depend on several factors including the existing system and the existing skill base. Following are some tips that may assist in successful implementation to ensure that dual purpose crops are an enduring part of the farming system

- Extracting value from dual purpose crops at a whole farm level requires optimising not only the grazing crop but also the other parts of the farming system

- Don’t underestimate the investment in skills required to make some of the changes. Start small to build confidence as this will minimise risk and build skill over time

- Whole farm feed budgeting prior to making systems changes will assist in understanding the extent of the capital requirements for the additional livestock and the stocking rates necessary to deliver profitability improvements

- If feed budgeting skills can be learned and perfected through exposure to dual purpose crops and then applied to other parts of the farm, then there is the potential for improvement in whole farm profit.

Introduction

The GRDC farming systems project has compared the performance of crop sequences over the 2018 to 2020 growing seasons to account for legacy effects of one crop to the next. This has helped to move thinking beyond individual crop performance within any year to rotation performance across years. Further insights will be delivered with GRDC’s investment into the second three-year phase which will run from 2021 to 2023.

The introduction of dual-purpose crops has the potential to increase whole farm profitability where the per hectare returns exceed those of the existing enterprises and their introduction doesn’t erode the profits of the existing system. The aim of this paper is to demonstrate some of the factors that will influence the financial performance of dual-purpose crops. Dual purpose crops will have a greater chance of being an enduring part of the system if there is general understanding of the success factors prior to implementing change.

This paper will take a theoretical approach and combine it with case studies to demonstrate some of the practical issues associated with integrating dual purpose crops into the whole farm system. The value created, or destroyed, as a result of the integration of dual-purpose crops into the system is dependent on a range of factors including skills, management, the existing system and the extent to which it is already optimised.

This paper will also address the methodology for assigning a value to the grazing component of dual-purpose crops and consider some of the issues associated when scaling up from experimental components to an integrated whole farm system.

Play to your strengths

Decisions around farming systems changes should have some element of weighting on financial performance however there are a range of other factors that are also important. The financial performance resulting from production delivered in farming systems experiments is highly dependent on the management applied to the plots. This is entirely appropriate as the aim of these experiments is to measure the effect of an experimental treatment or test a hypothesis which is usually easier if all other management factors are optimised.

Not all farm business managers have the same level of skill across their enterprise mix. Farm performance analysis often shows that in mixed enterprise farms some business operators consistently perform better in one enterprise than another irrespective of commodity price differences. There is little data showing why this occurs, but the speculation is that passion or natural preference for one enterprise over another plays a role in this outcome. This passion leads to a greater skill development in the preferred enterprise at the cost of skill development in another enterprise and that just exacerbates the relative difference in performance.

A case in point is a producer in a 600-millimetre mixed farming area of southern NSW with 15 years of farm production and financial performance data. The highest return and best use for their farmland is dryland cropping with livestock enterprise returns being the next most appropriate use based on the resource base. Despite this, the farm manager has exceptional livestock performance due the skills built in this enterprise, the desire to manage livestock and his implementation of a livestock system that matches feed supply with feed demand and the timing of offtake of trading livestock coinciding with the decline in feed quality.

For this particular producer, over the last 15 years the per hectare financial returns of dual-purpose crops, inclusive of the value of grazing income, have rarely exceeded those of the chosen livestock enterprise. While farm performance data suggests this is not reflective of similar farms in the area, it reflects the management and skill sets of this individual manager. Despite these results, the manager was an early adopter of dual-purpose crops and continues to grow them for the role they play in reducing the weed seedbank prior to sowing long term perennial pasture.

For every manager with strengths in livestock management skills and weaknesses in crop management skills there will be another with strengths in crop management skills and weaknesses in livestock management skills. There is real value in identifying the weakness and establishing the cost of that weakness prior to executing a change in system, as the investment in a system change requires appropriate skill sets. Capital investment without the necessary skill sets is likely to be insufficient.

The key point here is that some farm managers have strengths and skills that need consideration when deciding about which farming system to implement. The financial performance delivered in a research trial may never be achieved on some farms because the effort and discipline required to build the management skills to deliver the same results exceeds the marginal reward when compared to the alternative.

What do you give up and what do you gain?

Studies of human behaviour, psychology and mental processes have shown that we value a loss and a gain of the same magnitude differently. The value that we place on loss is far higher and has a far greater impact than the value we place on gain. In fact, some studies have shown that we fear loss nearly twice as much as we value gain. Given this, it is important to quantify the value of any potential downside as well as the frequency of occurrence of that downside.

The vast weight of research data involving dual purpose crops suggest that, provided a few simple grazing rules are followed, there is no marginal cost of foregone grain yield of moving from a grain only system to a dual-purpose cropping system. In other words, yields of grazed crops are not significantly dissimilar to yields of ungrazed or grain only crops. This suggests that there is little risk from the grain income side of introducing a dual purpose crop, but there may be perceived risk on the grazing side.

The risks in introducing a grazing enterprise to a system where there was previously no livestock include:

- Biosecurity risk. The introduction of weed seeds in the livestock themselves.

- Labour risk. The time taken to manage the grazing livestock erodes some value elsewhere on the farm.

- Management risk. The skills haven’t been developed so there are unknown elements that could induce cost.

- Capital risk. There is more capital required for the outlay of the livestock however this needs to be tempered with the extremely low probability that it would be completely lost.

- Production and price risk due to a lack of skill. The combination of these doesn’t combine to deliver the outcome necessary to generate an adequate return.

These risks need to be considered against the reward which is the additional income that can be generated from the grazing. It is also worth noting that many of these risks can be dealt with by taking a pro-active management approach to minimise their impact.

What base are you coming from?

An important step in establishing the value of any systems change is to first consider the status quo or base case. This is important because the value of a change in system depends in part on the existing system and its performance. When assessing the integration of dual-purpose crops into an existing farming system, there will be several factors that require consideration which are outside of the production and financial performance demonstrated in research trials.

These include, but are not limited to:

- Skills

- Human resources

- Capital requirements

- Land class suitability.

The extent of the change in technical skills, labour requirements and capital investment when integrating dual purpose crops into a farming system, previously devoid of this enterprise will differ depending on the existing enterprise mix. Table 1 shows that a mixed grain and livestock business will experience only small changes in skills, labour and capital investment when integrating dual purpose crops into the system. By comparison, the changes are large if moving from a livestock or grain only enterprise mix.

Table 1. The extent of the change in skills, labour and capital investment to integrate grazing of dual-purpose crops will differ depending on the existing enterprise mix.

Current enterprise | Change in skills, labour & capital investment |

|---|---|

Mixed grain and livestock enterprise | Small |

Livestock only enterprise | Large |

Grain only enterprise | Large |

Allocating grazing value to crops

The allocation of the value of grazing to a dual-purpose crop is necessary to account for the multiple streams of income (grain and grazing) that can be provided by the crop. There can be complexity associated with the allocation of the net value of grazing to dual purpose crops. Simplification sometimes results in miscalculation of the true value of the grazing resulting in erroneous values that can influence decision making. This can have major consequences where implementation is heavily dependent on financial performance.

Market value of feed

To assess performance at an enterprise level it is necessary to place a market value on the production generated by the dual-purpose crop. The market value of the grain is easily estimated as it is a simple calculation of yield by price. There is more complexity associated with the calculation of the value of grazing biomass because the value differs depending on how that biomass is used. The biomass can be used for trading livestock, creating value internally through utilisation in existing livestock enterprises or by agisting external livestock.

The value of a livestock trade allocated to a dual-purpose crop can be calculated as the net value or proportion of net value created by the trade. This is calculated as sales less purchases less all associated enterprise costs. If the trade occurs over a period which is longer than the dual-purpose crop grazing period, then the appropriate proportion of net earnings generated by the crop should be allocated.

The value of external agistment allocated to a dual-purpose crop is dictated by the price paid by the market. When feed is abundant the value may be low and when feed is in short supply the value increases. The range is usually around $0.50 cents to $2.00 per DSE per week.

The value to existing livestock enterprises of using a dual-purpose crop can be allocated in one of two ways. The first is to assign the market value of agistment as if the feed were to be sold as external agistment. The second is to establish the value generated from the use of the feed internally. The latter is far more difficult to calculate because splitting the costs and benefits of different components of a breeding unit is not straightforward.

In any livestock breeding enterprise, there are usually several income streams. These include trading livestock sales, cull and surplus female sales, bull, ram or wether sales and wool sales. The largest of the livestock income streams is usually the livestock trading component typically made up of young livestock such as lambs, hoggets, steers or heifers. In a breeding enterprise, the production of these trading livestock is dependent on a female breeding animal. This breeding animal incurs most of the enterprise cost and consumes around 75 percent of the total feed of the breeding and trading unit combined. Allocation of the trading income to the dual-purpose crop without either attribution of the cost of carrying the breeder or allocation of a purchase price of the lamb therefore results in unrealistically high values accrued against the dual-purpose crop.

Allocating a livestock trading enterprise value to a grazing crop

Where feed utilisation levels of fifty percent or above are achieved on pastures in the farming system then the inclusion of a livestock trading enterprise can be an effective means of utilising the additional feed supplied by the dual-purpose crop. To achieve feed utilisation levels of fifty percent or above, it is necessary to manage a livestock system that matches feed supply with demand. Typically, in a breeding operation, this means timing operational activities with high energy demand such as lambing, calving to coincide with the highest energy supply and ensuring trading livestock are sold as energy supply declines rapidly.

Where a trading enterprise is introduced for the sole purpose of generating revenue from the grazing crop, then the allocation of trading enterprise net earnings to the crop is relatively straight forward. The net earnings, or margin on the trade consists of sales less purchases less operational costs. It is generally not necessary to allocate any overhead costs to this trade unless it consumes a large proportion of the total labour use on farm. If a portion of the time spent by the trading livestock occurs off the crop, then the net earnings can be allocated on a pro-rata basis.

It appears to be a reasonably common industry practice to allocate the income of a livestock trading enterprise to the dual-purpose crop irrespective of the way the crop feed is utilised. This can be problematic as it may result in skewed results that aren’t truly reflective of the value at a whole farm level.

Industry practice appears to involve an estimation of grazing income, based on the estimation or measurement of weight gained on the crop by livestock, multiplied by a sales value per unit of weight gained. Some potential issues associated with the use of this methodology follow.

- If the business is a breeding business and doesn’t have a trading enterprise, then it is possible that this method will overestimate the value of income.

- There is no allocation of the value of any enterprise costs associated with the trade. If the trade was conducted purely for the consumption of the crop-supplied feed then the costs will include freight to farm, induction costs (animal health treatments including drench and vaccine), shearing and crutching costs and transaction costs including commissions, transaction levies and freight costs.

- There is no allocation of the financial impact of mortality rate on income. At a financial level, mortality is accrued as foregone income by multiplying only those livestock sold by the value per head. Per hectare calculations derived from per head performance multiplied by stocking rate will need to account for mortality. This means that some per hectare calculations will be based on the number of livestock purchased and some on the number of livestock sold with the difference between the two being mortality.

- Trading gains or trading losses are not allocated where income is calculated as sales value per unit of weight multiplied by weight gained.

Two components to a livestock trade

There are two components in a livestock trade that contribute to the margin net of costs. An explanation of these components follows.

- The trading margin – calculated as the difference between buy and sell price.

- The weight gain margin. The value of every unit of liveweight gain multiplied by the price per unit of liveweight gain at the point of sale. This must account for mortality as dead livestock tend not to put on a lot of weight.

The trading margin (difference in the buy and sell price) only applies to the weight purchased. When there is a positive price differential between the sell and buy price (i.e., the sell price exceeds the buy price) every kilogram purchased makes money. When there is a negative differential between the sell and buy price (i.e., the sell price is lower than the buy price) every kilogram purchased loses money. The weight gain margin is the value of every kilogram added after purchase.

It is the sum of the two that matters (i.e., makes the net income) – not one or the other in isolation. Some high-profile livestock producers have self-promoted their grazing and trading results on social media showing only the value of total weight at sale. In a livestock trading enterprise this gives an incomplete picture as it doesn’t declare the value at purchase or the enterprise cost.

Many livestock trading enterprise managers conduct their risk analysis and trade margin calculations based on there being an adequate margin over the volume traded rather than ensuring the buy and sell price being the same. That is, they tend to accept that the sell price might be lower than the buy price because they think that the value of the weight that they gain at a lower price (than the buy price) will more than compensate for the lower price at sale. This mentality is not captured where trading income is calculated as sales price by weight gained.

The assignment to grazing crops of the value of livestock weight gain multiplied by the sales value per kilogram is only appropriate if the buy and sell price in a trade is exactly the same and mortality rate equates to zero. This however only accounts for the income in the trade and without the cost associated with the trade it overestimates the net margin associated with crop grazing.

Tables 2 and 3 provide examples of the calculations that are used to estimate grazing income on dual purpose crop. The methodology used in Table 1 potentially overestimates the value of the grazing contribution as it doesn’t account for costs or trading gains or losses. The methodology in Table 3 more accurately values the grazing contribution to the crop as it accounts not only for the value of the weight gain but also for trading gains or losses, mortality and operating costs. The examples apply to a lamb trade however the principles apply equally to any livestock enterprise.

Table 2. Weight gain margin approach to valuation – does not account for costs or trading gain/loss

Biomass available for grazing (kg DM/ha) | 3,800 |

Utilisation | 75% |

Feed conversion efficiency (kg DM/kg lwt) | 8.3 |

Yield (cwt:lwt) | 50% |

Sale price ($/kg cwt) | $6.25 |

Carcase weight gained (kg cwt/ha) | 171 |

Gross value of weight gain ($/ha) | $1,069 |

Table 3. Net margin approach to valuation – accounts for costs trading gain/loss and mortality

Buy to sell price disparity | 0% |

Gross value of weight gain ($/ha) | $1,069 |

Mortality adjusted value of weight gain ($/ha) | $1,035 |

Trading gain/loss ($/ha) | $0 |

Enterprise & transaction costs ($/ha) | $436 |

Net margin on trade ($/ha) | $599 |

Bottom line relative to headline | 56% |

Table 4 shows the assumptions that drive the outputs shown in Tables 2 and 3.

Table 4. Assumptions driving production and financial outputs.

Assumption | Metric |

|---|---|

Mortality rate for period | 1% |

Induction & enterprise costs ($/head) | $8 |

Sales costs (commissions/fees/freight) | 7% |

Buy to sell disparity | 0% |

Yield (lwt to cwt) | 50% |

Sale price ($/kg cwt) | $6.25 |

Feed conversion efficiency | 8.3 |

Crop area | 250 |

Target sale weight (kg cwt/head) | 22 |

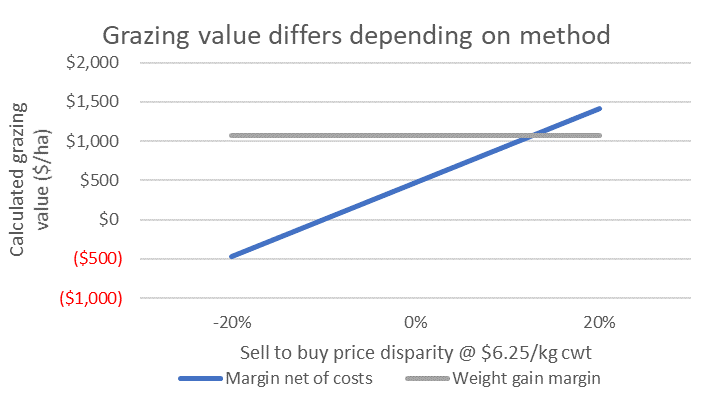

Figure 1 shows that the weight gain margin method for valuing grazing to crops is insensitive to price disparity. This results in over estimations of net grazing value except where sell to buy price disparity exceeds 10 percent. The magnitude of the outcome of this analysis differs based on the selling price which in this example is $6.25 per kilogram carcase weight (lamb).

Figure 1. The weight gain margin method of grazing valuation is insensitive to trading gains or losses and ignores costs.

Shuffling the deck chairs or capturing the value? A case study demonstrating the difference

Farming systems trials have shown that dual purpose crop profits are highest where grain yield is optimised and vegetative crop biomass is well-utilised. Several research studies have concluded that the additional value generated through the inclusion of dual-purpose crops to the farming system adds considerably to whole farm profitability.

While farm benchmarking data shows that there are individuals who are able to capture the benefits of including dual purpose crops into their systems there are as many who generate no additional value. Individual farm benchmarking data sets have been examined to explore these issues and gain some understanding of why the additional return from dual purpose crop inclusion is not being delivered across the farm.

Table 5 shows two farming systems. The first three columns represent a livestock only system while the next three represent a system with 80% of the total farm area as pasture with the remaining 20 percent as dual-purpose crop (DP crop). The type of livestock enterprise, the time of lambing and calving and the time of turnoff of trading livestock are all important but they are not drivers of the outcome in the context of this analysis.

Table 5. Biomass production calculations for two systems – one livestock only, the other includes 20 percent dual purpose crop

Livestock 100% Dual purpose crop 0% | Livestock 80% Dual purpose crop 20% | |||||

|---|---|---|---|---|---|---|

Pasture | DP crop | Total | Pasture | DP crop | Total | |

Enterprise (% total area) | 100% | 0% | 80% | 20% | ||

Area (ha) | 1000 | 0 | 1,000 | 800 | 200 | 1,000 |

Biomass grown (kg DM/ha) | 7,366 | 0 | 7,366 | 7,366 | 3,980 | 6,689 |

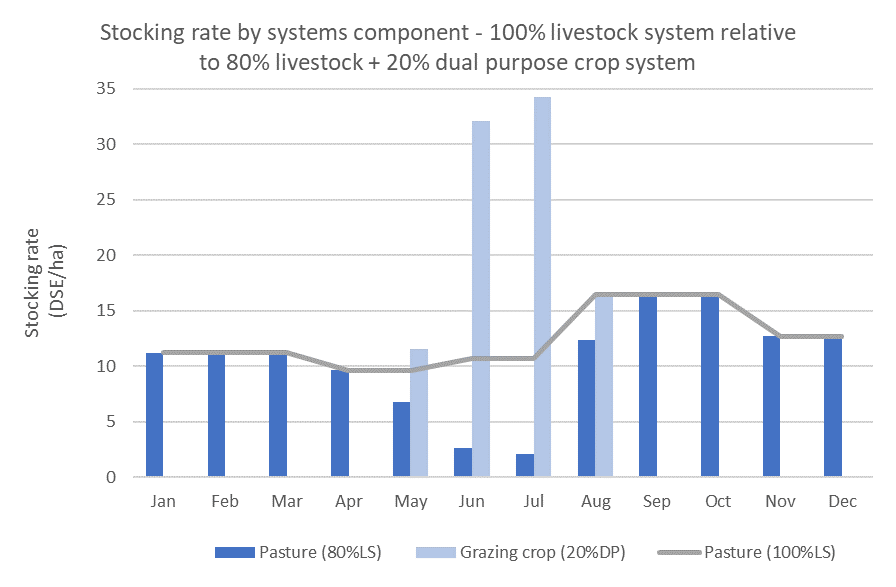

Figure 2 shows the stocking rate by systems component of the two farming systems. The grey line represents the monthly stocking rate, expressed in DSE per hectare, on pasture of the livestock only system. The dark blue bars represent the monthly stocking rate on the 80-pasture area while the light blue bars represent the monthly stocking rate on the 20 percent dual purpose crop area.

Figure 2 Shows the value of dual purpose crops is short duration grazing during Autumn and mid winter.

Figure 2. Stocking rate by month for a 100% livestock system vs an 80% livestock + 20% dual purpose crop system.

Table 6 shows stocking rate per hectare by component (pasture and crop) and by farming system. It also shows opening and closing annual biomass per hectare as well as feed utilisation levels. Feed utilisation is calculated as intake divided by feed grown. The closing crop biomass and the utilisation levels in the crop demonstrate that the additional feed supplied by the dual-purpose crop has been very well utilised. The issue however is that the lower mid-winter stocking rate in the pasture, shown as the dark blue bars in Figure 2, has reduced the average annual stocking rate on the pasture.

This reduction in average annual pasture stocking rate in the mixed livestock crop system has led to a reduction in feed utilisation demonstrated by the utilisation rate and the lower average annual stocking rate when compared with the livestock only system. If the pasture system was achieving a stocking rate of 12.5 DSE per hectare prior to introducing dual purpose crop it should be achieving the same stocking rate afterwards. Instead, the stocking rate on pasture declined.

At a whole farm level this means that the 9,980 DSE managed in the pasture and dual-purpose crop system represent 80 percent of the 12,430 DSE managed in the livestock only system. Given the pasture area in the pasture crop system represents 80% of the pasture area in the livestock only system this stocking rate should have been achieved in the absence of the dual-purpose crop and the 1,580 DSE in the dual-purpose crop should have been additional livestock. In other words, the grazing crop has added no marginal grazing value at a whole farm level.

This doesn’t mean that the dual-purpose crop hasn’t paid for itself, but it does mean that there is no additional grazing value added as a result of dual-purpose crop inclusion. The contribution of grain typically dwarfs the contribution of grazing to dual purpose crop income so there may still be value in adding dual purpose crops to the enterprise mix but their value isn’t optimised. This is covered in more detail in Table 6.

Why is it so? For those that don’t keep good livestock production records or differentiate pasture stocking rates from crop or whole farm stocking rates then it is possible that this issue isn’t even known. It is plausible that the extremely high stocking rates on the crop, where the majority of livestock graze during a period that is conventionally difficult to manage and which accounts only for the minority of total grazed area, are causing misjudgements about the whole farm stocking rate. This is why recording stocking rate by area grazed is particularly important.

Dual purpose crops can provide potential benefits beyond production and its value. In cases where dual purpose crops are grazed with trading livestock, producers have been forced to become more skilled at feed budgeting. Many managers, because of growing dual purpose crops, are very attuned to crop growth rates, wastage rates, livestock intake and the factors that influence these.

In some cases, these feed budgeting skills have delivered improvements in feed utilisation in pasture systems as these managers become more confident in their ability to manage the livestock pasture interface. In some cases, the value of the improvements to the other parts of the farming system, depending on its scale may be greater than the value of the introduction of the dual-purpose crops to the system.

Table 6. Stocking rate per hectare by component (pasture and crop) and by farming system and opening and closing annual biomass per hectare as well as feed utilisation levels for 100% livestock system vs. an 80% livestock and 20% dual-purpose crop system. Dual purpose crop biomass is well utilised but pasture utilisation decreases.

Livestock 100% | Livestock 80% | |||||

|---|---|---|---|---|---|---|

Pasture | DP crop | Total | Pasture | DP crop | Total | |

Opening biomass (kg DM/ha) | 2,500 | 2,500 | 1,230 | |||

Closing biomass (kg DM/ha) | 2,526 | 2,884 | 508 | |||

Average annual stocking rate | 12.43 | 12.43 | 10.5 | 7.9 | 10.0 | |

Utilisation rate | 49% | 42% | 58% | |||

Farm stocking rate DSE | 12,430 | 12,430 | 8,400 | 1,580 | 9,980 | |

The impact on financial performance of two systems and three scenarios is presented in Table 7. The first column represents an efficient livestock only business (LS OPT). The next three columns represent the enterprise components of an 80% pasture base and 20% dual purpose crop system (LSC SUB) with pasture utilisation compromised or sub optimally stocked. The rightmost three) columns represent the enterprise components of an 80% pasture base and 20% dual purpose crop system (LSC OPT) with pasture utilisation and stocking rate optimised.

The value of the biomass in a dual-purpose crop represents only a small proportion of the total value of the crop. The majority of the total enterprise earnings are in grain production.

Table 7, which is an extension of Table 6, shows the difference in financial performance between enterprise components and between systems with sub optimal and optimal feed utilisation. In the system with sub optimal pasture utilisation the livestock (August lambing wool flock) are agisted onto the crop at a value of $1 per DSE per week. This is shown as crop grazing income at a gross level or Agistment/grazing margin at a per hectare level. This equates to $68 per hectare.

This agistment income is then seen as an expense in the livestock enterprise. When spread over all the livestock it equates to approximately $1.40 per DSE. The gross overhead costs allocated to the livestock enterprise decline from $310,000 to $250,000 but this equates to no net change on a per DSE basis. This is demonstrated in the cost per DSE which is $25 for the LS OPT and LSC SUB systems. Profits per DSE decline from $45 per DSE in the LS OPT system to $44 per DSE in the LSC SUB system due to the additional cost of the agistment onto the crop.

In the system with optimal pasture utilisation (LSC OPT), crop biomass is utilised with a livestock trade rather than the existing wool flock. The average annual stocking rate on the crop equates to 7.9 DSE per hectare but unlike the pasture, which is grazed year-round, it has been derived from short duration high intensity grazing for only a proportion of the year.

The number of livestock grazed on pasture increases relative to the LSC SUB system to reflect the per hectare stocking rate of the LS OPT system. This equates to 9,980 DSE. All of the expenses associated with the trade have been deducted so the net earnings of the trade are what is shown as the grazing margin. This means that there is no cost to be accrued against the existing livestock enterprise. The overhead cost base of the existing livestock enterprise is maintained at $25 per DSE which delivers the same profit per DSE.

The assumptions for the trade are shown in Table 8. The margin for the livestock trade ($308 per hectare) compared with the agistment income reflects the higher risk in this enterprise.

The grain income is assumed to be $1,238 per hectare which is higher than the average of the three-year grain income in the farming systems trial to attempt to reflect less volatility. The outcome of the analysis is highly sensitive to the value of the grain income per hectare. This reinforces the message around the importance of skills. Croppers know how much timeliness and management skill contributes to attaining the production while others may be less aware.

Per hectare comparisons

Livestock/pasture enterprise returns

The LS OPT system delivers operating profit or EBIT of $560 per hectare. The LSC SUB system delivers EBIT of $544 per hectare from the livestock due to additional agistment costs associated with grazing the dual-purpose crop. The LSC SUB system has maintained the 12.4 DSE per hectare stocking rate on the pasture by agisting on the crop which adds no value at a whole farm level.

The LSC OPT system generates the same return as the LS OPT system per hectare as the stocking rate per hectare on pasture has remained the same, but the additional feed produced by the crop is consumed using a livestock trading enterprise. At a gross level, profits have declined but only by the proportion of area sown to crop.

This means that there is no marginal cost associated with the crop as it has been grazed with trading livestock.

Crop enterprise returns

The LSC SUB system generates operating profit or EBIT of $555 per hectare in profit primarily due to low agistment income of only $68 per hectare when compared to the LSC OPT system. The LSC OPT system has higher grazing income because the net returns of trading (after costs) in this example are higher than the value attributed to agistment. The LSC OPT system generates $796 in EBIT per hectare which weights the whole farm EBIT per hectare up. This demonstrates that the value of the dual-purpose crop comes from creating additional value from the crop grazing.

Bottom line

The bottom line (EBIT) is demonstrated by the column titled ‘Whole farm.’ This is the aggregation of the enterprise contribution of income, expenses and profits within each system and scenario. The LSC SUB system generates less return to the whole business relative to the LS OPT system not because the grazing crop didn’t deliver solid production and financial performance but because that performance came at the cost of optimising the performance in the livestock system.

The LSC OPT system generated more profit across the whole farm because the stocking rate in the pasture system was maintained and the crop profits were higher than the livestock only system.

The returns of both the LS SUB system and the LS OPT system are highly sensitive to grain production, pasture feed utilisation (stocking rate) and agistment or grazing returns.

In this case study the livestock system generates the majority of the whole farm profit so it is critical that per hectare performance is maintained in this enterprise to ensure that whole farm profit isn’t eroded with the inclusion of a dual purpose cropping system.

The key message associated with this whole farm analysis is that without good records it is difficult to establish the value contributed by dual purpose crops at a whole farm level. Without recording whole farm stocking rate and taking it further to understand stocking rate per pasture and crop hectare it is impossible to establish the contribution of different enterprises to the whole farm performance. A good starting point for those looking to compare the value of dual purpose crops with alternative enterprises is to have good farm records to allow for the analyses to be conducted.

Table 7. Where whole farm grazing is optimised there is a greater business case to introduce dual purpose grazing crops. The difference in financial performance between enterprise components and between systems with sub optimal and optimal feed utilisation

System | LS OPT Livestock Optimal SR | LSC SUB | LSC OPT | ||||

|---|---|---|---|---|---|---|---|

| Pasture | Pasture | Crop | Whole farm | Pasture | Crop | Whole farm |

Stocking rate (AADSE) | 12,425 | 8,400 | 1,580 | 9,980 | 9,980 | 1,580 | 11,560 |

Area (ha) | 1,000 | 800 | 200 | 1,000 | 800 | 200 | 1,000 |

Gross profit ($/DSE) | $95 | $95 | $95 | ||||

Enterprise expenses ($/DSE) | $25 | $25 | $25 | ||||

Agistment expenses ($/DSE) | $1 | ||||||

Overhead expenses ($/DSE) | $25 | $25 | $25 | ||||

EBIT ($/DSE) | $45 | $44 |

|

| $45 |

|

|

Gross profit grain ($/ha) |

|

| $1,238 |

|

| $1,238 |

|

Agistment/grazing margin ($/ha) |

|

| $68 |

|

| $308 |

|

Gross profit ($/ha) | $1,180 | $1,185 | $1,305 | $948 | $1,185 | $1,546 | $1,257 |

Enterprise expenses ($/ha) | $311 | $329 | $450 | $340 | $312 | $450 | $340 |

Overhead expenses ($/ha) | $311 | $312 | $300 | $310 | $312 | $300 | $310 |

EBIT ($/HA) | $559 | $544 | $555 | $547 | $561 | $796 | $608 |

Gross profit livestock ($) | $1,180,419 | $948,100 | $948,100 | $948,100 | $948,100 | ||

Gross profit grain ($) | $247,500 | $247,000 | $247,500 | $247,500 | |||

Crop grazing income ($) | $13,543 | $13,543 | $61,650 | $61,650 | |||

Component gross profit ($) | $1,180,419 | $948,100 | $261,043 | $1,209,143 | $948,100 | $309,150 | $1,257,250 |

Enterprise expenses ($) | $310,637 | $249,500 | $90,000 | $339,500 | $249,500 | $90,000 | $339,500 |

Agistment grazing expense ($) | $13,543 | $13,543 | |||||

Overhead expenses (4) | $310,637 | $249,500 | $60,000 | $309,500 | $249,500 | $60,000 | $309,500 |

Total operating costs ($) | $621,273 | $512,543 | $150,000 | $662,543 | $499,000 | $150,000 | $649,000 |

EBIT ($) | $559,146 | $435,557 | $111,043 | $546,600 | $449,100 | $159,150 | $608,250 |

It is possible to calculate the minimum per hectare profits from the dual-purpose crop enterprise required to break even with the LS OPT system. Deduct the whole farm livestock enterprise EBIT in the LSC SUB and LSC OPT systems from the LS OPT system and dividing that figure by the crop area.

For example, the LSC SUB system compared to the LS OPT system: $559,146-$435,557 = $123,589 ¸ 200 = $617 per hectare.

For example, the LSC OPT system compared to the LS OPT system: $559,146-$449 100 = $110,046 ¸ 200 = $550 per hectare.

This approach can be used in forecast budgets to assist in decisions.

Table 8 Livestock (lamb) trading assumptions

Livestock trade assumptions | |

|---|---|

Weight gain (kg/head/day) | 0.275 |

Yield (cwt to lwt %) | 46% |

Feed adjustment period (days) | 10 |

Sale weight (kg cwt/head) | 21 |

Sale weight (kg lwt/head) | 45.7 |

Purchase weight (kg lwt/head) | 29.2 |

Price in ($/kg cwt) | $8.00 |

Price in ($/head) | $107.28 |

Price out ($/kg cwt) | $8.50 |

Price out ($/head) | $178.50 |

Sales cost ($/head) | $12.50 |

Enterprise costs ($/head) | $8.00 |

Total cost ($/head) | $20.50 |

Net margin ($/head) | $50.73 |

Net margin ($/ha) | $398 |

Net margin ($ gross) | $61,650 |

What this means to you

There is no one size fits all approach to the integration of dual-purpose crops into a farming system. The value of the integration will depend on several factors including the existing system and the existing skill base. Following are some tips that may assist in successful implementation to ensure that dual purpose crops are an enduring part of the farming system.

- Extracting value from dual purpose crops at a whole farm level requires optimising not only of the grazing crop but also the other parts of the farming system.

- Don’t underestimate the investment in skills required to make some of the changes. Start small to build confidence as this will minimise risk and build skill over time.

- Whole farm feed budgeting prior to making systems changes will assist in understanding the extent of the capital requirements for the additional livestock and the stocking rates necessary to deliver profitability improvements.

- Where there is opportunity for feed budgeting skills learned as a result of exposure to dual purpose crops to be implemented to other parts of the farm there is massive opportunity for improvements in whole farm profitability.

Acknowledgement

The research undertaken as part of this paper is made possible by the significant contributions of growers through the support of the GRDC, the author would like to thank them for their continued support.

Contact details

John Francis

Agrista

192 Dukes Road, Lake Albert

Ph: 0427 259 005

Email: john@agrista.com.au

GRDC Project Code: CSP1703-007RTX,

Was this page helpful?

YOUR FEEDBACK